- JSW Steel and Tata Steel hit 52-week highs amid firm demand and supply limits in China

- China's steel output cuts and India's extended safeguard duty support local producers

- Brokerages remain bullish, raising target prices on JSW Steel and Jindal Steel and Power

Metal stocks continue to be in the limelight on Tuesday, outshining benchmark indices and sustaining momentum for the fourth consecutive session.

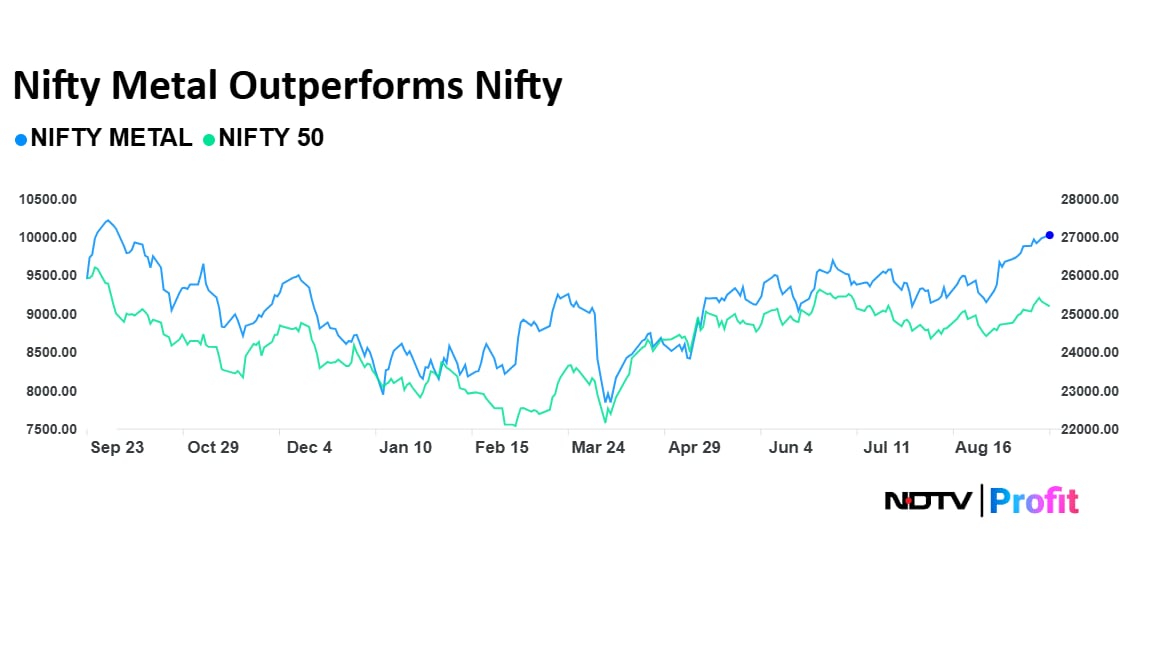

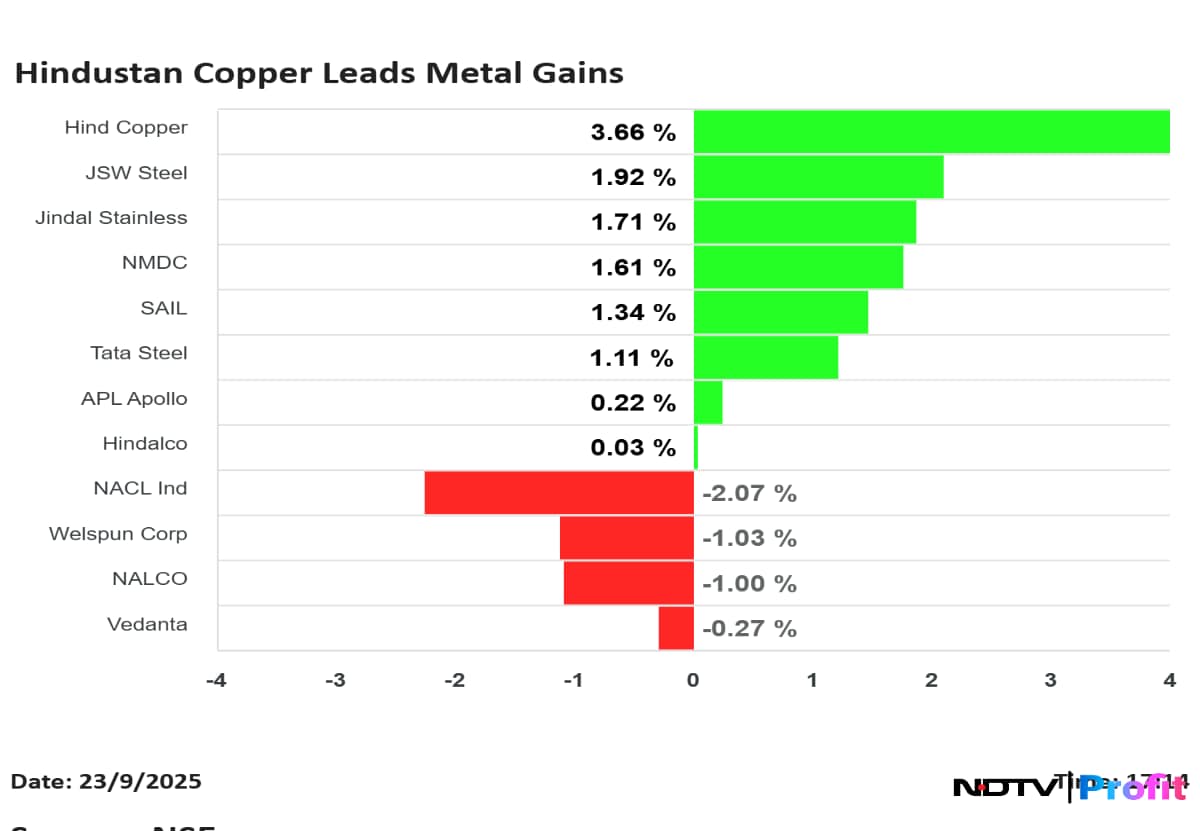

On Tuesday, the Nifty Metal index gained 1.3%, extending its winning streak, even as the Nifty 50 slipped 0.13%. Metals have surged 17.24% year-to-date in comparison with the Nifty's 6.01%, and over the past year, the outperformance is sharper — Nifty Metal is up 7.13% while the benchmark is down 2.97%.

Heavyweights led the rally on Tuesday with Hindustan Copper Ltd. sparkling with a 5.20% surge to Rs 312. JSW Steel Ltd. climbed 2.78% to a fresh 52-week high of Rs 1,148, Tata Steel Ltd. also touched its yearly peak at Rs 173.81 with a 1.41% gain, while Jindal Steel rose nearly 2%.

What Is Working For The Metal Sector?

“Metals extended their winning streak, with JSW Steel and Tata Steel hitting fresh 52-week highs on optimism around firm demand, impending price hikes, and supply constraints from China,” said Hariprasad K, SEBI-registered research analyst and founder of Livelong Wealth.

Investors are increasingly viewing the sector as a blend of cyclical opportunity and relative safety, especially when cherry-picking quality names keeping the current market and global scenario in mind, said Kranthi Bathini, director - equity strategy at WealthMills Securities Pvt.

Another key point is that earlier this month, China announced measures to reduce steel output. This is seen as a positive for Indian producers since supply tightening in the world's largest market supports prices both globally and domestically.

In addition to this, the Indian government extended safeguard duty on select steel products for three more years. This has led to a decoupling of domestic and international steel prices, with local prices currently trading at a 9% discount to imports, giving Indian steelmakers a competitive edge.

Brokerages Remain Bullish

Nomura, in its report on Tuesday, said that it sees “good times on the anvil” with production cuts in China, possible stimulus measures, and an improvement in domestic prices. It also expects an Ebitda CAGR of 25%-27% over fiscal 2025–28F across its steel coverage universe.

The brokerage is bullish on both JSW Steel and Jindal Steel and Power and has raise the target price to Rs 1,300 and Rs 1,150, respectively.

Morgan Stanley, earlier this month, had upgraded JSW Steel, Tata Steel, Steel Authority of India and Jindal Steel and Power. It also said that it is a beginning of "spreads expansion cycle" and expects the domestic prices to rise with demand.

CLSA also believes “the worst looks behind.” The brokerage prefers non-ferrous metals given tighter demand-supply dynamics. It also highlighted continued focus on China's capacity cuts.

Will The Rally Sustain?

"Market has been holding 25,000 levels of Nifty so we can see some outperformance for metal... In a long-term perspective, there is much more room for the rally," said Bathini.

He has also advised shareholders already invested in the metal sector to continue holding as the sector will get further boost as steel prices are expected to firm up further and the demand outlook is improving.

“Investors see sustained momentum in the sector as a potential driver of margin expansion in the coming quarters,” said Hariprasad.

According to Bathini, a greater policy focus on infrastructure and capital goods is expected to drive metals higher, while the recent GST cuts for cement will further boost construction activity and indirectly benefit the metals space.

The GST cut on auto sector, which consumes nearly 60–70% of metals in its value chain, will be another indirect leg of support.

The combination of global supply constraints and a favourable macro backdrop is providing metals with strong tailwinds.

However, Bathini also pointed that while domestic demand is on a higher note, metals remain global assets, and subdued conditions globally still play a role in shaping the outlook.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.