So, in a week, the market has thrown up a bit of excitement – as we are back near the higher end of the recent consolidation band. Four sessions above 25,000 and all that! Wow. Imagine that!

Look what we have all been reduced to. A few sessions above 25,000 is something to celebrate? But months of sideways action have now made us all kind of complacent that this market is not going down. After all, argue the bulls, what else can go wrong from here? Every kind of bad news has come in, right? Poor results on a trot, Trump tariffs, high valuations, etc., etc. Now, the only thing that is left is for the market to shake off its ennui and start moving up, they assert.

But the counterarguments can and are being made. What more does the market want? the bears ask. The budget gave us tax cuts, then the RBI gave us interest rate cuts, and now the govt has given us GST cuts. The DIIs are buying up everything the FIIs are throwing at them, and it is still raining IPOs. Still, the market doesn't go up, and ergo, it must go down, the bears argue.

Who is correct in this debate? Difficult to say.

So, we continue to wait for the market to resolve this range thingy. It has to be something news-driven, for sure, from within or from overseas. For sure, the expectations for Q2 numbers are low. So, negative surprises may not be very many or may not impact markets too badly. In fact, the market may be positively surprised by some numbers that may come out.

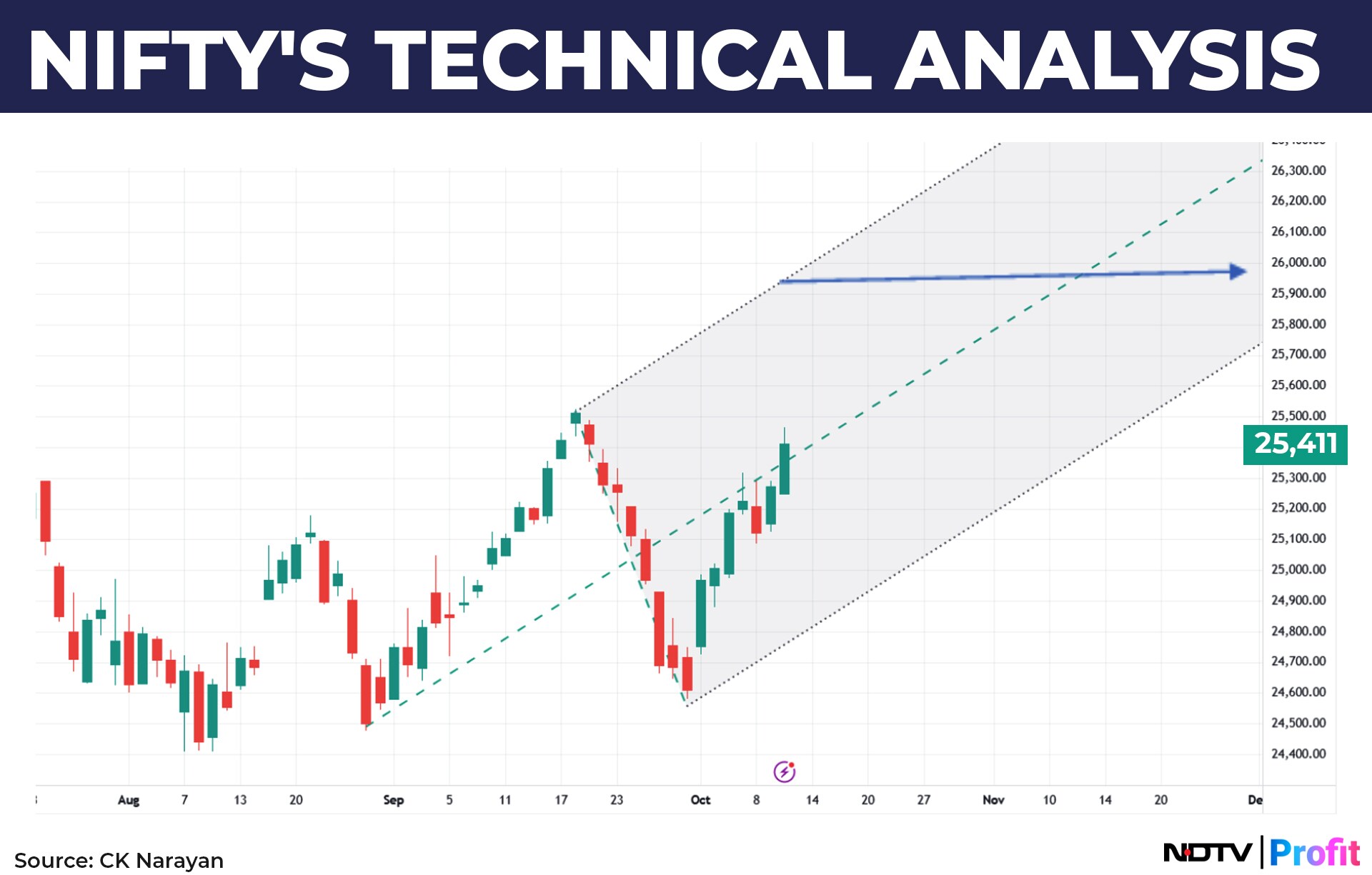

As far as price action goes, refer to chart 1, which shows several rally attempts marked on Nifty daily. We can see that each of them has been a sharp affair. So is the current one. Let not the swiftness fool you because we have seen that earlier, and all of them ended with a pullback into the range. Actually, ever since the June dip, we should be thankful that the market has now dawdled – it has neither shot up nor pushed down with quick turnarounds. Those swift of feet would have probably succeeded some in this market as well.

Each of the prior rallies ended with a bearish candlestick formation. That is the first thing to watch for early next week. If it doesn't appear, then we may have a change in thinking. And that would be a good signal of an intended change. The Friday candle is a firm one. Weekly candle ain't much.

Sentiment is cheered, like it usually is, whenever we reach higher levels. But not by much, as the sentiment indicators that I have shown in earlier letters have not changed their readings in any of the time frames (H/D/W). So, it is just the 25,000 crowd that is applauding the upmove right now. Not enough. We need to see more.

TCS, as usual, kicked off the new earnings season. I thought the meagre profit growth was not good enough. But the market has this wonderful mechanism called ‘analyst expectations', and apparently, the numbers were better than what this analyst bunch thought they ought to have been. Very soon, I think, these kinds of ‘expectations' are going to be put to the sword by AI. With the advent of various tools, almost everyone can and will soon have his or her own expectations. And this stuff will die a death. I do think all those ‘results prequel' reports will bite the dust swiftly.

Be that as it may, the stock ended well for the week, making a decent pattern on the weekly chart too. So, possibly, it is time for the stock to rally. Will it stimulate a rally across the IT sector? There are some expectations for Infy results (large orders), and TCS itself announced intent to do something new in AI and data centre areas. Almost all the other IT leaders have their results due for next week, and hence the fate of this sector will be known by the end of next week. It currently has about 12% weight on the Nifty. Technically, I find that HCL Tech is the best placed among the group. If the results there are good, then I would be inclined to buy it.

With the Index heading higher, it is our duty to map out higher possibilities. Chart 2 shows the next pitchfork setting. The median line is crossed. The upper channel is at 25,900 levels. So, there can be good news – if there is good enough news flow to trigger continued upside action!

We spoke about the 12% of the Nifty. Banks constitute some 35% of the Nifty. What is the scene there? It is obvious that they need to fire if the Nifty has to have a chance to take that shot at 26,000 levels. During the week, Pvt Banks were up 2.48%, while PSU Banks were up 1.45%. So, there is some action there. Financial services were up 1.61% for the week. Now, that is a decent start. If we keep that up in the coming weeks, we could see banks and financials add some heft to the Nifty. No bank names except Axis Bank, scheduled for results in the coming week, but some financial names are listed. So, perhaps, this sector may not move the needle for the Nifty in the coming week? Likewise, no auto names either.

So, will the Nifty find the going a bit tough to carry on? The week following the next is full of holidays. So that would be another glimmer of trend possibilities. Let's remember these as we go into next week.

This is important in light of the PCR being 1.41 for next week's option positions on the Nifty. Lots of puts sold from ATM levels downward. So, the market is biased towards the upside. This is important if the rise doesn't show follow-through.

People were also perked up a tad with the FII showing some green shoots of buying in cash and ended the week with fewer shorts (1.85L contracts) than the earlier week. This seems quite meagre, and we may need to see a lot more activity from the FIIs before we can consider them to be a player again in the current game.

In the meanwhile, the entire globe is agog with talk on gold and silver. Both have been racing higher. See chart 3.

The powerful drive in gold over the past six weeks smacks of some very brisk short covering. It is a near-vertical climb after an already long drive upward. In an earlier update I had mentioned that temporary highs on the metals are made only after a bout of outperformance from silver. In chart 3 we can see some of that has come through. Is that much enough?

Consider this: Silver is traded much through ETFs since it is difficult to store it. But now ETF issuers are starting to halt sales of Silver ETFs because there isn't space for storage anymore! Further, last week we saw a strange situation where the ETF premium over the underlying shot up sharply. What was strange about it is that various ETFs listed showed varying price levels of premiums to the spot! How can this be? There is something out of whack in the local silver market ETFs. This certainly doesn't look like a price to buy gold or silver. Maybe one can book out of some of the long ETF positions too. But this would be a pure profit-taking call, as there are no weakness signals in either chart as yet. So, one would be selling into strength to take profits.

In the latest exchange between PM Modi and US President Donald Trump on social media platform X, the word ‘my friend' has made a comeback. Is this a signal of a thaw, finally? Trump lost out on the Nobel Peace Prize, so that is another common factor attributed to Trump's actions. The UK, in the meanwhile, sent a plane load of a trade delegation to India, and a flurry of announcements are going on. Historically, I think Trump may be, perhaps inadvertently, setting up the individualisation of nations. Those that can are now standing up. China, primarily. They just delivered a body blow to their exports of rare earth minerals and other stuff. There is talk of local deals with nearbycountries happening in INR even if it is far away from convertibility. The world may be discovering that existence without the dollar hegemony is possible, after all?

CK Narayan is an expert in technical analysis, the founder of Growth Avenues, Chartadvise, and NeoTrader (https://neotrader.in), and the chief investment officer of Plus Delta Portfolios.

Disclaimer: The views and opinions expressed by experts and investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.