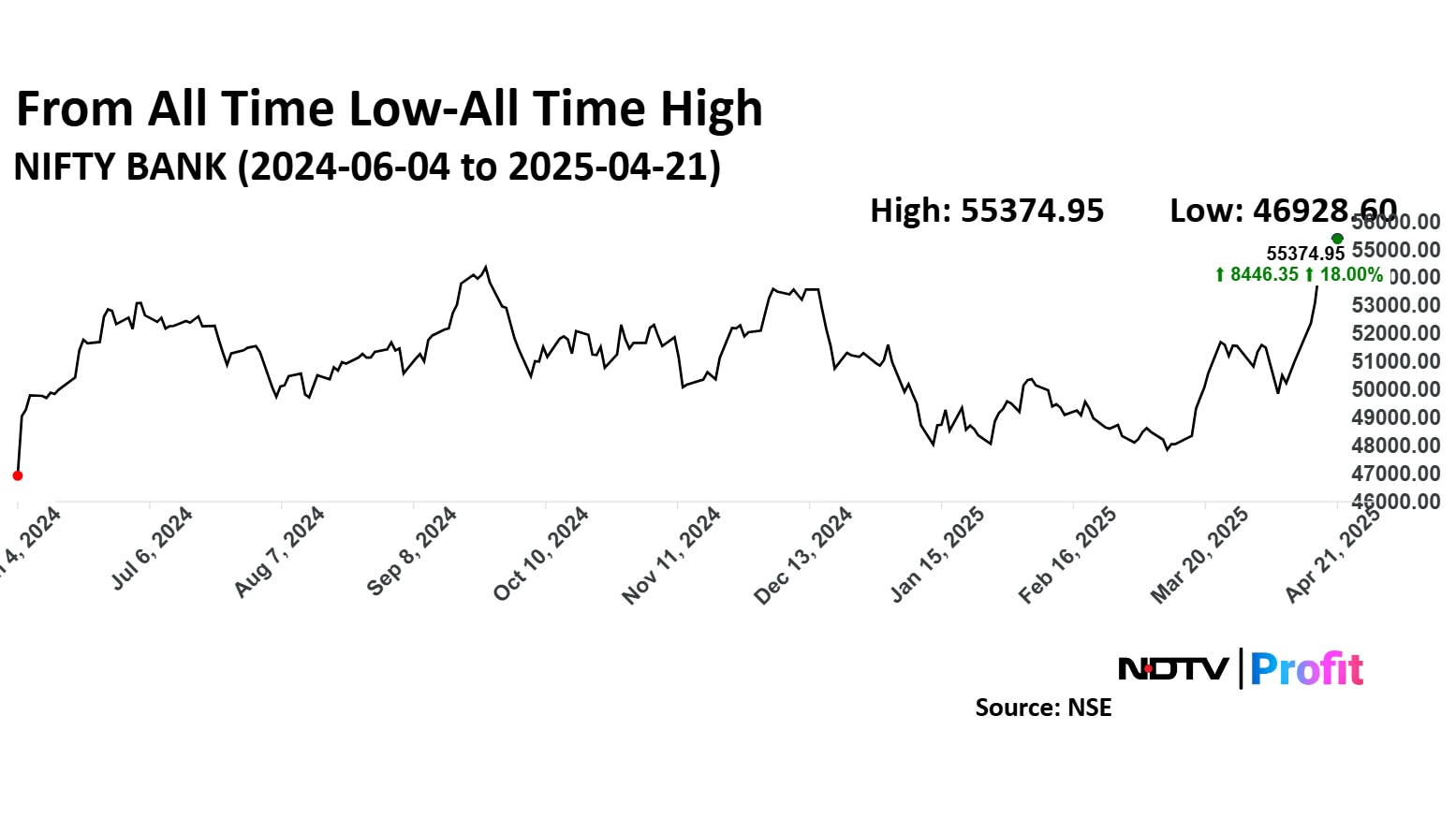

The Nifty Bank index surged to an all-time high on Monday, adding 1000 points as it rose nearly 2% to trade at 55,291.05. This strong performance is the result of a combination of factors, including strong quarterly earnings from major banks, consecutive rate cuts by the Reserve Bank of India, and ample liquidity in the banking sector.

The Nifty Bank index has been on an upward trajectory for the last five consecutive trading sessions. Over the past 12 months, the index has surged by 15.12%, with an 8.09% increase in just the last five sessions.

Q4 Earnings

One of the reason for this sharp rally is major banks reporting robust fourth quarter earnings for FY25, contributing to positive sentiment in the banking sector.

The biggest private lender of the country, HDFC Bank's net profit increased by 6.7% year-on-year to Rs 17,616 crore, with a 10.3% rise in net interest income to Rs 32,066 crore. Meanwhile, ICICI Bank's net profit surged by 18% year-on-year to Rs 12,630 crore, driven by higher net interest income and operating profit, with improvements in both net and gross NPA ratios.

Yes Bank's profit after tax rose by 11% year-on-year to Rs 1,739 crore, with a notable decrease in provisions and contingencies, and stable asset quality.

Ample Liquidity

The banking sector is currently experiencing ample liquidity. On March 31, the RBI absorbed Rs 3.46 lakh crore from the banking system, indicating a significant increase in liquidity compared to the previous quarter when it absorbed only Rs 87,702 crore on Dec 31. This ample liquidity allows banks to lower lending rates, further supporting the surge in the Nifty Bank index.

With increased liquidity, banks have more funds available to lend. This allows them to lower lending rates, making borrowing more attractive for businesses and consumers. Lower lending rates tend to stimulate economic activity, leading to higher loan demand and increased interest income for banks contributing to better earnings.

RBI Rate Cuts

The Reserve Bank of India's decision to reduce the key interest rate by 25 basis points to 6% and shift its monetary stance from 'neutral' to 'accommodative' has provided a significant boost to the banking sector.

This marks the second consecutive rate cut this year, following a similar reduction in February. The policy change is aimed at revitalising economic growth amid cooling inflation and global trade uncertainties.

Lower interest rates make borrowing more affordable for consumers and businesses, likely leading to increased spending and investment. Major banks like State Bank of India have already reduced their lending rates, translating to lower Equated Monthly Installments for borrowers.

The accommodative stance also ensures ample liquidity in the banking system, improving loan disbursements and bolstering market sentiment

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.