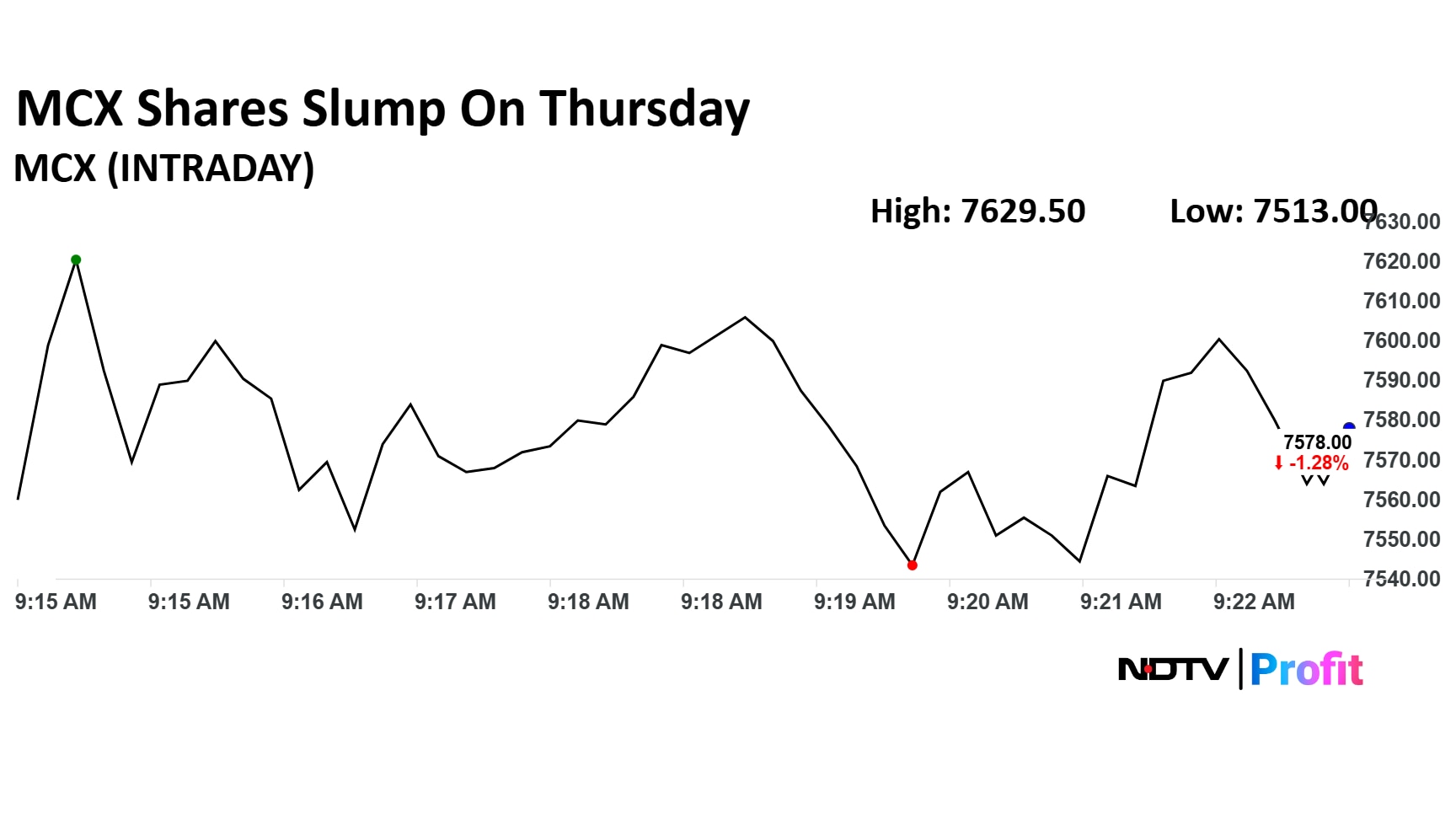

The share price for Multi Commodity Exchange of India Ltd. fell as much as 2.12% to trade at Rs 7,513 apiece in early trade on Thursday.

The stock rose over 5% on Monday to hit a fresh life high after it received approval from the Securities and Exchange Board of India to launch electricity derivatives.

On June 6, the platform had received approval from the markets regulator to launch electricity derivatives. The electricity derivatives contracts to be introduced by MCX will enable generators, distribution companies and large consumers to hedge against price volatility and manage price risks more effectively by enhancing efficiency in the power market.

"The introduction of electricity derivatives marks a pivotal development in India's commodities ecosystem," Praveena Rai, chief executive officer of MCX, said. "These contracts will offer participants a reliable, transparent, and regulated platform to manage power price risks, which are becoming more dynamic due to renewables and market-based reforms."

Earlier in May, SEBI had imposed a monetary penalty of Rs 25 lakh on the MCX on account of its failure to properly disclose information related to its software contract with 63 Moons Technologies Ltd., formerly known as Financial Technologies India.

MCX Share Price Today

Shares of MCX fell as much as 2.12% to Rs 7,513 apiece, the lowest level since June 6, 2025. They pared loss to trade 1.02% lower at Rs 7,595 apiece, as of 9:30 a.m. This compares to a 0.11% advance in the NSE Nifty 50.

The stock has risen 21.19% on a year-to-date basis, and is up 99.52% in the last 12 months. The relative strength index was at 65.51.

Out of 10 analysts tracking the company, six maintain a 'buy' rating, three recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.