- India VIX surged over 5% from multi-month lows, signalling rising market volatility

- Nifty 50 closed at 25,202.35, down 0.49%, after a volatile trading session

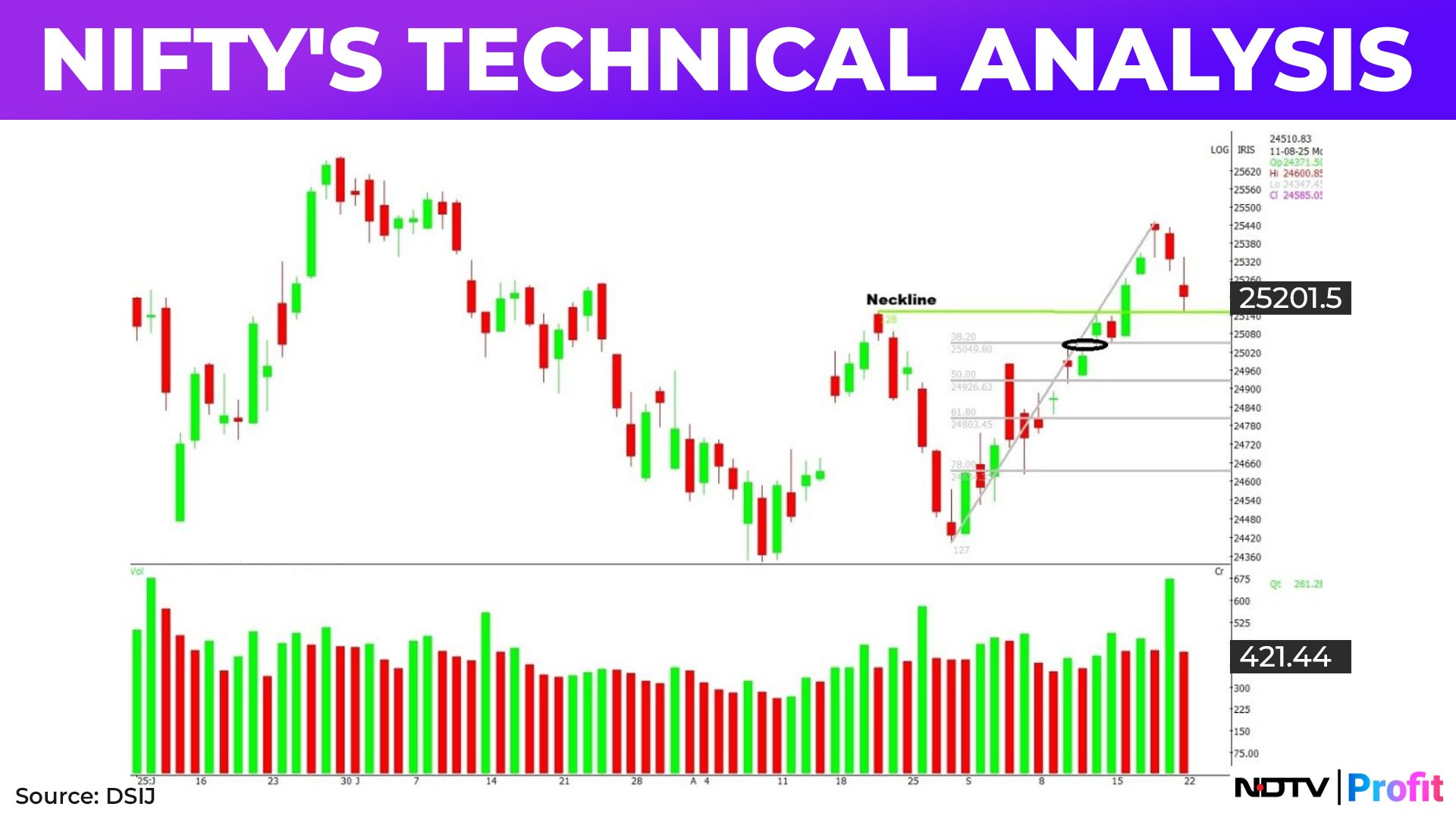

- The 25,037-25,150 range is a crucial support zone for the Nifty 50 index

The week began on a predictable note for Indian equity benchmark indices, as a knee-jerk reaction was seen on the back of the H-1B visa announcement. The Nifty 50 opened lower but soon witnessed a smart recovery, climbing above the 25,300 mark. However, the rebound lost steam in the latter part of the sessions, with a sharp sell-off dragging the index to an intraday low of 25,151—an important support level. The index finally settled at 25,202.35, down 0.49%. Most sectoral indices ended in the red, with Nifty IT plunging 2.95%, its steepest single-day fall since April 2025.

On the daily chart, the index continued its pattern of lower highs and lower lows, forming a bearish candle with a sizable upper shadow. At present, the index is trading near a make-or-break zone. The 25,037-25,150 range is a crucial support band, marked by the confluence of the double-bottom neckline, an opening upside gap observed on the daily chart, and a 38.2% retracement of the rally from 24,405 to the recent swing high of 25,449. As long as this zone holds, traders may consider long positions around these levels. On the upside, resistance is expected in the 25,330-25,360 zone. A decisive close above this range would break the sequence of lower highs and lows seen in the recent sessions, giving bulls momentum to push towards the level of 25,550.

Shifting focus to the Nifty IT index, which has been the talk of the town lately on the back of the H-1B visa news, the daily chart shows the formation of a small-bodied green candle with shadows on either side. Interestingly, this pattern has emerged near the upside gap area of Sept. 10, 2025. The price action in the coming sessions will be crucial, as a lack of follow-through selling may indicate that the correction has stalled after filling this gap, paving the way for an attempt to fill the downside gap created on Sept. 22.

Overall, active traders are advised to adopt a measured approach by maintaining lighter positions in view of volatility once again raising its ugly head. The India VIX has already jumped over 5% from multi-month lows, and with the weekly expiry scheduled on Tuesday, further spikes cannot be ruled out. Hence, selective stock-picking and disciplined risk management remain the need of the hour.

Stock of the Day: NLC India

NLC India formed a sizable bullish candle during the second week of September, accompanied by solid volumes – the highest weekly volumes recorded since March this year. Adding to the strength, the stock's weekly RSI crossed above the 60 mark for the first time since October last year, indicating a clear shift in momentum. Furthermore, the 14-period RSI has entered a super-bullish range, as it held above the 60 mark, even during the recent phase of minor correction, reaffirming the stock's strong momentum.

On Monday, Sept. 22, the stock formed a bullish candle with a higher high and higher low, supported by decent volumes. The daily MACD remains firmly in an uptrend and is seen diverging from its nine-period average, thus validating positive bias.

Considering these factors, the stock is likely to extend its uptrend and has the potential to test levels of Rs 279-290 in the short to medium term. However, the bullish undertone would stand negated if the stock falls below Rs 247.

Disclaimer: The views shared by investment advisers on NDTV Profit are their own. They do not reflect the views of NDTV Profit. Viewers should consult a financial adviser before making investment decisions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.