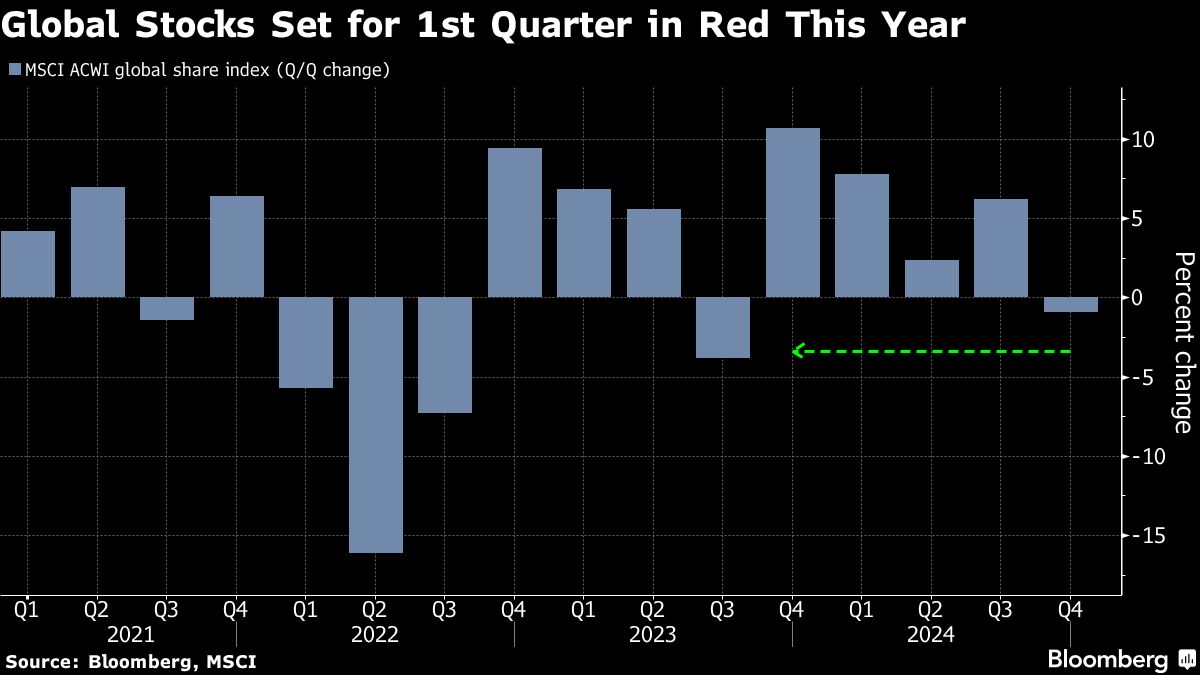

Global equities posted small moves on the last trading day of 2024, on course for their first quarterly loss this year after Monday's weak showing on Wall Street.

European stock trading was muted, with markets in Germany, Italy and Switzerland among those shut on New Year's Eve, with shortened sessions in London and Paris. US futures kept to narrow ranges following declines of more than 1% for both the S&P 500 and the Nasdaq 100 on Monday.

A gauge of global shares looks poised to finish the current quarter in the red, snapping a four-quarter winning streak. Despite the latest weakness, it remains on track to gain for a second consecutive year.

The cautious tone Tuesday partly reflects lingering concerns about the stamina of this year's US stock rally, driven predominantly by the so-called Magnificent Seven cohort of tech giants. It's also evidence of the uncertainties facing investors in 2025, ranging from President-elect Donald Trump's protectionist policies to the outlook for central bank policy and the health of the European and Chinese economies.

The Bloomberg Dollar Spot Index was steady and on course for its best year since 2015 in a rally fueled by Trump's reelection in November and the Federal Reserve's less dovish policy pivot. An index of Treasuries looks set to eke out a small gain for the year, with yields edging lower on Tuesday.

“Investors are in wait-and-see mode,” Noel Dixon, senior macro strategist at State Street Corp., told Bloomberg Television. “We don't know what the retaliatory effects are going to be and how the Fed is ultimately going to react to those tariffs.”

In Asia, trading was thin because several regional markets including South Korea's were shut for a public holiday. Japanese markets are closed through Jan. 6. Stocks fell in Australia and mainland China, with those in Hong Kong flat.

Chinese equities shrugged off data that pointed to an improvement in both services and manufacturing activity. Investors also showed little reaction to President Xi Jinping's remark that China's 2024 economic growth is expected to be around 5%, a target set by policymakers earlier in the year.

“Don't think 2024 GDP growth still matters for market actually as most have already moved towards faith that the government wants to meet the 5% target,” said Xin-Yao Ng, investment director at abrdn. “Perhaps it's more to do manufacturing PMI being below consensus, and within that some components like persistently soft input and output prices continue to suggest deflationary pressure.”

Meanwhile, in the latest sign of simmering tensions between Beijing and Washington, the US Treasury Department said it was hacked by a Chinese state-sponsored actor through a third-party software service provider.

As for commodities, gold was flat and set for one of its biggest annual gains this century after advancing 26%. Oil pushed higher after factory activity expanded for a third month in China, the latest evidence of economic recovery in the world's top crude importer.

In Europe, German Chancellor Olaf Scholz and his deputy, Robert Habeck, used their New Year addresses to castigate Elon Musk over his backing for a far-right party in February's snap election.

Key events this week:

New Year's Day holiday, Wednesday

US construction spending, jobless claims, manufacturing PMI, Thursday

US ISM manufacturing, light vehicle sales, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 8:48 a.m. London time

S&P 500 futures fell 0.1%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index fell 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0408

The Japanese yen rose 0.5% to 156.08 per dollar

The offshore yuan fell 0.3% to 7.3352 per dollar

The British pound was little changed at $1.2543

Cryptocurrencies

Bitcoin rose 2.2% to $93,941.35

Ether rose 2% to $3,382.08

Bonds

The yield on 10-year Treasuries declined two basis points to 4.51%

Germany's 10-year yield declined three basis points to 2.37%

Britain's 10-year yield declined two basis points to 4.60%

Commodities

Brent crude rose 0.6% to $74.42 a barrel

Spot gold rose 0.4% to $2,615.91 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.