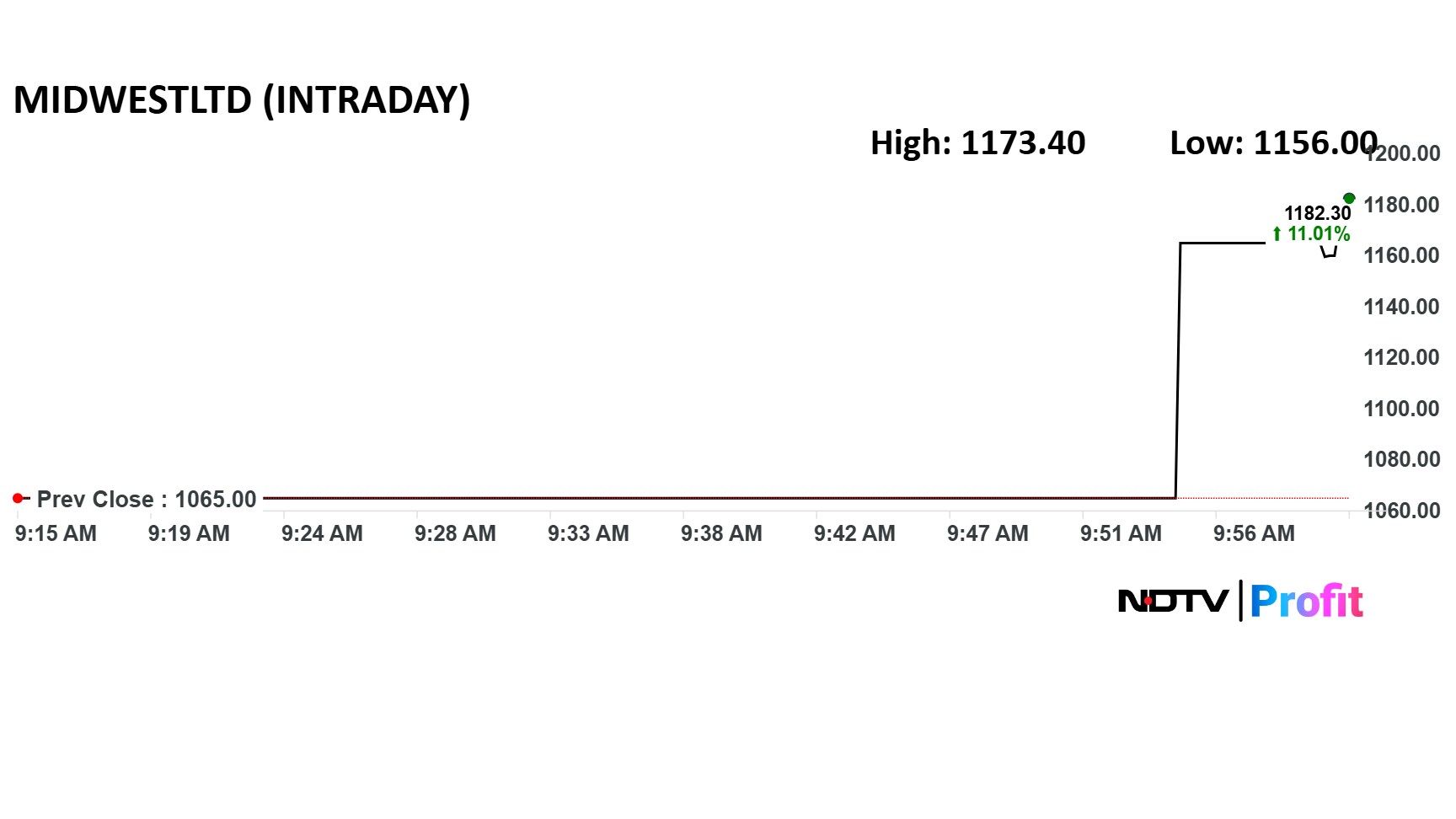

Shares of Midwest Ltd. made a strong debut on the stock market on Friday, listing at a premium of over 9% to the IPO price. The share price opened at Rs 1,165 on the BSE and NSE, compared to an issue price of Rs 1,065.

The initial public offering of Midwest concluded its subscription process on Oct. 17. The mainboard issue was oversubscribed 87 times, led by demand from non-institutional investors (168.07 times). Institutional buyers subscribed 139.87 times, and retail investors placed bids 24.26 times the offer.

The IPO was a book-built issue valued at Rs 451 crore, with a fresh issue of 0.23 crore shares worth Rs 250 crore and an offer for sale (OFS) of 0.19 crore shares worth Rs 201 crore.

Midwest is involved in the exploration, mining, processing, marketing, distribution, and export of natural stones. It is India's largest producer and exporter of Black Galaxy Granite and held a share of approximately 23% of the Indian export market for Black Galaxy Granite in fiscal 2024, as per the offer documents.

Its customers, comprising processors and distributors, are located across 17 countries, with China, Italy, and Thailand being their primary export markets.

Midwest has earmarked Rs 130 crore from the proceeds of the fresh issue to fund its subsidiary's capital expenditure, as well as about Rs 26 crore for capital expenditure on the purchase of electric dump trucks.

A sum of Rs 56 crore will be used to repay outstanding borrowings, while Rs 3.2 crore will go towards capital expenditure for solar energy integration.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.