India's benchmark stock indices snapped their three-day rally to close marginally lower on Tuesday on likely profit booking after indices hit a fresh record high in the previous session.

Information technology stocks came under pressure as hope of an earlier rate cut by the Fed waned following the release of economic data in the US. Mid- and small-cap banks led outperformance in the broader indices.

The NSE Nifty 50 ended 8.70 points, or 0.04%, lower at 22,453.30, while the S&P BSE Sensex fell 110.64 points, or 0.15%, to close at 73,903.91.

The market has been witnessing range-bound activity for the last two days, said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

"For the traders, 22,350/73,700 and 22,500/74,100 would act as key levels for Nifty and Sensex, respectively, to watch," he said. "On the higher side, above 22,500/74,100, the market could rally till 22,600-22,650/74,500-74,600. On the flip side, dismissal of 22,350/73,700 could accelerate the selling pressure."

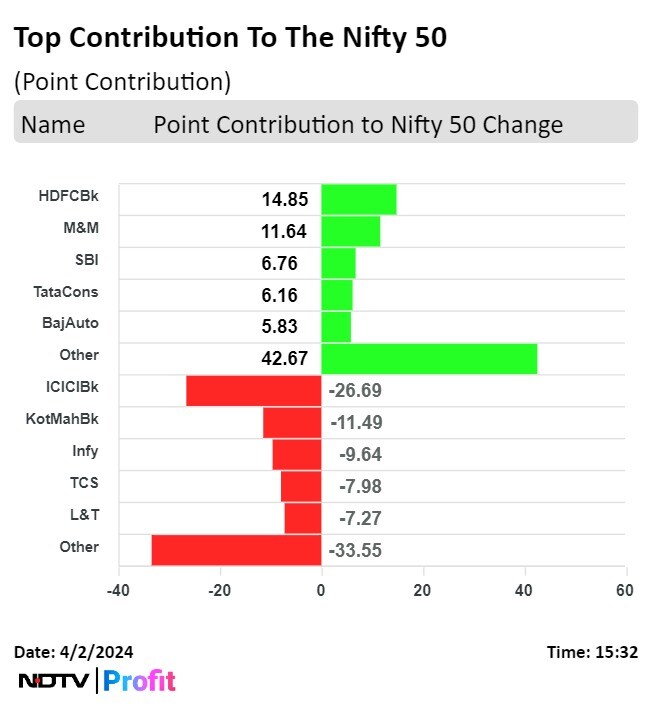

Shares of Bajaj Auto Ltd., HDFC Bank Ltd., Mahindra & Mahindra Ltd., State Bank Of India and Tata Consumer Products Ltd. contributed to the gains in the Nifty.

While ICICI Bank Ltd., Infosys Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd., and Tata Consultancy Services Ltd. weighed the index.

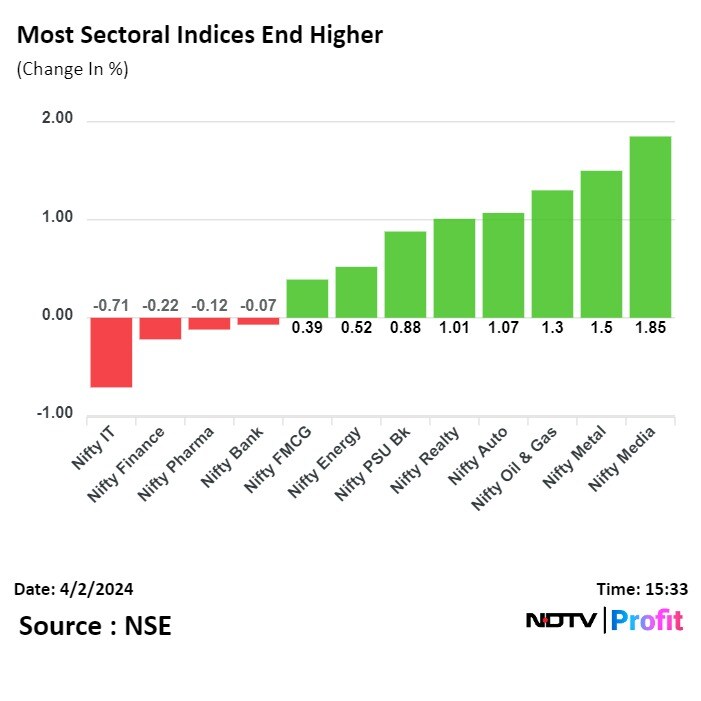

On the NSE, Nifty Media led gains as most sectoral indices ended higher, while Nifty IT fell the most.

Boarder markets outperformed benchmark indices, with the S&P BSE Midcap closing with 1.14% gains and the S&P BSE Smallcap ending 1.28% higher on Tuesday.

On BSE, 16 sectors advanced and four declined. S&P BSE Consumer Durable rose the most at 1.82%. S&P BSE TECK was the worst performer.

Market breadth was skewed in favour of the buyers. Around 2,839 stocks rose, 1,009 stocks declined, and 112 stocks remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.