Mortgage Bonds, Home Lenders Jump As Trump Targets Housing Costs

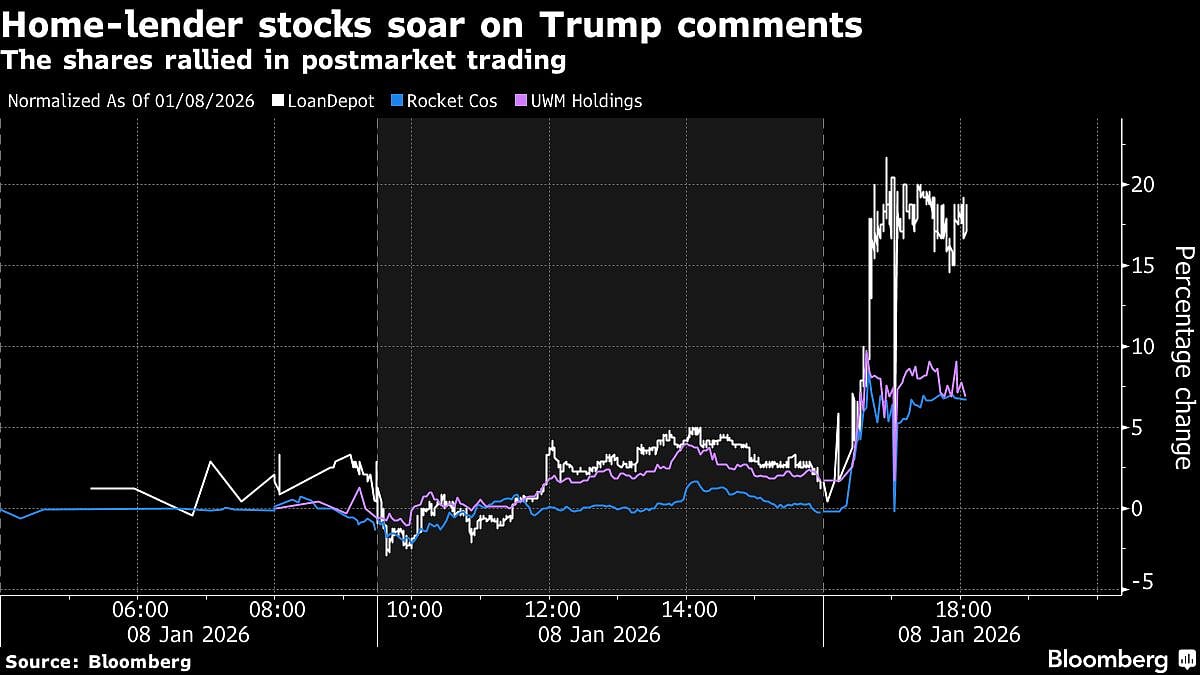

Shares of Rocket Cos Inc., meanwhile, jumped as much as 9.7%, while both LoanDepot Inc. and Opendoor Technologies Inc. amassed double-digit advances in after-hours trading in New York.

Mortgage bonds rose and home-lender stocks rallied after President Donald Trump said he was directing the purchase of $200 billion of the securities in a move to bring down the cost of housing.

Risk premiums on mortgage debt narrowed following the announcement, as investors bought more of the bonds backed by home loans compared to Treasuries. Shares of Rocket Cos Inc., meanwhile, jumped as much as 9.7%, while both LoanDepot Inc. and Opendoor Technologies Inc. amassed double-digit advances in after-hours trading in New York.

In the Treasury market, the yield on 10-year notes — a benchmark for mortgage rates — edged lower shortly before close. The dollar was little changed after Trump announced the move in a social media post.

“This announcement is a bazooka by the administration though we are light on details,” said Priya Misra, a portfolio manager at JPMorgan Investment Management. “MBS spreads reacted strongly and for good reason.”

The director of the Federal Housing Finance Agency, Bill Pulte, said soon after Trump’s announcement that Fannie Mae and Freddie Mac can execute the purchases “very quickly.”

The late afternoon trades in New York follow a busy week for global markets, which have responded to a military operation in Venezuela, gyrations in the oil market and protests in the US.

“This is not a serious proposal and if it did ‘succeed’ in making mortgages cheaper, it would only succeed in driving home prices higher,” said Christopher Maloney, a mortgage strategist at Bok Financial Services Inc. “The affordability problem comes from the supply side of the ledger, and any housing proposal which does not address that is not a serious proposal.”

There are roughly $9 trillion worth of agency mortgage bonds outstanding, so if Fannie and Freddie carry out all the purchases it would amount to just over 2% of the market. Still, additional demand on the scale that the president laid out would likely push those premiums down further, translating into lower rates on the mortgages that US households buy.

The purchases would also add to what Fannie Mae and Freddie Mac have already been doing in recent months. Their portfolios — the bonds and loans they hold onto rather than selling to investors — totaled about $234 billion as of October, the biggest since 2021.

“It looks like the increase in Fannie and Freddie portfolio holdings is set to continue in the coming months, which should help bring down rates a bit,” said Gennadiy Goldberg, head of US rates strategy at TD Securities. “But the biggest driver of mortgage rate downside would be lower Treasury yields.”

Demand for the bonds has broadly been rising in recent months, pulling spreads on mortgage bonds to around the tightest level since 2022. Some investors expect banks to buy more of the mortgage-backed securities as well, in part because rising deposits have given them more money to put to work.

US mortgage backed securities gained 8.6% in 2025 amid strong demand, notching their best year since 2002, according to Bloomberg index data.