India's benchmark stock indices continued their gains for the fourth consecutive session to end at fresh record closing highs on Wednesday, ahead of the Federal Open Market Committee's meeting later in the day. Shares of Maruti Suzuki India Ltd. and Bharti Airtel Ltd. led to gains.

Both indices closed at their highest levels. The NSE Nifty 50 closed up 93.85 points, or 0.38%, at 24,951 and the S&P BSE Sensex closed 285.94 points, or 0.35%, higher at 81,741.

Brent crude oil snapped its two-day fall to close 1.63% higher at $79.91 due to geopolitical tensions arising out of Israel's attack on Beirut.

After some movement in the morning trade, the index remained rangebound for the rest of the day, according to Aditya Gaggar, director at Progressive Share Brokers Pvt., to settle the last day of the month on a positive note at 24,951.15, with gains of 93.85 points.

"The index is heading towards the psychological barrier of 25,000 and a sustainable move above the same will push the index further higher to 25,200, whereas on the downside, 24,800 will be considered immediate support," he said.

.jpeg)

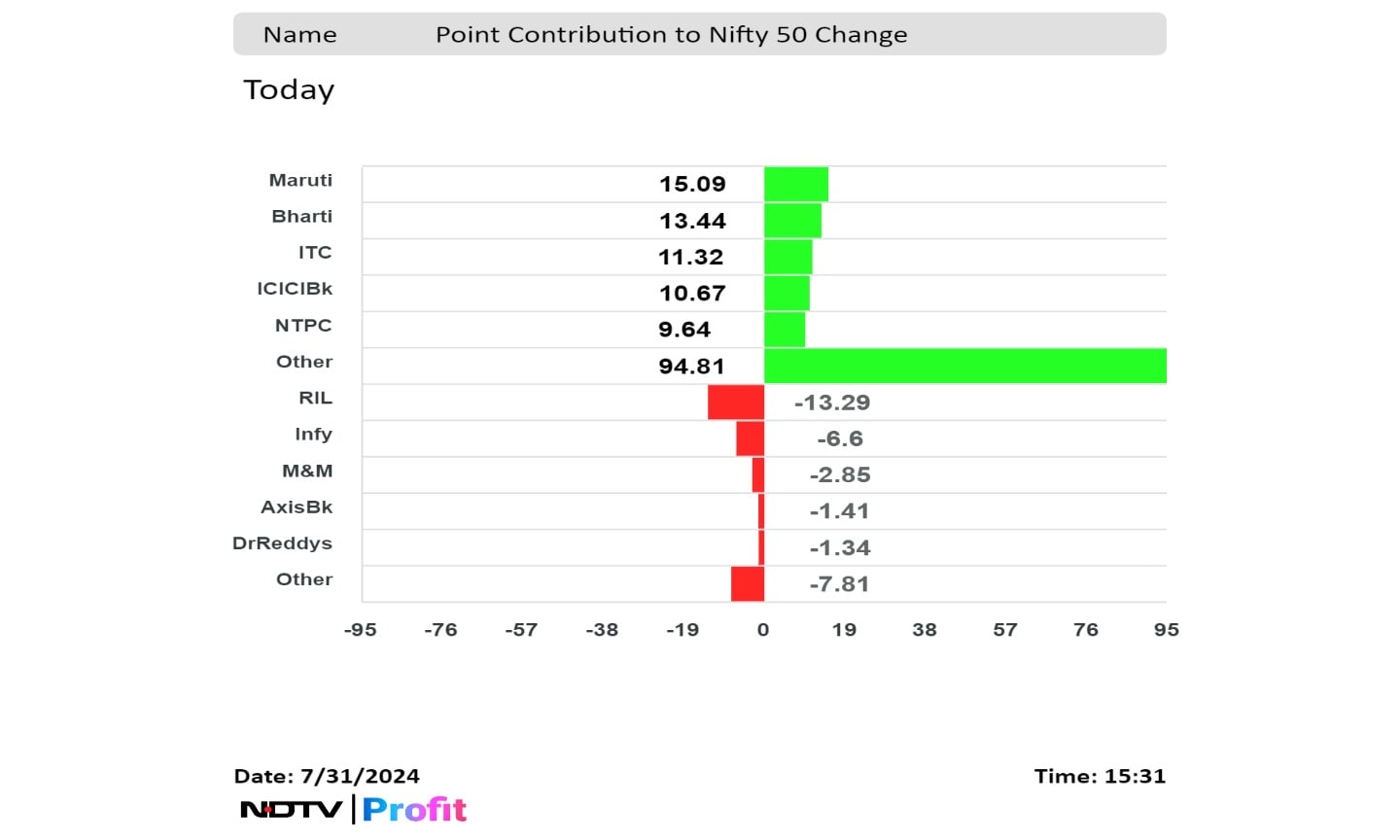

Shares of Maruti Suzuki India Ltd., Bharti Airtel Ltd., ITC Ltd. and ICICI Bank Ltd. were positively contributing to changes in the Nifty 50.

While those of Reliance Industries Ltd., Infosys Ltd., Mahindra and Mahindra Ltd., Axis Bank Ltd., and Dr. Reddy's Laboratories Ltd. negatively contributed to the change.

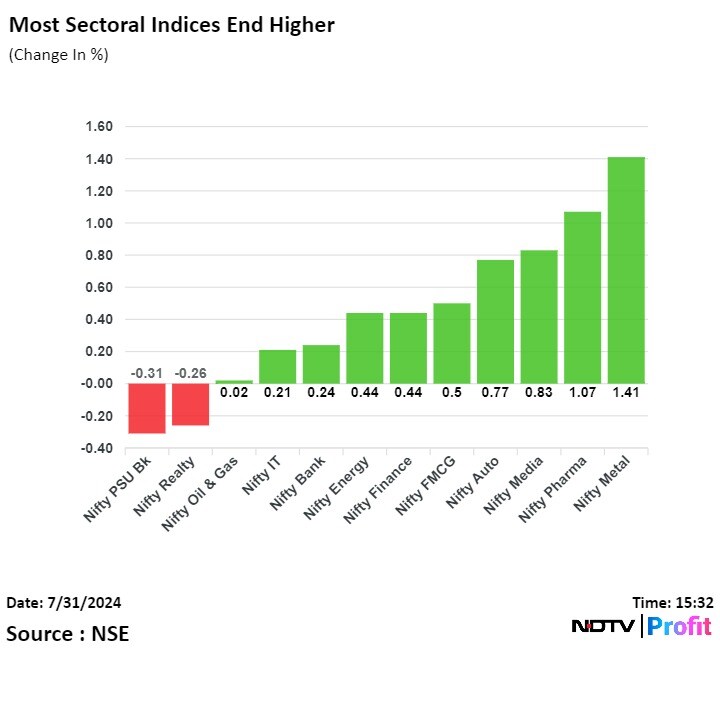

On NSE, 10 out of 12 sectors were trading higher, with Nifty Metal and Pharma advancing the most. The Nifty PSU Bank fell the most.

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.86% higher and Smallcap ended 0.14% lower.

On BSE, 17 out of 20 sectors advanced, and three declined. The S&P BSE Utilities rose the most, and the S&P BSE Realty declined the most.

Market breadth was skewed in favour of buyers. Around 2,132 stocks rose, 1,820 stocks declined, and 85 remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.