India's benchmark indices ended higher for the third day on Tuesday, despite starting the day flat, as HDFC Bank Ltd., Reliance Industries Ltd. and Kotak Mahindra Bank Ltd. gained.

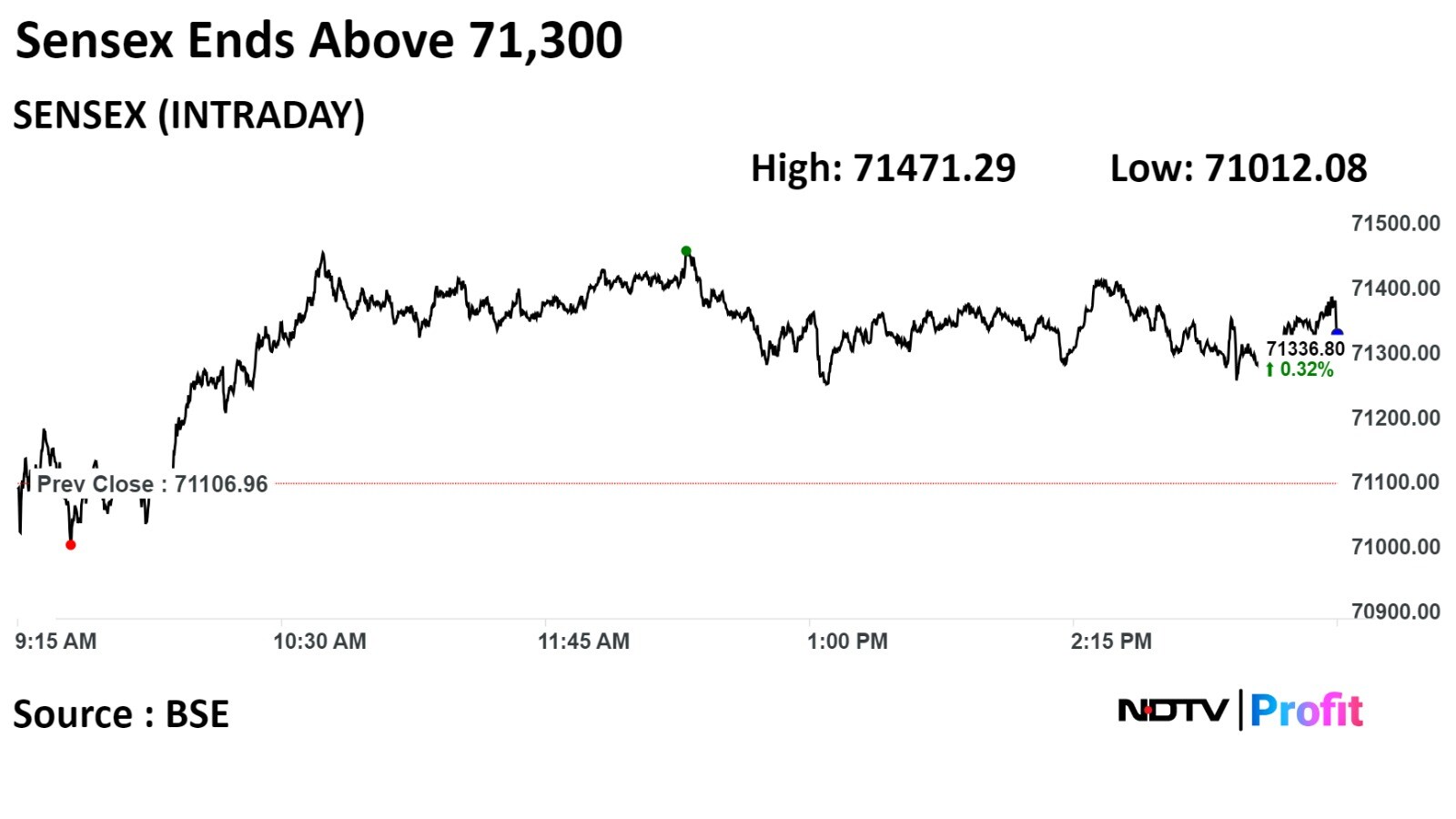

The NSE Nifty 50 ended 91.95 points, or 0.43% higher at 21,441.35, while the S&P BSE Sensex ended 229.84 points, or 0.32% higher at 71,336.80.

"Technically, the short-term texture of the market is volatile; hence, level-based trading would be the ideal strategy for day traders. We are of the view that as long as the index is trading above 21,400 or 71,300, the pullback formation is likely to continue. Above the same, the market could move up to 21,475-21,550/71,300-71,600. On the flip side, below 21,200/70,700, the sentiment could change. Below the same level, the market could retest the level of 21,100–21,000/70,400–70,000. However, crossing 21,600/71,900 could lead to a rally towards 21,900-22,000/72,800-73,00 levels," said Shrikant Chouhan, head, equity research, Kotak Securities Ltd.

Bharti Airtel Ltd., HDFC Bank Ltd., Kotak Mahindra Bank Ltd., NTPC Ltd., and Reliance Industries Ltd. were positively contributing to changes in the Nifty 50.

Bajaj Finance Ltd., Bajaj Finserv Ltd., Infosys Ltd., Tata Consultancy Services Ltd. and Tata Motors Ltd. weighed on the index.

Eleven of the 14 sectors on the NSE advanced, with Nifty PSE emerging as the top gainer. Of the three sectors that declined, Nifty Media fell the most.

The broader markets outperformed the benchmark indices; the S&P BSE MidCap gained 0.72%, whereas the S&P BSE SmallCap was 0.48% higher.

Eighteen of the 20 sectors compiled by BSE advanced, while two declined. S&P BSE Oil and Gas rose the most.

The market breadth was skewed in favour of buyers. Around 2,330 stocks rose, 155 stocks declined, and 145 remained unchanged.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.