The NSE Nifty 50's immediate support level is seen near 24,000, while the key resistance is positioned near 24,350–24,360, with further resistance at 24,365, according to analysts.

"Technically, on a daily chart, the Nifty has formed a green candle, indicating strength," Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd. "On the upside, the index will find an immediate hurdle near 24,350-24,360 levels.

The 50-day exponential moving average is placed near 24,365. If the index manages to sustain above 24,365, the upmove can extend towards 24,550. On the downside, the index will find important support near last week's low, which was around 23,870, according to Yedve.

As long as the index remains below 24,365, traders should focus on booking profits on bounce and wait for a fresh breakout," Yedve said.

"Technically, after an early morning intraday dip, the market found support near 24,000/79,300 and bounced back sharply," Shrikant Chouhan, head of equity research at Kotak Securities. "A bullish candle on the daily charts, along with a higher bottom formation on the intraday charts, indicates a further uptrend from the current levels."

For trend-following traders, the 24,000/79,300 mark would act as a crucial support zone for the Nifty and the BSE Sensex. As long as the market is trading above this level, the bullish sentiment is likely to continue, Chouhan said.

On the higher side, the indices could move up to 24,400–24,500/80,500–80,800. However, if they drop below 24,000/79,300, the uptrend would be vulnerable, according to Chouhan .

"Given the volatile global economic environment and mixed domestic factors, we expect the market to consolidate within a broad range in the near term," said Siddhartha Khemka, head, research, wealth management, Motilal Oswal Financial Services Ltd.

The Bank Nifty settled the day on a positive note at 52,109 levels. "Technically, on a daily chart, Bank Nifty formed a doji candle, indicating uncertainty. The index is facing strong resistance near 52,500–52,600 levels.

On the downside, the 21 DEMA, is approaching 51,590 and will act as immediate support for the Bank Nifty. Traders are advised to book profits on the bounce and wait for a sustained breakout above 52,600 to build up a fresh position, Yedve said.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the third consecutive session on Monday, while the domestic institutional investors remained net buyers for the fourth straight session.

The foreign portfolio investors offloaded stocks worth Rs 238.3 crore and the DIIs bought shares worth Rs 3,588.7 crore, according to provisional data by the National Stock Exchange.

F&O Cues

The Nifty November futures were up by 0.51% to 24,429 at a premium of 153 points, with the open interest up by 3.7%.

The open interest distribution for the Nifty 50 December 5 expiry series indicated most activity at 25,000 call strikes, with the 23,000 put strikes having maximum open interest.

Market Recap

The NSE Nifty 50 and BSE Sensex extended gains to the second day as Reliance Industries Ltd. and Infosys Ltd. share prices led. The benchmark indices recovered at the later part of the session.

The Nifty 50 ended 144.95 points or 0.60% higher at 24,276.05, and the Sensex closed 445.29 points or 0.56% up at 80,248.08.

Major Stocks In News

Torrent Power: The board approved the opening of QIP to raise up to Rs 5,000 crore to pare debt at a floor price of Rs 1,555.75 apiece. The company may, at its discretion, offer a discount of not more than 5% on the floor price calculated for the issue.

Bajaj Finserv: The company has ended co-branded card partnership with DBS Bank India. The move comes as the non-bank lender seeks to end co-branded partnerships for credit cards.

Hindustan Unilever: The company has made payment of Rs 193 crore on tax demand order. The company has updated on the tax dispute relating to the GSK deal.

Nazara Technologies: The company announced five investments totalling Rs 196 crore to drive growth across gaming and entertainment. The company will invest Rs 148 crore in existing arms including Sportskeeda, Nodwin Gaming and Datawrkz.

Godrej Properties: The company closes QIP, sets the issue price at Rs 2,595 per share. The issue price indicates a 4.86% discount to the floor price.

Global Cues

Stocks in the Asia-Pacific region powered ahead, following an overnight rally on Wall Street, led by technology stocks, ahead of the Federal Reserve Chair's speech and barrage of data prints.

Equity benchmarks in South Korea and Japan led to gains during the session's opening. The Nikkei was 433 points, or 1.12%, higher at 38,936, while the S&P ASX 200 was up 66 points, or 0.78%, at 8,514 as of 5:35 a.m.

Data on US factory orders, durable goods and the S&P Global Composite PMI are due on Wednesday. India's Reserve Bank of India will decide on its key interest rates on Friday.

Stocks on Wall Street hit a new peak powered by technology stocks with the S&P 500 index notching its 54th closing record this year. The S&P 500 index and the tech-heavy Nasdaq Composite rose 0.24% and 0.97%, respectively, on Wednesday. The Dow Jones Industrial Average slipped 0.29%.

Treasury 10-year yields advanced two basis points to 4.19%. The dollar snapped a three-day losing streak following Donald Trump's threat on the BRICS nations on using the Dollar.

The Brent crude was trading 0.01% lower at $71.83 a barrel as of 6:00 a.m. IST, and the West Texas Intermediate was up 0.12% at $68.18.

Key Levels

US Dollar Index at 106.44

US 10-year bond yield at 4.20%.

Brent crude down 0.01% at $71.83 per barrel.

Bitcoin was up 0.42% at $95,818.06

Gold spot was up 0.17% at $2,643.64

Money Market

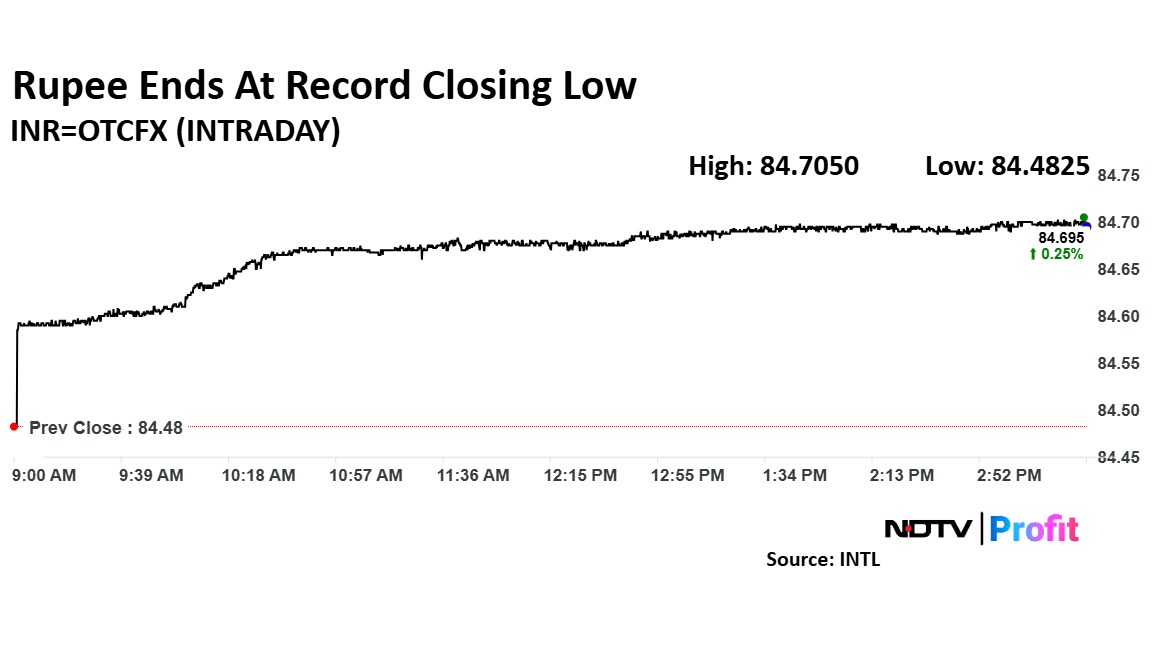

The Indian rupee weakened to end at a record closing low against the US dollar following Donald Trump's threat to impose a 100% tariff on the BRICS countries if they don't continue using the dollar. Slowing economic growth also weighed on the domestic currency.

The domestic unit depreciated 21 paise to trade at a record closing low of 84.70 after opening flat at 84.59 against the US dollar, according to Bloomberg data. The Indian rupee fell as much as 22 paise to 84.71 during the session against the greenback.

Trump demanded a "commitment" from BRICS nations that they will not create a new currency as an alternative or endorse any other currency to replace the dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.