- Nifty 50 hit a one-year high driven by a surge in financial stocks on Friday

- Nifty Defence and Nifty Finance are the top sectoral gainers, with Defence up 24%

- Bajaj Finance, HDFC Bank, and ICICI Bank are major contributors to Nifty's growth in this period

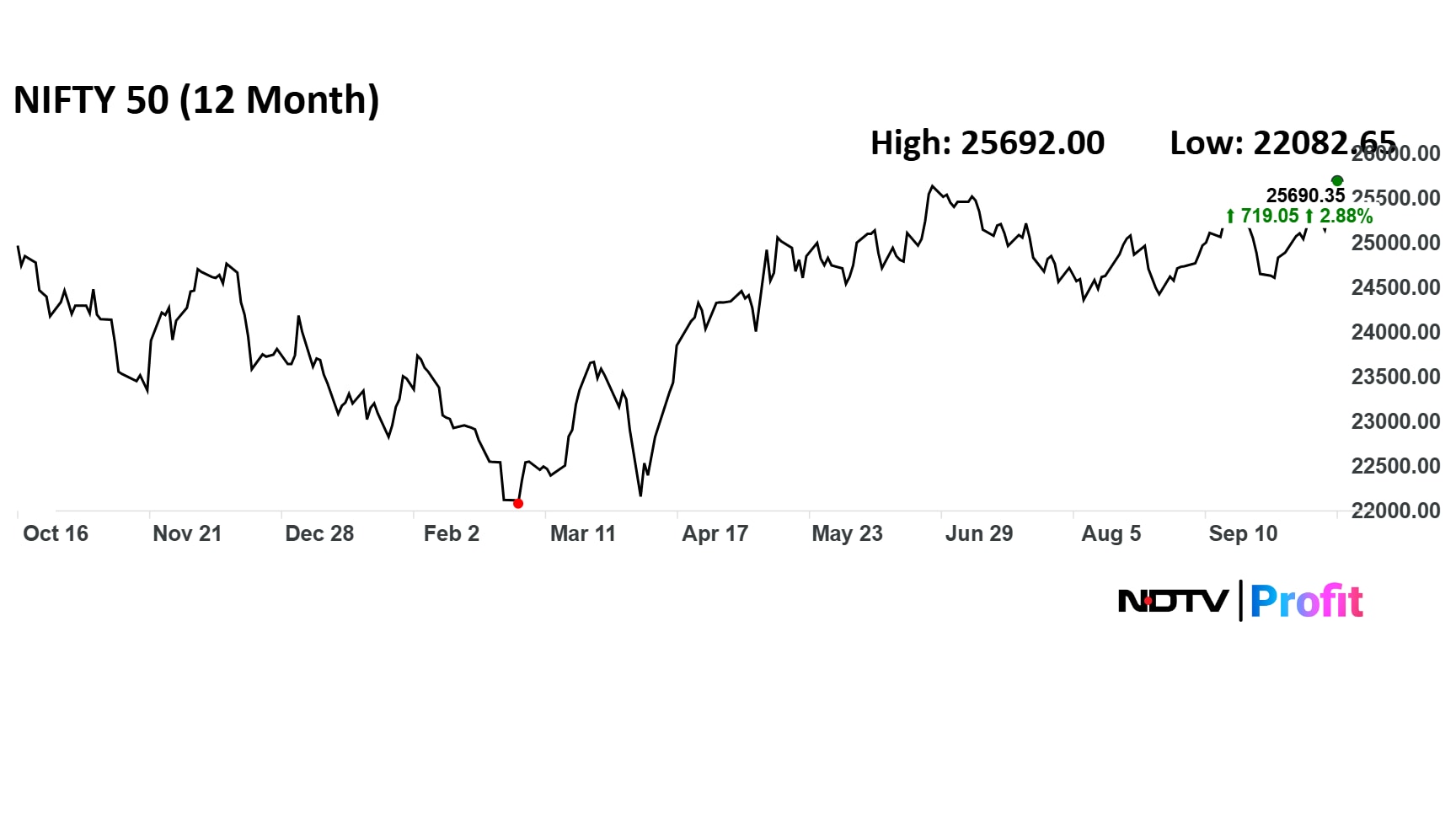

India's benchmark Nifty 50 hit a one-year high during early trade on Friday, driven by a surge in financial stocks. Telecom, auto and oil and gas sectors contributed the most to gains in the 12-month period.

The Nifty Defence and Nifty Finance are the top sectoral gainers. The Nifty Defence has surged 24% since Oct. 17, 2024.

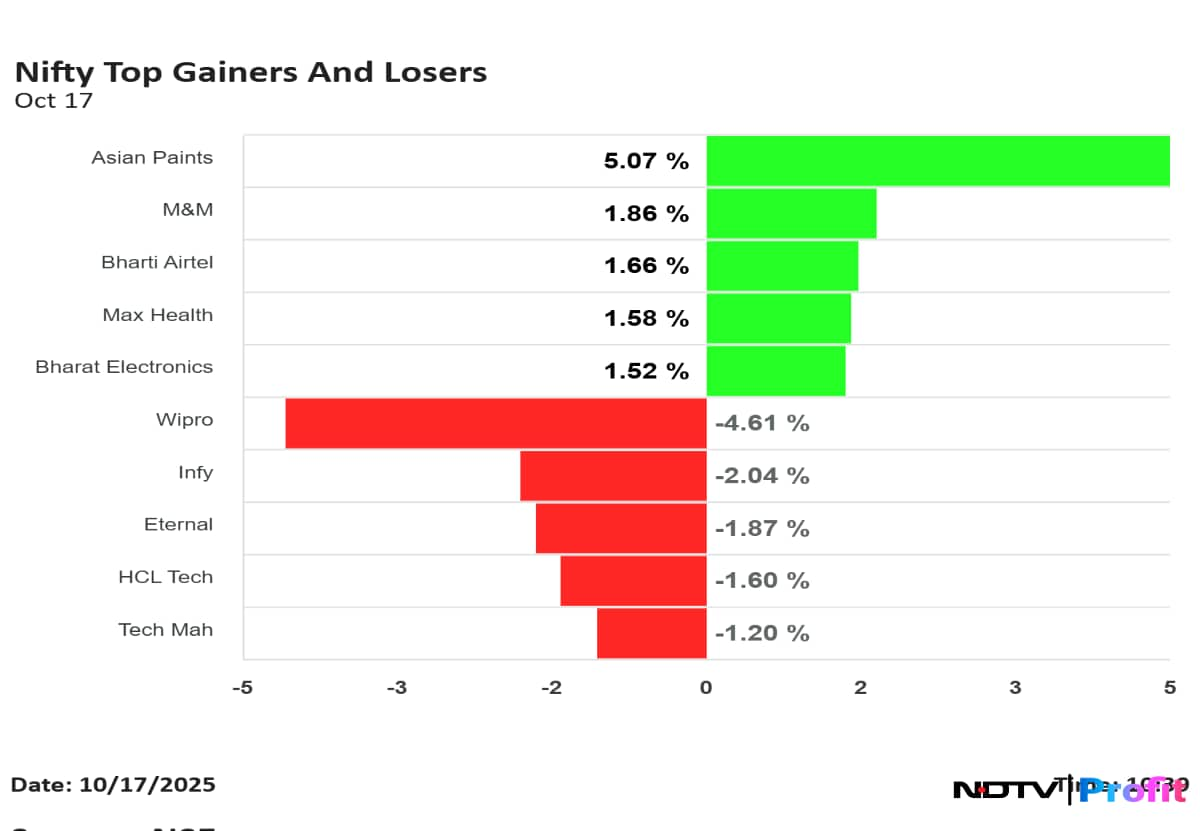

On the other hand, Nifty IT has fallen 18% to be among the top sectoral losers in the last year. The Nifty Media has shed the most by nearly 25%.

Indian equities have managed to stay firm despite persistent foreign fund outflows, global trade frictions including the US-India tariff standoff, and geopolitical uncertainty.

After more than a year of consolidation, the breakout signals that market bulls are back in command and potentially setting the stage for a strong performance in the near term, according to Rajesh Bhosale, equity technical analyst at Mumbai-based broking firm Angel One.

With this breakout, the Nifty now appears poised to retest the calendar year high around 25,700, followed by the 26,000 mark, and eventually the all-time high near 26,300, he said.

Nifty Rally: Key Reasons

Corporate earnings upgrade expected. Nifty earnings growth is projected at 8% in FY26 and 16% in FY27, compared to 1% in FY25, while valuations remain reasonable at nearly 20 times FY26 earnings, according to Motilal Oswal Financial Services Ltd.

Valuations have moderated. The Nifty one-year forward price-to-earnings have moderated from a high of 23.4 in September 2024 to 22.7 now, closer to the three-year median.

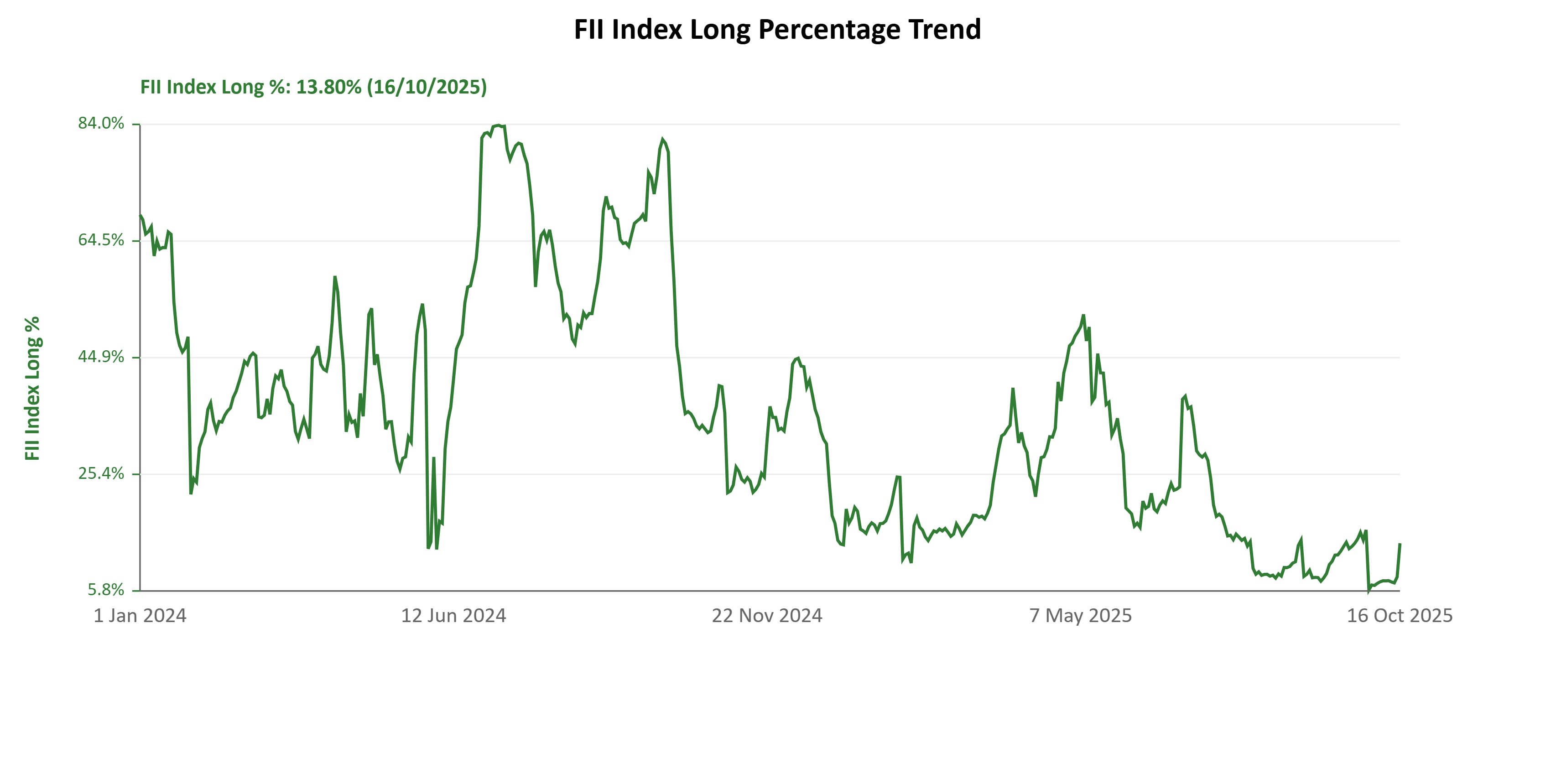

FIIs are going long. Overseas investors have started going long on the Nifty index since the end of September. On Thursday, the FII Index Long ratio stood at 13.8.

Financial stocks are contributing the most to the gains. Bajaj Finance, HDFC Bank and ICICI Bank have contributed majorly to Nifty's growth.

One-Year Performance

Top Nifty Gainers

Bajaj Finance up 55%

Eicher Motors up 53%

Bharat Electronics up 47%

Maruti Suzuki India up 36%

Max Healthcare Institute up 28%

Top Nifty Losers

Trent down 38%

TCS down 28%

Infosys down 27%

Tata Motors down 26%

Coal India down 21%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.