Midwest Shares In Focus After Motilal Oswal Initiates Coverage

The bullish coverage note cites the company’s strong positioning in the black granite market and emerging new growth avenues.

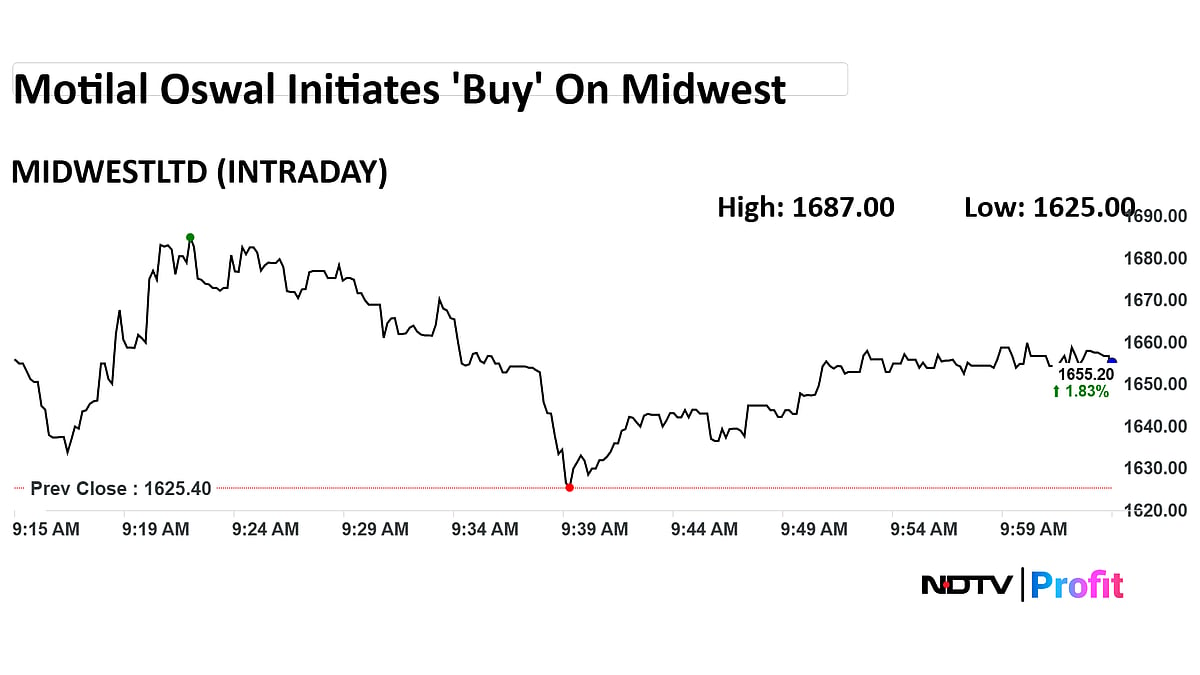

Mining and materials player Midwest Ltd. shares are in focus today. Brokerage major Motilal Oswal has initiated coverage on the stock with a 'Buy' rating, at a target price of Rs 2,000.

The bullish coverage note cites the company’s strong positioning in the black granite market and emerging new growth avenues. Midwest, a prominent player in India’s dimensional stone space, has carved a niche as the country’s largest producer and exporter of Black Galaxy and Absolute Black granite.

MOSL observes that granite remains the bedrock of Midwest’s steady growth, propelled by sustained global demand and operational scalability. This foundation, according to MOSL, supports a stable earnings trajectory and expanding cash flows.

The company accounts for over 64% of Black Galaxy exports and around 16% of domestic production in FY 2025. The company mines over 1.38 million cubic meters of granite annually, backed by a distribution network spanning 17 countries and five continents.

Looking ahead, MOSL highlights Midwest’s strategic diversification into quartz and beach mineral sands as the next major growth frontier. The company has over 23 million tonnes of quartz resources and plans to ramp up production by 242,000 tonnes per annum.

This is alongside exploration in Sri Lanka for ilmenite, garnet, zircon, and other heavy minerals.

The MOSL report also points to Midwest’s improvements in operational efficiency and sustainability — from captive solar power and induction haulage systems to piloting electric dump trucks.

These initiatives are expected to lower fuel costs, reduce downtime, and enhance environmental credentials, thereby boosting operational cash flows (OCF) and reinforcing valuation support.

Midwest listed in October of this year, at a premium of over 9% to the IPO price.

Midwest has earmarked Rs 130 crore from the proceeds of the fresh issue to fund its subsidiary's capital expenditure, as well as about Rs 26 crore for capital expenditure on the purchase of electric dump trucks.