Indian equity markets suffered a brutal decline on Monday extending their losses for a third consecutive session, amid a global rout triggered by escalating trade tensions. The Nifty Midcap 100 plummeted 7.26% to 46,966.60—its lowest level in a month—as panic gripped investors across sectors following a steep sell-off in global equities.

The decline was largely driven by fears of a full-blown global trade war after US President Donald Trump's recent tariff announcement, which sparked retaliatory measures from China. The growing uncertainty has raised the spectre of a potential recession in major economies, prompting widespread liquidation in the Indian markets.

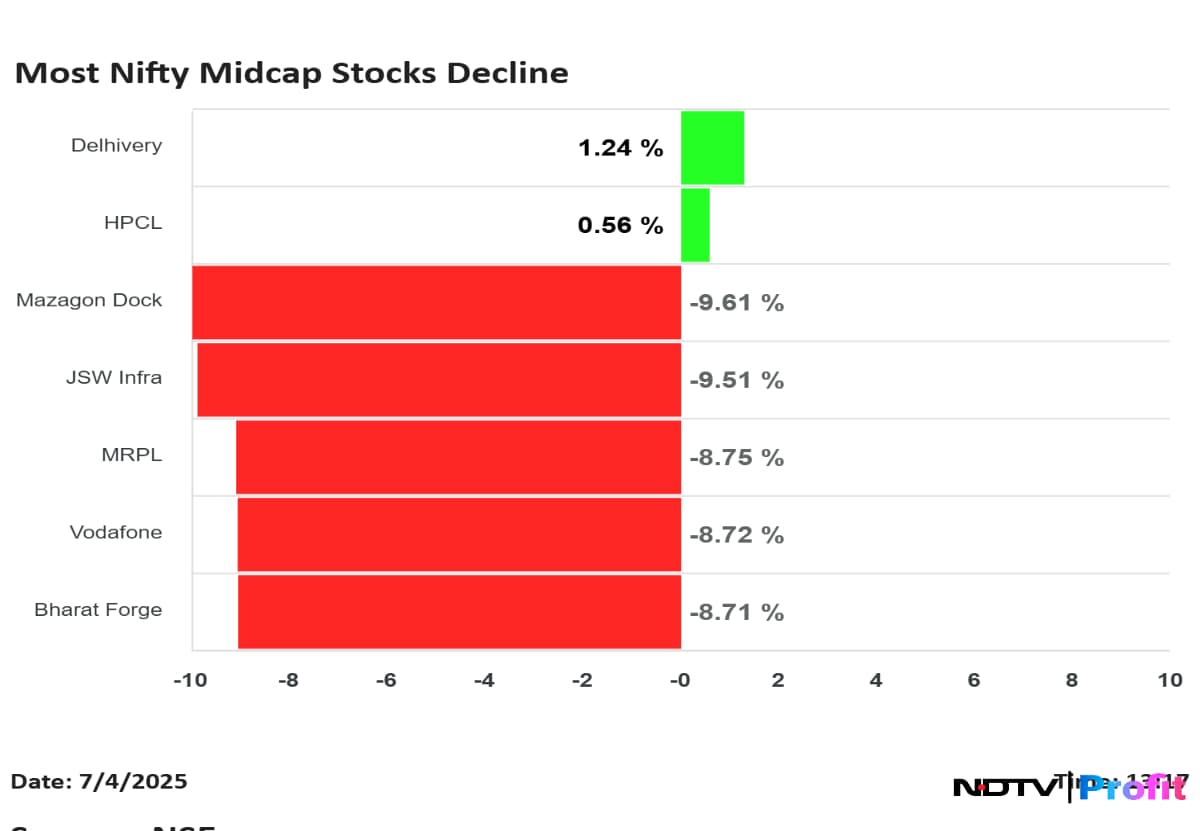

Among the worst-hit stocks in the midcap space were Mazagon Dock Ltd. and JSW Infrastructure Ltd.—both of which led the decline. Other significant losers included Ipca Laboratories Ltd. and Suzlon Energy Ltd., which dropped over 16% each.

Bharat Dynamics Ltd. and Bharti Hexacom Ltd. fell by more than 14%, while Gland Pharma Ltd., Mazagon Dock Ltd., and Sun TV Ltd. were down by around 13%. Cochin Shipyard Ltd. lost 11%, while Mangalore Refinery and Petrochemicals and Rail Vikas Nigam Ltd. slipped around 12%.

Several other midcap companies, including Aditya Birla Capital Ltd., Bharat Forge Ltd., CG Power Ltd., IRB Infrastructure Developers Ltd., IREDA Ltd., Kalyan Jewellers Ltd., Persistent Systems Ltd., Steel Authority of India Ltd., SJVN Ltd., Solar Industries Ltd., Syngene International Ltd., and Torrent Power Ltd. declined about 10%.

In contrast, only a handful of stocks managed to resist the broader market sell-off. Delhivery Ltd. and HPCL Ltd. stood out as rare gainers in an otherwise red-dominated session.

The sell-off wasn't limited to the midcap segment. Benchmark indices also witnessed heavy losses, in line with sharp declines across Asian markets and US futures.

Both the BSE Sensex and NSE Nifty 50 opened with a gap-down and continued to slide through the day. The Nifty 50 fell 5.07% to 21,743.65, while the Sensex dropped by 3,939.68 points to 71,425.01.

The first few months of 2025 have proven turbulent for Indian equities, especially for the broader markets. The Nifty Midcap 100 is down over 15% year-to-date.

Although the index managed a strong rebound in March, gaining 7.69%, those gains have already been wiped out in April, with a 6.14% fall recorded in just the first week of the month.

Earlier in the year, the index had declined by 9.57% in February and 6.51% in January. Over the past 12 months, the Nifty Midcap 100 has lost 3.08%, highlighting the persistent weakness in the segment.

With global volatility on the rise and investor sentiment turning increasingly risk-averse, Indian markets are likely to remain under pressure in the near term as uncertainty looms large over global trade and economic growth.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.