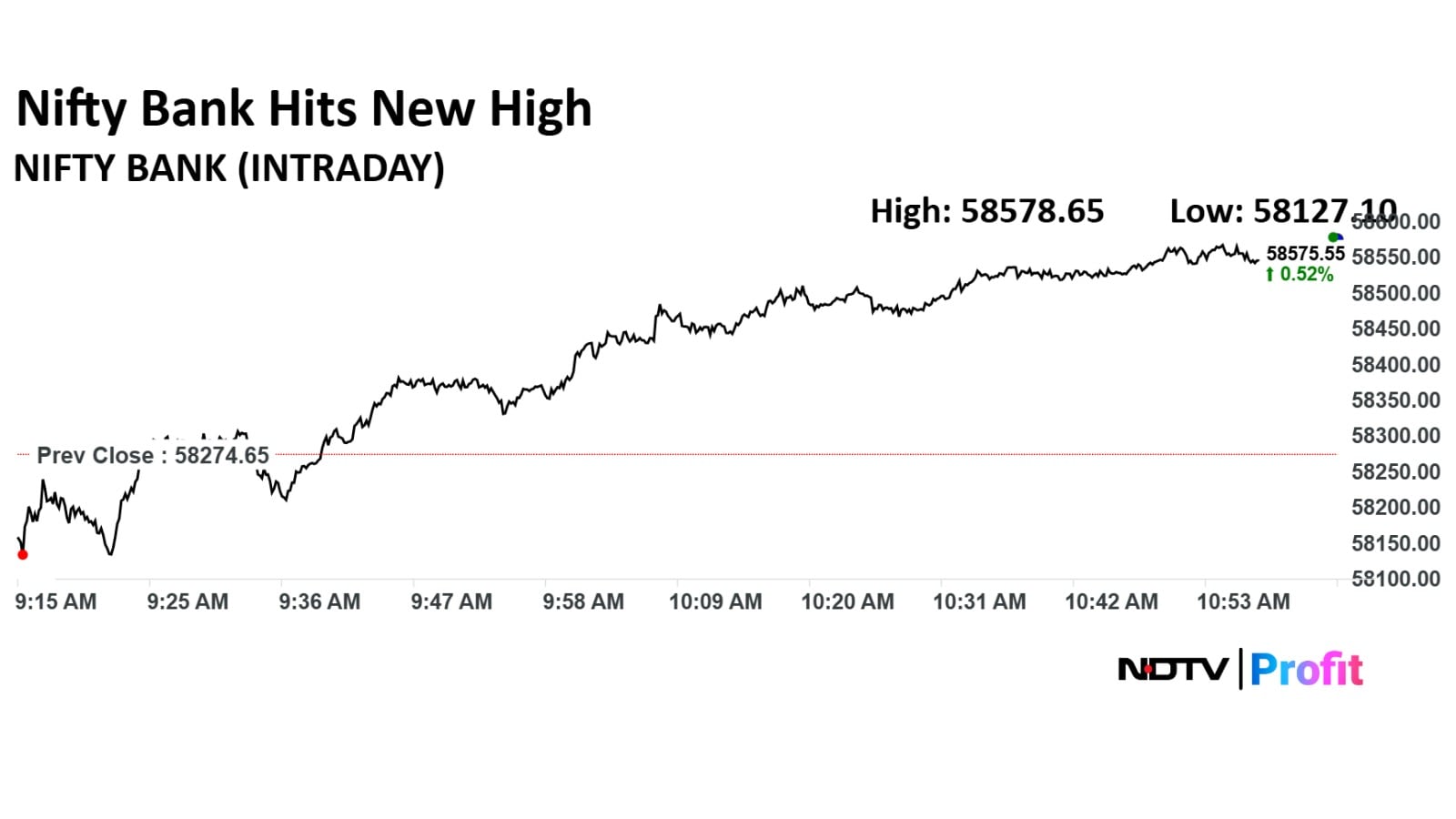

- Nifty Bank index hit a record high of 58,609.20, gaining 0.57 percent on Thursday

- Strong Q2 results and positive interest rate outlook boosted investor confidence in banks

- Banks showed broad-based credit and deposit growth across retail, corporate, and SME sectors

The Nifty Bank index surged to a new record high of 58,609.20 on Thursday, gaining 0.57%, as optimism strengthened around large private sector lenders and public sector banks. The move reflects growing confidence in the banking sector's earnings resilience, asset quality improvement, and macroeconomic support from easing inflation.

The rally in Nifty Bank has been underpinned by strong second-quarter results and a favourable interest rate outlook. Both private and state-owned banks have reported robust credit growth and improving profitability metrics, boosting investor sentiment.

The index rose 0.57% to 58,609.20, but it pared gains to trade 0.46% higher at 58,543.85 as of 11:15 a.m.

“From a macro perspective, the backdrop remains broadly supportive for equities, with October CPI inflation easing to a record low and strong second-quarter earnings from PSU banks, autos, metals, and FMCG adding further depth to the ongoing rally,” said Ponmudi R, CEO of Enrich Money.

Strong Credit and Deposit Growth in Q2

Banks delivered healthy growth in both credit and deposits during the September quarter. Loan demand remained broad-based across retail, corporate, and SME segments, while deposit mobilisation accelerated with improving liquidity conditions.

Continued Asset Quality Improvement

Asset quality across the banking system continued to strengthen. Better recoveries, lower slippages, and prudent provisioning have contributed to cleaner balance sheets, particularly among PSBs that have benefited from earlier reforms.

Profitability Surprising on the Upside

Banks posted stronger-than-expected profitability in the second quarter, driven by sustained credit momentum, lower credit costs, and improving efficiency ratios. Several large lenders also reported better fee income growth and cost control, adding to the sector's earnings momentum.

Lower Inflation Boosting Rate-Cut Hopes

October's Consumer Price Index (CPI) inflation eased to a record low, increasing expectations of a rate cut in the coming quarters. A lower interest rate environment is typically favourable for banks, as it reduces funding costs and stimulates loan demand.

Positive Surprise on Net Interest Margins

Despite concerns about deposit repricing, several banks delivered a positive surprise on NIMs during quarter ended September, supported by a sharper reduction in deposit costs and efficient management of lending rates.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.