Shares of National Aluminium Co. rose nearly 4% on Tuesday, after its third quarter net profit went up over threefold, beating analysts' estimates.

The aluminium manufacturer's profit increased to Rs 1,566 crore in the December quarter, in comparison to Rs 471 crore in the year-ago period, according to an exchange filing on Monday. Analysts tracked by Bloomberg had a consensus estimate of a Rs 1,183-crore profit.

Revenue increased 39% year-on-year for the three months ended December 2024, reaching Rs 4,662.2 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose to Rs 2,327.5 crore. Ebitda margin was flat at 49.9%. The company reported the highest-ever revenue from operations and profit in the third quarter, Nalco said in a press release on Monday.

The rise in profit and revenue is attributable to better sales realisation in alumina and metal, higher sales volume of alumina, use of captive coal and reduction in cost of raw materials, according to Brijendra Pratap Singh, chairman and managing director at Nalco.

Nalco announced an interim dividend of Rs 4 per share at a face value of Rs 5 on the paid‐up equity share capital of Rs 918.32 crore for the financial year 2024‐25. The board has set Feb. 14 as the record date for determining the shareholders eligible for the dividend payout.

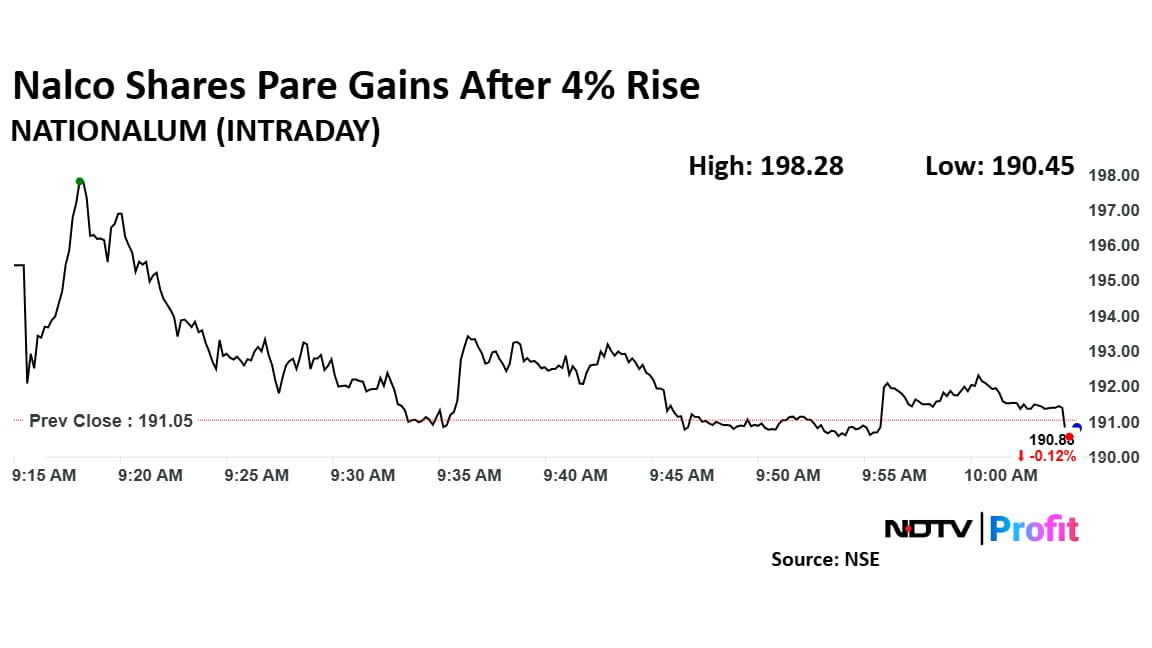

Nalco Shares Rise

Shares of Nalco rose as much as 4% to Rs 198.28 apiece, the highest since Feb. 10. It pared gains to trade 0.96% higher at Rs 192.89 apiece, as of 9:48 a.m. This compares to a 0.25% decline in the NSE Nifty 50.

The stock has risen 33.79% in the last 12 months. Total traded volume so far in the day stood at 9.7 times its 30-day average. Relative strength index was at 43.

Out of 11 analysts tracking the company, five maintain a 'buy' rating, three recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 33.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.