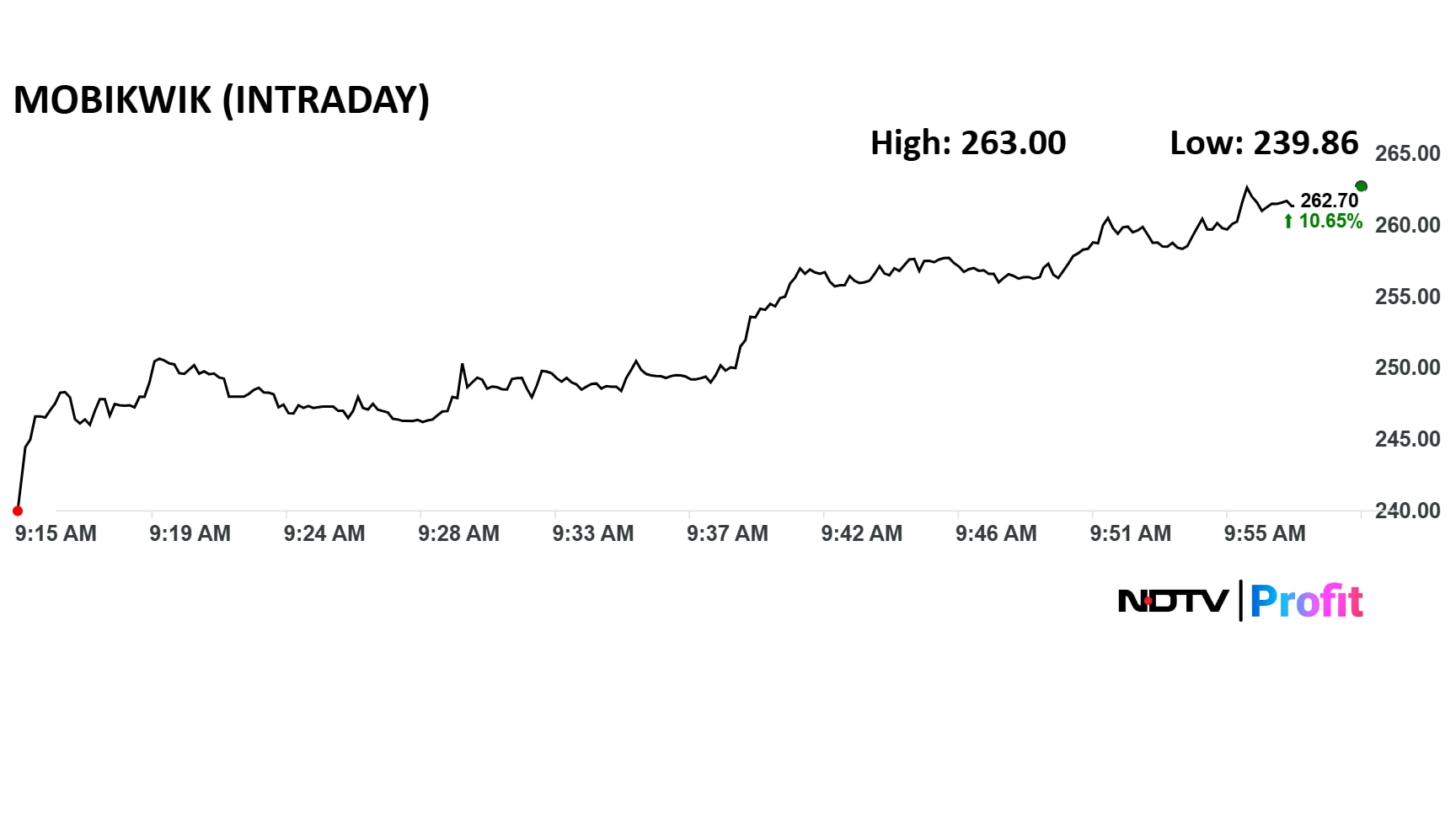

Shares of One Mobikwik Systems Ltd. surged over 10% on Tuesday. amid high trading activity. Abu Dhabi Investment Authority offloaded its entire equity via block deals in the previous session.

One Mobikwik share gained as much as 10.8% to Rs 263. The total traded volume was 5.3 times the 30-day average with a turnover of Rs 288 crore.

Since Monday, the stock has gained 18% on the back of higher trading activity. The share price surged as much as 16% on Sept. 1 as ADIA sold 16.44 lakh shares or a 2.1% stake to make a complete exit.

Other than ADIA, some of the key public shareholders in the company include Bajaj Finance (10.21%), Peak XV Partners (9.92%) and Cisco Systems (1.54%).

As far as the foreign investors are concerned, some of Mobikwik's key investors include Government Pension Fund Global (3.01%), Societe Generale (1.2%), and Citigroup Global Markets (1.12%).

HDFC Banking & Financial Services is the most prominent DII investor, with a holding of around 2.08%

Mobikwik share price movement on Sept. 2.

Who Bought ADIA Stake?

ADIA's 2.1% stake sale was picked up by three separate entities, including BOFA Securities Europe SA, which bought 5 lakh shares or 0.63% stake at Rs 243.61.

SSPL Securities purchased 3 lakh shares or 0.38% stake at Rs 237.03 while S I Investments picked up 4 lakh shares or 0.51% stake at Rs 248.42 per share.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.