Microsoft Corp. has become the second company in the world to reach a $4 trillion market capitalization after reporting quarterly earnings that beat Wall Street's expectations, sending the stock soaring in premarket Thursday.

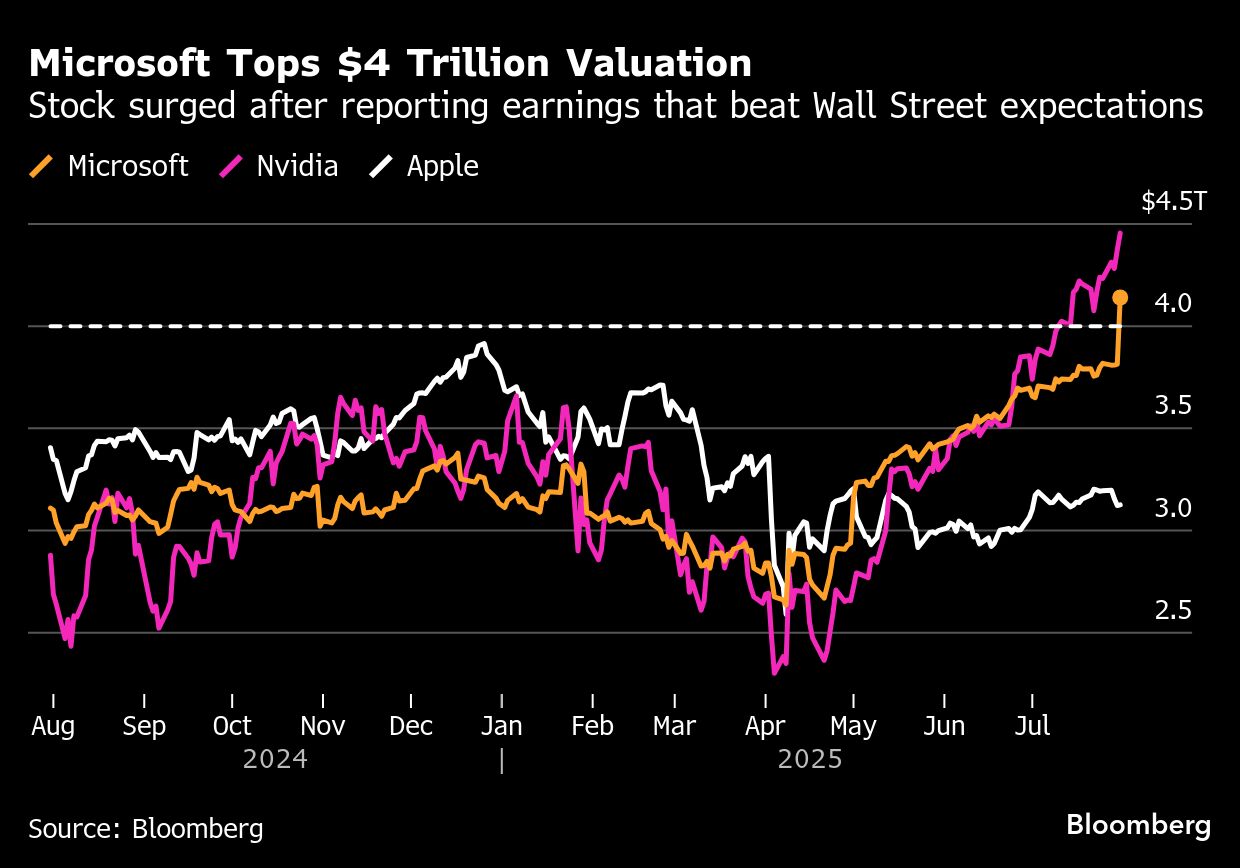

Shares of the technology behemoth jumped as much as 8.2% in early trading in New York, pushing its market value to $4.1 trillion. Nvidia Corp. became the first company to hit the milestone earlier this month.

“Microsoft is getting the recognition that it deserves because it is the operating system for business. All of us run our businesses on Microsoft with Word, with Outlook, with Excel,” said Kim Forrest, chief investment officer at Bokeh Capital Partners LLC. “This quarter's results point to an even better position for Microsoft because, like Nvidia, there appear to be no substitutes.”

The company's latest results confirmed that it's a leader in the artificial intelligence boom that's lifted megacap tech stocks, and the broader market, for the last few years. Microsoft reported better-than-expected growth in its cloud business, and its closely-watched Azure cloud-computing unit posted a 39% rise in sales, handily beating the 34% analysts expected.

On a call with analysts, Chief Financial Officer Amy Hood said Microsoft expects fiscal first quarter capital expenditures at more than $30 billion, and full year revenue growth in the double digits. In addition, Azure is expected to post a 37% growth rate in the first quarter, above forecasts.

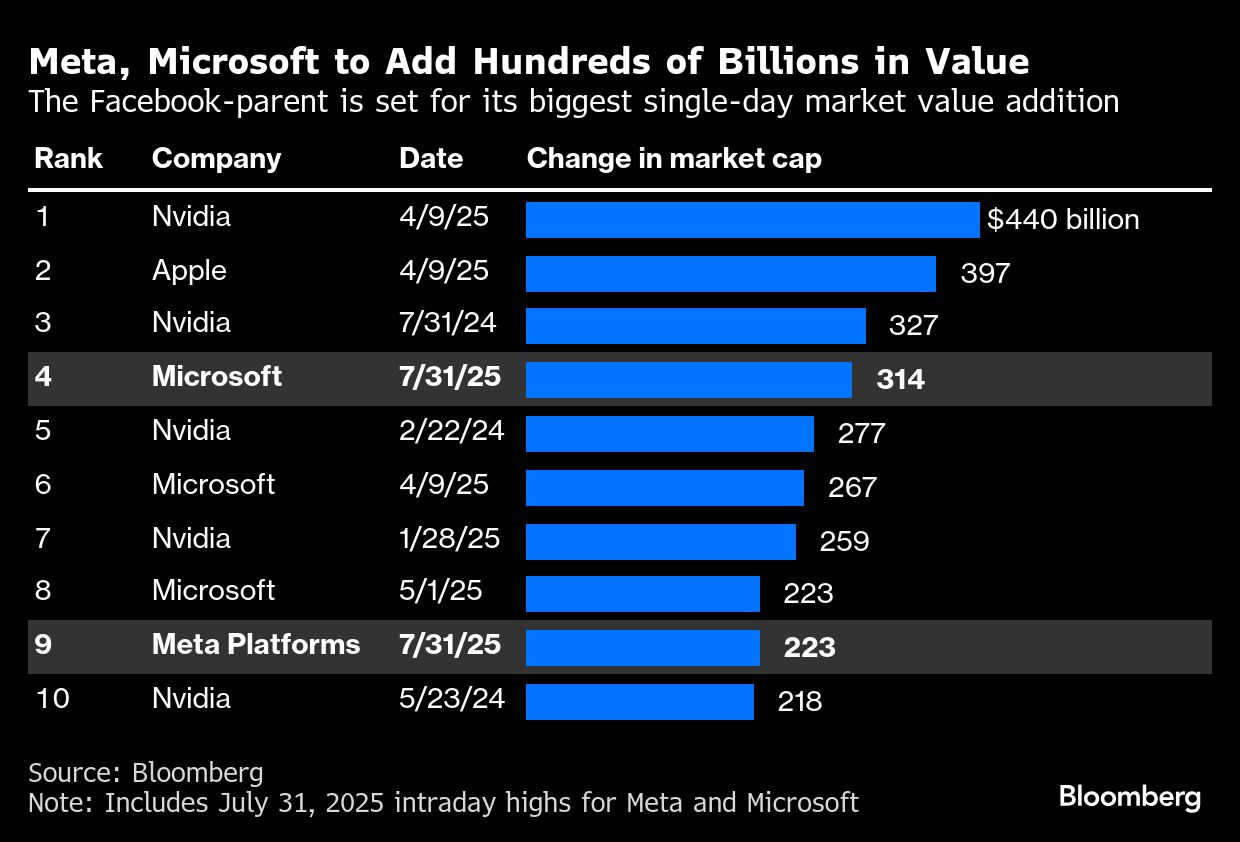

Investors are welcoming outsized spending on AI infrastructure. Meta Platforms Inc. also lifted the low end of its forecast for 2025 capital expenditures and provided an early steer on 2026 spending. Shares in the Facebook-owner rallied as much as 13%, adding more than $223 billion to the social media giant's market cap — if gains hold, this would be its biggest single-day market value addition ever.

The stocks are the second and third-best performers among the so-called Magnificent Seven mega tech stocks this year. Since its April 8 trough when President Donald Trump's sweeping tariff threats spurred a broader market selloff, the stocks surged more than 50% and are trading at record highs.

This year has marked something of a rebound for Microsoft stock. It had lagged its peers in 2024 and the first quarter of 2025, the only Magnificent Seven stock in the red for that period, as investors grew concerned about its AI position and Azure growth.

Wall Street is largely bullish on Microsoft shares, with 68 of the 72 analysts covering the company giving it a buy rating and one giving it a sell, according to data compiled by Bloomberg.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.