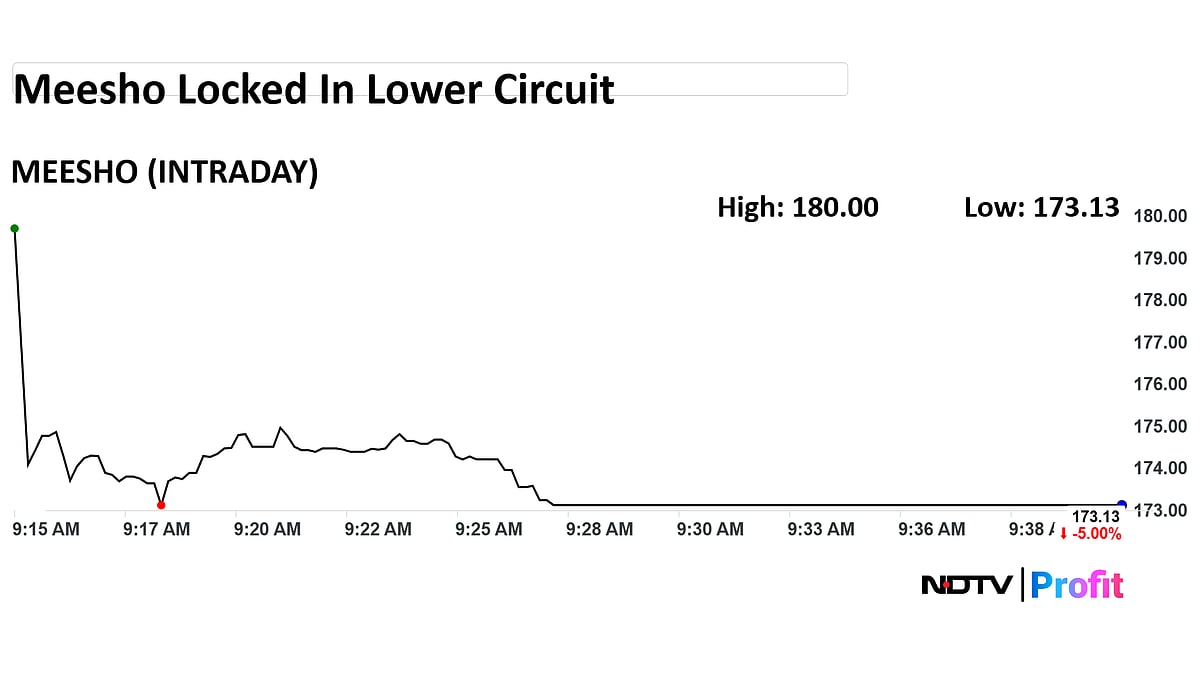

Meesho Shares Stuck In Lower Circuit As Shareholder Lock-In Expires

The end of the shareholder lock-in period does not mean all those shares will be sold immediately; it only makes them eligible for trading.

Shares of Meesho Ltd are in focus today as its one-month shareholder lock-in period comes to an end. This will free up as many as 109.9 million shares of Meesho, or 2% of its outstanding equity for trading.

The e-commerce player's stock is currently locked in the lower circuit at 5%, with the price at Rs 173.13 apiece.

Two analysts tracked by Bloomberg, who have coverage on this stock, have a 'buy' rating on it, with an upside potential of 21.3%.

The end of the shareholder lock-in period does not mean all those shares will be sold immediately; it only makes them eligible for trading.

Despite recent fluctuations, Meesho’s stock continues to trade well above its IPO price. The shares have gained nearly 64% from the issue price of Rs 111, even after a correction of about 28% from the post-listing peak of Rs 254.

SoftBank-backed e-commerce platform Meesho made a stellar debut on December 10, listing at a premium and closing its first trading day 53% above the IPO price.

The three-day public offering, valued at over Rs 5,000 crore, attracted strong interest from all investor categories. The IPO was oversubscribed 79 times, with retail investors bidding more than 19 times their allotted quota, while the qualified institutional buyers’ segment saw an impressive 120 times subscription.

The mid-December rally last year was fuelled largely by aggressive early demand and short-covering. As that initial buying momentum faded, profit-taking kicked in, prompting a natural pullback. With sentiment reversing quickly, the stock faced sharp downside pressure.

While Meesho continues to post strong revenue growth and operates a distinct social commerce model, the timeline to sustainable profitability remains uncertain. Investors are cautious about the trajectory of earnings, especially in a market environment that is increasingly prioritising profitability over pure growth.