- Nifty Bank rose 0.78% above 55,000 after RBI kept repo rate at 5.5% and stance neutral

- Kotak Mahindra Bank and ICICI Bank gained over 1%, supporting the Nifty Bank index rise

- Nifty PSU Bank slipped into red before and after the RBI Monetary Policy Committee decision

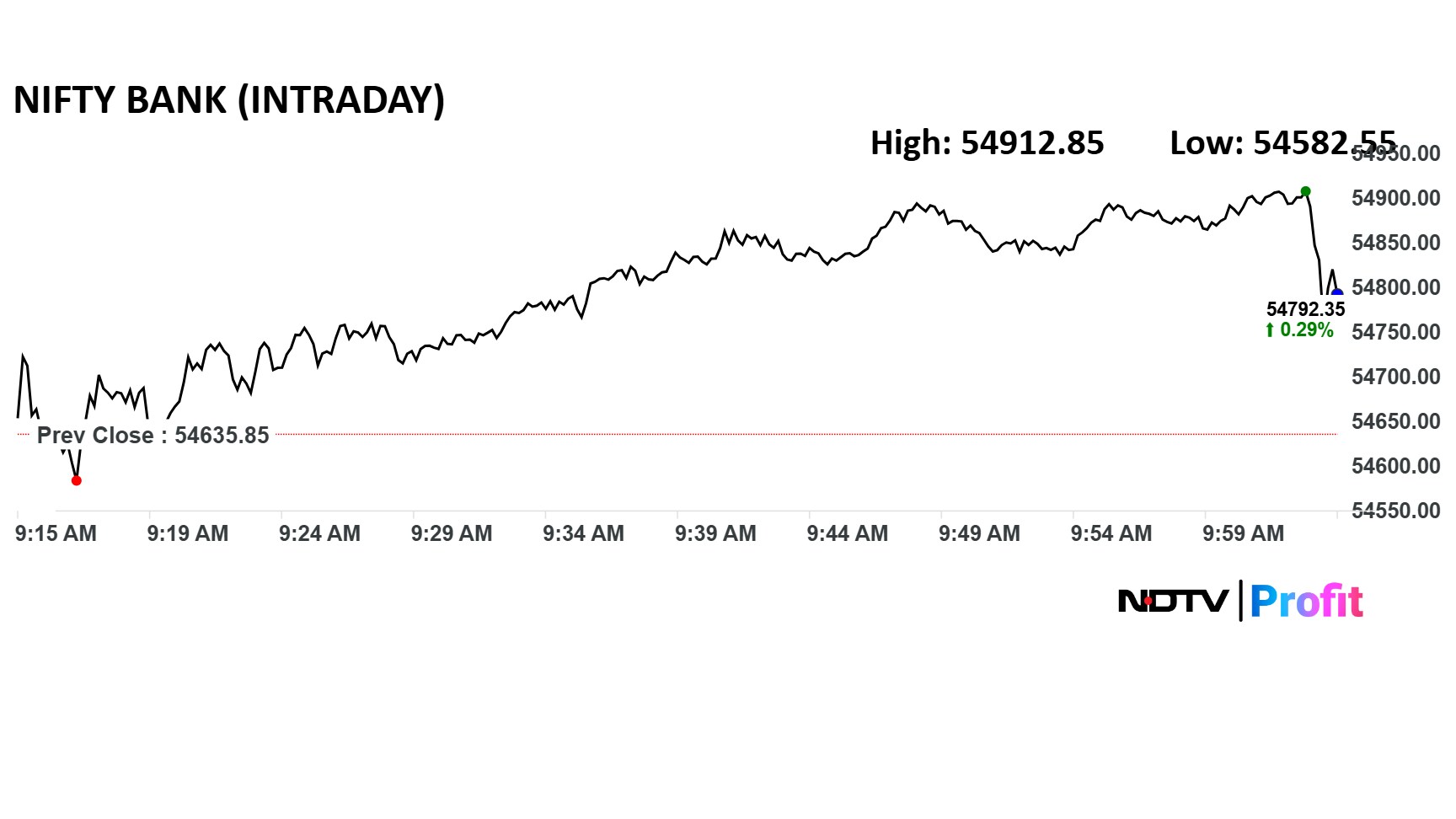

Nifty Bank surged to its day's high after the RBI Governor Sanjay Malhotra maintained the repo rate at 5.5% and retained the stance at 'neutral.' The index rose as much as 0.78% to levels above 55,000.

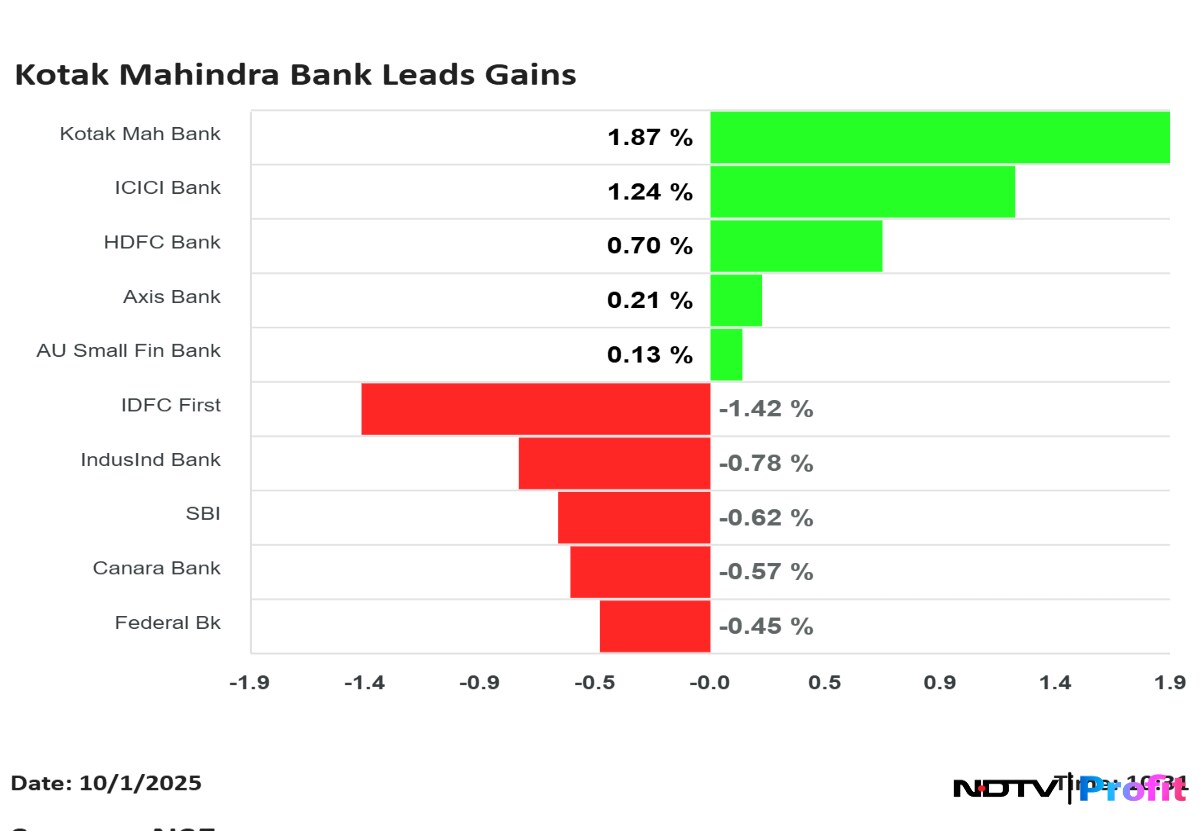

The gains of the index was supported by gains in counters like Kotak Mahindra Bank and ICICI Bank, that gained over 1%. Other names in green included, HDFC Bank, Axis Bank and AU Small Finance Bank.

The names dragging the index was IDFC First Bank, IndusInd Bank and SBI. The Nifty PSU Bank had slipped into red ahead of the MPC and continued to trade with losses after the decision.

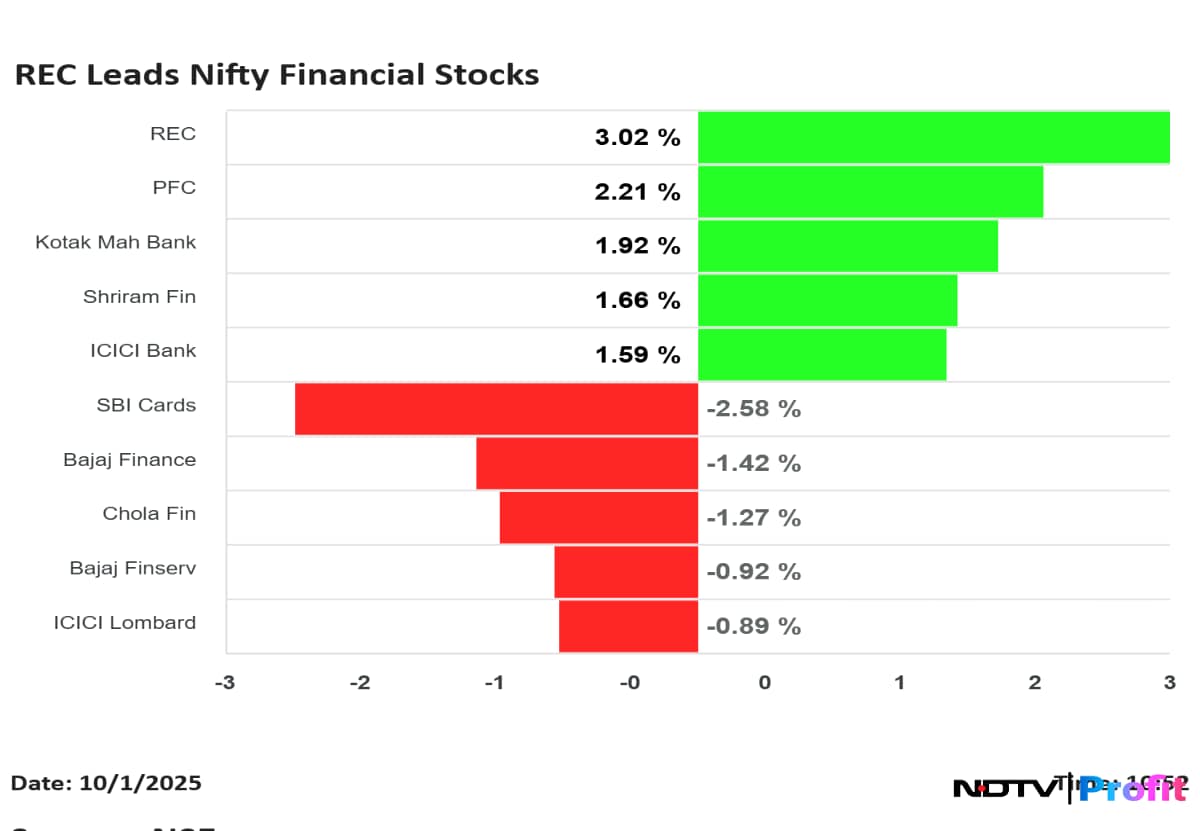

Nifty Finacials were trading in green with insurance players like REC, PFC leading the pack on the back of Malhotra's proposal during the MPC meet.

He said that the Central Bank is set to introduce risk based insurance premiums to incentive risk for banks.

The Reserve Bank of India's Monetary Policy Committee, led by RBI Governor Sanjay Malhotra, retained the benchmark repo rate at 5.5%, after front-loading the three rate cuts in February, April and June this year. However, the RBI revised the CPI inflation forecast downward while revising the GDP growth forecast upward.

Space for monetary action has opened up, Malhotra said, adding that the MPC considers it prudent to wait before beginning to cut rates further.

Amidst benign inflation, prevailing global uncertainties and tariff-related developments are likely to decelerate growth in H2:2025-26 and beyond, stated the resolution of the MPC. "The current macroeconomic conditions and the outlook have opened up policy space for further supporting growth," it stated.

The RBI revised the inflation forecast from 3.7% in June to 3.1% in August to 2.6% in October. CPI inflation is projected at 1.8% for Q2 and Q3, 4% for Q4, and 4.5% for Q1 next year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.