- Shares of NCC rose nearly 4% after announcing a Rs 2,063 crore order win from Assam

- The order is for expansion and modernisation of Gauhati Medical College & Hospital

- NCC reported a 5% decline in net profit to Rs 167 crore in the September quarter

Shares of NCC jumped nearly 4% minutes after the market opened on Wednesday as the company announced a major order win worth Rs 2,063 crore.

The company informed investors that it had secured an order worth Rs 2,063 crore from the Public Works (Health & Education) Department, Assam, for the expansion and modernisation of Gauhati Medical College & Hospital, in an exchange filing after market hours on Tuesday.

The company also stated that neither the promoter nor the promoter group companies have any interest in the entity awarding the order. It further clarified that the order does not fall under related-party transactions.

“The Company has received a Letter of Acceptance dated 21st November 2025 from the Public Works (Health & Education) Department, Assam, for the Expansion and Modernization of Gauhati Medical College & Hospital, Guwahati, Assam State,” NCC said in its regulatory filing.

For the September quarter, the company reported a net profit of Rs 167 crore, a 5% decline from last year's Rs 175 crore.

Revenue for the quarter dropped 12.6% year-on-year to Rs 4,543 crore, while Ebitda fell 11.5% to Rs 394 crore, with margins expanding by 20 basis points to 8.7% from 8.5% in the same quarter last year.

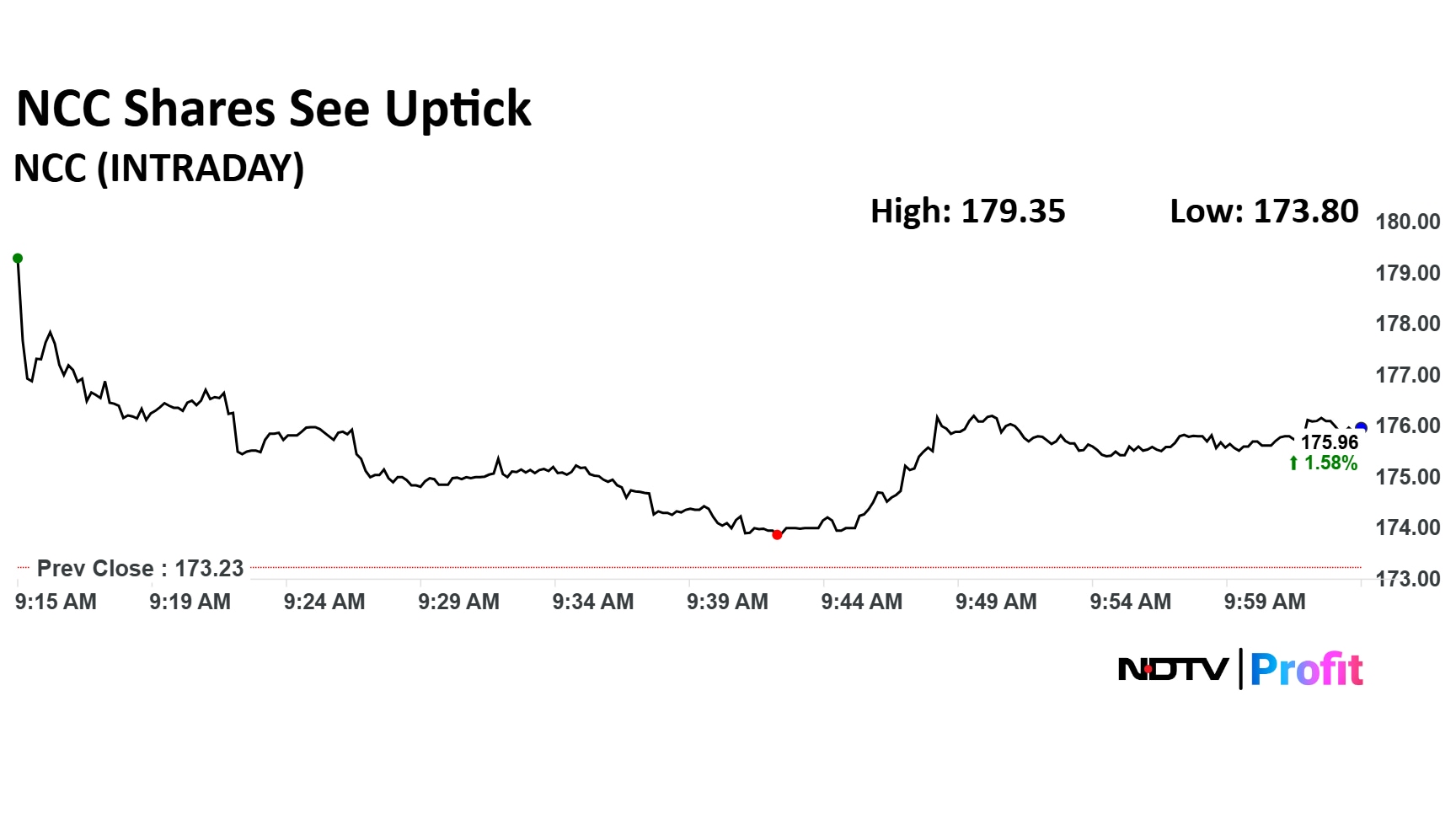

NCC Share Price Today

The scrip rose as much as 3.53% to Rs 179.35 apiece, paring gains to trade 0.39% higher at Rs 173.91 apiece, as of 09:55 a.m. This compares to a 0.73% advance in the NSE Nifty 50 Index.

It has fallen 5.89% on a year-to-date basis, and 40.75% in the last 12 months. The relative strength index was at 15.71.

Out of 15 analysts tracking the company, 10 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 35.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.