National Stock Exchange of India (NSE) has made sweeping changes to the way Futures and Options (F&O) trade, effective Monday, Dec. 8.

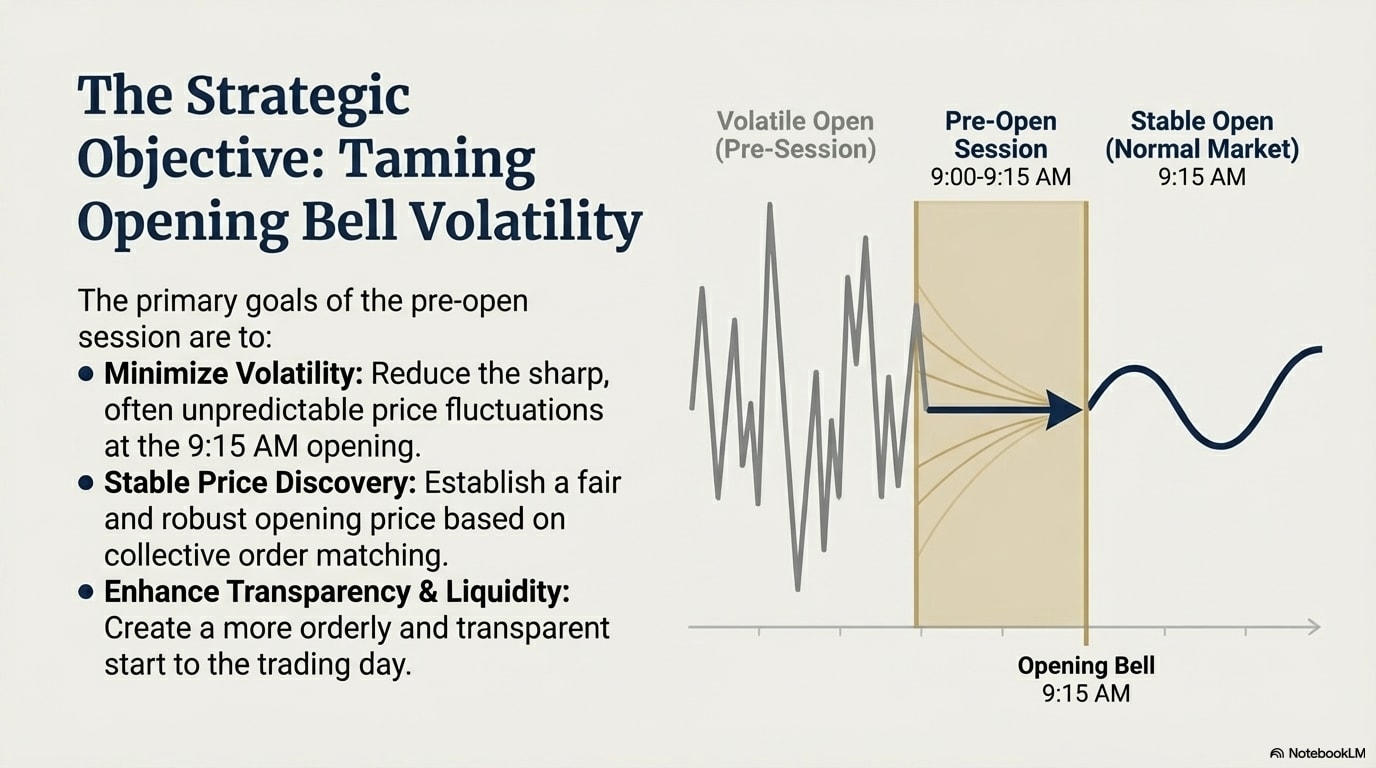

Starting Monday, NSE will conduct pre-open sessions for equity derivatives between 9 a.m. to 9:15 a.m. During this timeframe, traders will be able to conduct call auctions, mirroring the existing pre-market session for the cash segment.

The new pre-open window applies to current-month futures on stocks and indices. Next-month futures will also be included, but only during the final five days prior to their expiry.

As part of the new framework, the pre-open session will be split into three different phases, the first of which, between 9 - 9:08 a.m., will allow market participants to enter, modify or cancel orders.

This will be followed by a four-minute session, during which order matching and trade confirmations will take place. The second phase will end at 9:12 a.m and this is when the system will identify an opening price.

Between 9:12 a.m. and 9:15 a.m., a buffer period will run to ensure a smooth transition to normal market session.

F&O pre-market session breakdown. (Photo generated by Notebook LM)

NSE has introduced these changes in order to increase transparency and reduce volatility often seen at market open in the equity derivative segment. That being said, the new mechanism excludes option contracts, spread contracts, and corporate action ex-dates.

NSE has clearly instructed that all orders must meet margin requirements upfront. While limit and market orders are permitted, Stop-Loss and Immediate or Cancel (IOC) orders are prohibited during the pre-open phase.

Moreover, no order modifications are allowed during the matching window. There are also stricter enforcement regarding position limits, which come into force on Monday as well.

Stemming from an earlier Securities and Exchange Board of India (SEBI) circular, intraday position breaches on weekly expiry days will now attract regulatory action.

Specifically, breaches on options expiry days will trigger an Additional Surveillance Deposit (ASD), thus signalling a tighter grip on speculative excesses.

Key objectives of the new F&O rules. (Photo generated by Notebook LM)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.