Everything was going well before Israel changed the odds with the attack on Iran. Just before that, the Ukraine-Russia war theatre had also looked up a bit. The Hamas matter is not yet settled before Israel has opened a new front. India-Pak tensions are still brewing. Within the US, the National Guard had to be called out in California.

The world is no longer a peaceful place – that is clearly evident. We were trying to rely on what the chart was saying. But realise that even the charts will only reflect the actions of the people. But wars and stuff like that are never known to the people, and hence they cannot be reflected on the charts either. So, there is always that bit of uncertainty in the market at all times – the 'unknown unknown', as it is called.

So, what is the next best thing? Well, as far as traders are concerned, there is the stop stoploss. Provided, you are able to exercise them when they are hit. Realise that there is a vast difference between having a stop and being able to execute it. Investors think they can do without a stop loss. But that is not really true – it is just that those stops are deeper, and most of the investors think that such stops never come into play. So, they have got used to not thinking or speaking about stops on investments. But even those need to have a stop. Depending on what type of investments they are, the stops could vary.

In our present case, the short term was smashed, of course, with the wide gap from the war news. Even before that there were a couple of days of decline, but I would doubt that is anyway related to the war gap. Some traders exited as individual levels were hit. Buying eased, and that created a small down move.

Now, we should take a look at how the market fared recently. Chart 1.

Everyone got so focused on Friday's fall. But see it in a larger context. The Friday action looks big because we all got excited with the upside breakout from a multi-week range! We were looking for an acceleration in both Nifty and Bank Nifty, and the disappointment created by the gap down move of Friday really hurts. Because it means that the market may go down to do some retests of other supports or will have to make fresh efforts to climb back up all over again! Painful, isn't it?

The big yellow rectangle is the recent trend. The small green rectangle at its end is the immediate area of focus for traders. If the lows are protected (24600 area), then one can breathe easy about avoiding some pain. But realise that we are back to attacking the 24800 area yet again for bulls to regain their foothold.

Also, note that if the low is broken, then there is yet another gap support zone beneath (24,100-24,400). Meaning, nothing alarming, really.

But for those who went long at 25200, it would certainly be alarming, as they would be staring at a deep gash. The question such people will then have to ask is, 'How much of a gash can I withstand to my account?' And also, how much will that impact my mind to make a new trade?

Can we say which of these can happen? I doubt it, and I personally don't even want to attempt it. Mainly because of what I wrote in the opening paragraphs – that the market is responding to some freaky macro events that have no warnings and also don't have any clarity. Can anyone say if the skirmish will flare up (after all, Iran has declared war, not said it will retaliate)? We know that both Iran and Israel are chess pieces that are being played on a giant chessboard between the USA, China, Russia, etc. When the game goes to some silly levels like these, forecasting should be off.

Why? Because we don't know who is playing which game! Plus, we have some prima donnas at the head of each of these governments! Fringe players are around trying to get their jollies off in this war game. Other factors like oil prices flaring, gold prices already soaring, the dollar skidding, mixed corporate earnings, rate cuts done but transmissions may take time, etc., are all also getting mixed into the broth.

The net effect is that the picture for the immediate future has got highly clouded. So, prudence says, we should pull back. Shelve the bullish targets and expectations that we laid out in earlier letters (they were made in normal functioning markets and hence had a good chance of succeeding). Then wait for some clarity to emerge. One point that may be valid here is that with too many wars going on in the world, the impact of these events should probably play out quickly. Our own near-war with Pak had an impact of just a day. Recent Ukraine attacks and Russian retaliation had a mild impact. So, can this Iran thing also end that way? Or will the world powers, aligned on opposite sides, use this Iran thing as a proxy play?

The good news is that how those plays will show up on the charts can be read, and some reasonable conclusion drawn. But with the caveat that something out of the ordinary can always happen overnight. Hence, big commitments should be avoided no matter what the blandishments are. If the market shakes off the events swiftly, then this is still a correction within the medium- and long-term trend. So, then we will have to deal only with the short term where the trend is wobbling.

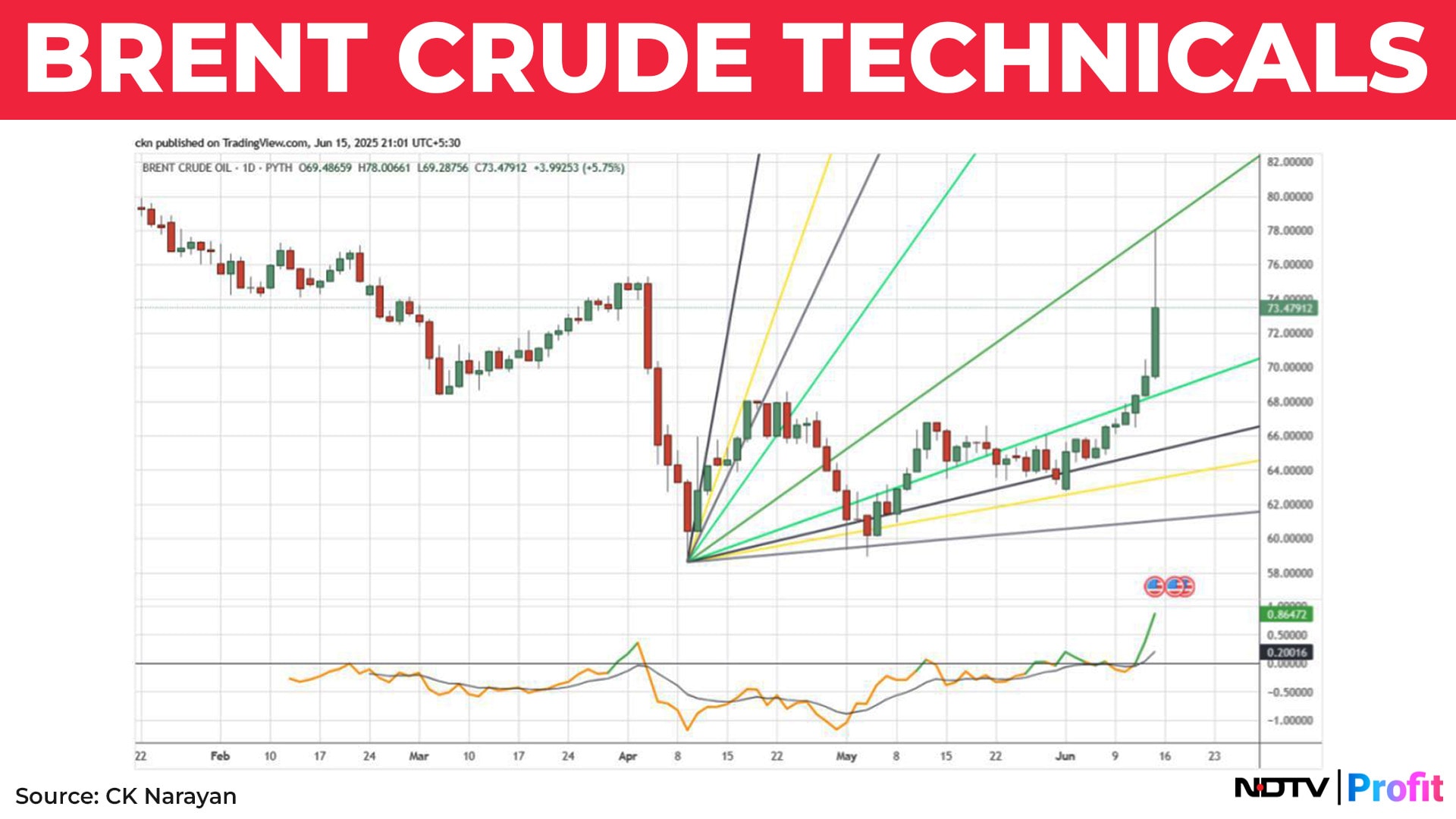

Let that evidence emerge. Should happen in the next week itself, I would reckon. So, not much to wait. Evidence shall come from oil charts because oil prices are the best indicators of geopolitics. Here too oil flared up some $10 in a day or two. Chart 2 shows Brent daily.

The prices shot up, hit the rising Gann angle for resistance, and had a nice sell-off at the highs. But the strong move pulled up the momentum indicator strongly higher. This is not going to dissipate in a hurry. The immediate moves to watch would be whether the candles in coming sessions can trade above the 73.50-75 area. If they do, then Brent would work its way higher, and that would mean that the world is anticipating the Iran conflict to continue. That would not be good news. It would undo all the good work and inputs we have had recently, such as interest rate cuts, liquidity infusion, positive reaction to the Q4 results, etc. Crude, after all, is a giant item on the country's balance sheet. If Iran's supply is going to go off the market, then crude prices will certainly move higher. How will all that play out? No idea. Just watch the crude chart.

No point, I feel, in looking at which sector has outperformed or underperformed. Those will keep getting adjusted every day and will be a difficult call for traders, let alone investors. This will be more deceptive noise than concrete info.

Mid- and small-cap indices had raced to strong highs on their indices recently, implying that retail grabbed stocks left and right. Suddenly caught on the wrong foot by these macro events, they may be wondering which way to go. My advice is simple – if you used leverage to buy them, exit those. Use your own money only. Then, check which are the ones you bought on pure momentum and see whether that momentum is intending to persist or has vanished. If the latter, then exit those also. Only hold those that continue to show promise.

The tendency may be to book out some profits (whatever may still be there) and to hold the losers in the hope that they will ‘come back'. This will be stupidity. If this is your hand, then for every profit that you book, also book an equal if not even slightly higher loss. Meaning, reduce overall position.

We return to stock-specific action and to a possibly day trading scenario once again. I had earlier mentioned that we had entered a phase of swing trading and advised holding positions beyond the day. Events have transpired in such an unpredictable way as to put paid to that conclusion. So, shelve those ideas. Maybe get out of stocks that you have created on that basis by setting suitable stops on them. Ideally, if those stocks have to survive in their trend, last week's low should survive. Keep that in mind.

So, that's it for this week. We are forced to the sidelines on index as well as stock trading. If the down move continues, we will be forced to take some losses on the positions which we should not shirk. There are supports beneath, but those will only lead to time wasting and not improve the price levels by much. So, time for some painful decisions in the week ahead, perhaps. If it doesn't happen, then the market will not take much time to recover. But let the market show us its intentions, and then we can become active and aggressive. Not before.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.