- Foreign institutional investors will boost Indian mid- and small-caps when flows turn positive

- India's underperformance versus emerging markets is currently too wide, says Samir Arora

- FIIs sold large financial, IT, and consumer stocks, shifting slightly to smaller companies

Indian mid- and small-cap stocks will outperform their larger peers when foreign institutional flows turn positive, according to Samir Arora of Helios Capital.

"India's underperformance compared to emerging markets is too wide now. Investors in general are allocating to non-US markets, and India cannot be an exception," Arora told NDTV Profit in a televised interview on Friday, adding that global markets have outperformed Wall Street despite an AI frenzy-driven boom in the US.

He said FIIs have been selling large financial stocks, information technology and consumer companies, while shifting a small portion of their portfolio to smaller and new-age companies.

"If FIIs start buying, large-caps will do well, but that will give domestic fund managers confidence to go aggressive on small- and mid-caps," he said.

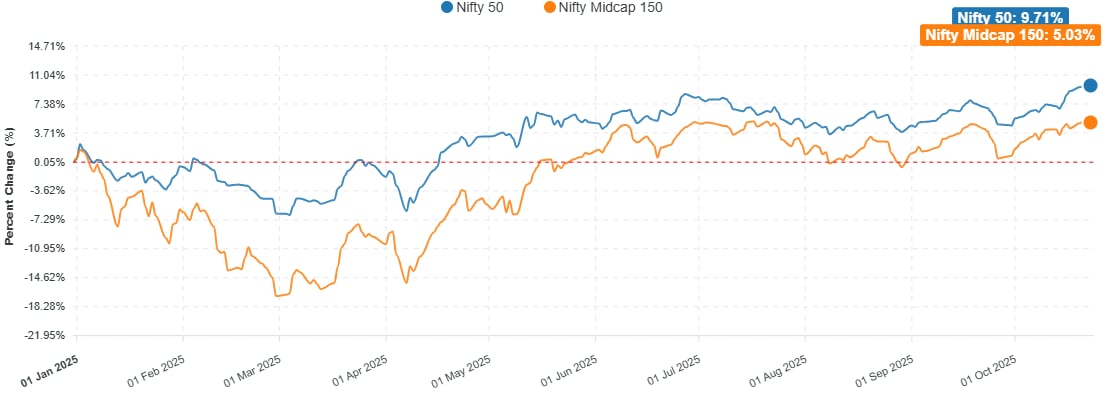

Nifty versus Nifty Midcap 150 year-to-date.

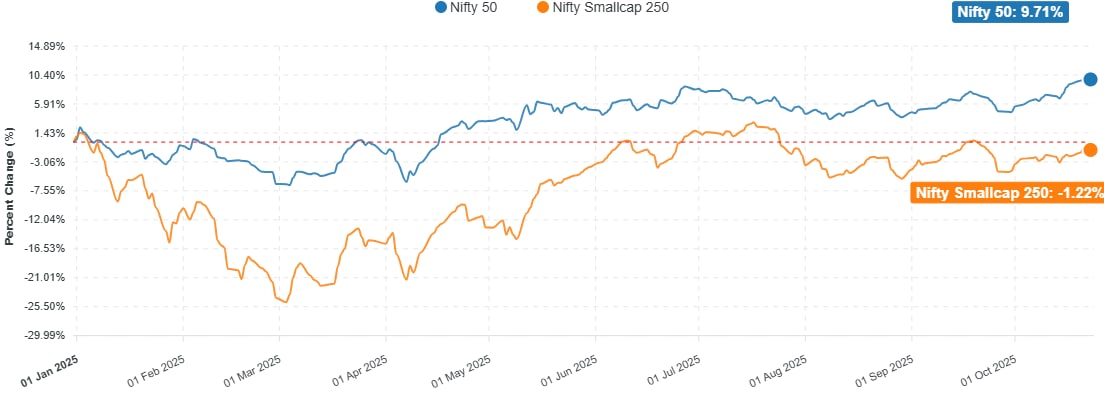

Nifty versus Nifty Smallcap 250 year-to-date.

Overseas funds have pulled out Rs 1.46 lakh crore from Indian equities so far in 2025. After three consecutive months of selling, October has recorded a positive flow of Rs 8,100 crore so far, as per NSDL data.

India's benchmark Nifty and Sensex have edged close to their September 2024 peak, driven by consistent domestic inflows that have supported the market amid FII exodus.

Arora noted that FIIs will have a greater interest in India after a trade deal with the United States goes through.

The trade talks between the two countries are progressing with both countries engaged in discussion, Commerce and Industry Minister Piyush Goyal said on Thursday.

India and the US want to conclude the first tranche of the trade pact by the end of the year. The proposed agreement aims to more than double the bilateral trade to $500 billion by 2030 from the current $191 billion.

President Donald Trump has claimed India has agreed to reduce Russian energy imports in exchange for tariff relief, a key demand from Washington. Half of the 50% US tariff on Indian goods is a penalty for Russian oil purchases.

Watch Samir Arora's full interview here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.