Nestle India saw its share price decline by 3.85% on Wednesday following a downgrade from Bank of America (BofA). The brokerage lowered its rating on Nestle India from "Neutral" to "Underperform", citing modest business trends and a rich stock valuation as key factors behind the decision.

BofA's analysis pointed to a combination of subdued growth, cost pressures, and increased competition from various players, including cooperatives and regional competitors, as a challenge that could impact Nestle India's near-term performance.

The brokerage noted that while pricing could remain a key growth driver amidst sharp inflation in commodities like coffee and cocoa, overall growth is expected to remain modest.

The downgrade also reflects concerns about Nestle India's ability to balance growth and margins in a rapidly changing consumer landscape. BofA highlighted that the company's operating margin might be capped and could move slightly lower.

Additionally, the bank cut its earnings estimates for Nestle India by 3-5% to factor in recent trends and cost pressures.

Despite the downgrade, BofA acknowledged the potential for a strategy refresh under new leadership. Manish Tiwary, formerly of Amazon and Unilever, is set to take over as Managing Director in August, replacing Suresh Narayanan. The new leadership is expected to address emerging issues and opportunities, such as health consciousness and premiumisation, which could influence Nestle India's mid-to-long-term portfolio strategy.

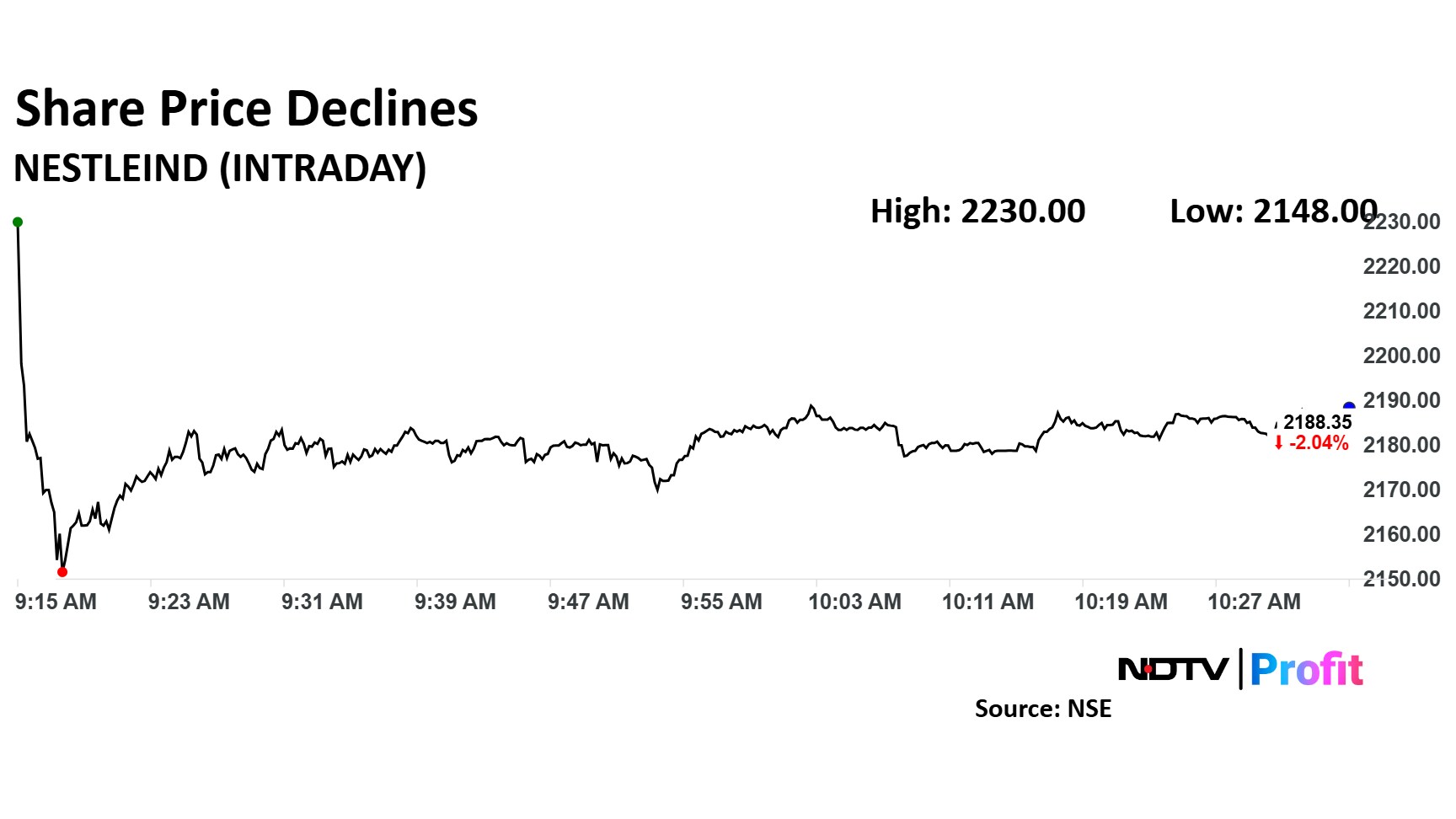

The scrip fell as much as 3.85% to Rs 2,148 apiece. It pared losses to trade 2.07% lower at Rs 2,187 apiece, as of 10:33 a.m.

It has fallen 16.60% in the last 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 43.

Out of 39 analysts tracking the company, 11 maintain a 'buy' rating, 19 recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.