- Mazagon Dock Shipbuilders' Q1 net profit fell 35% to Rs 452 crore, missing estimates

- Ebitda dropped 53% to Rs 302 crore due to high provisions of Rs 510 crore

- Provisions addressed losses and cost escalations in two fixed-price contracts

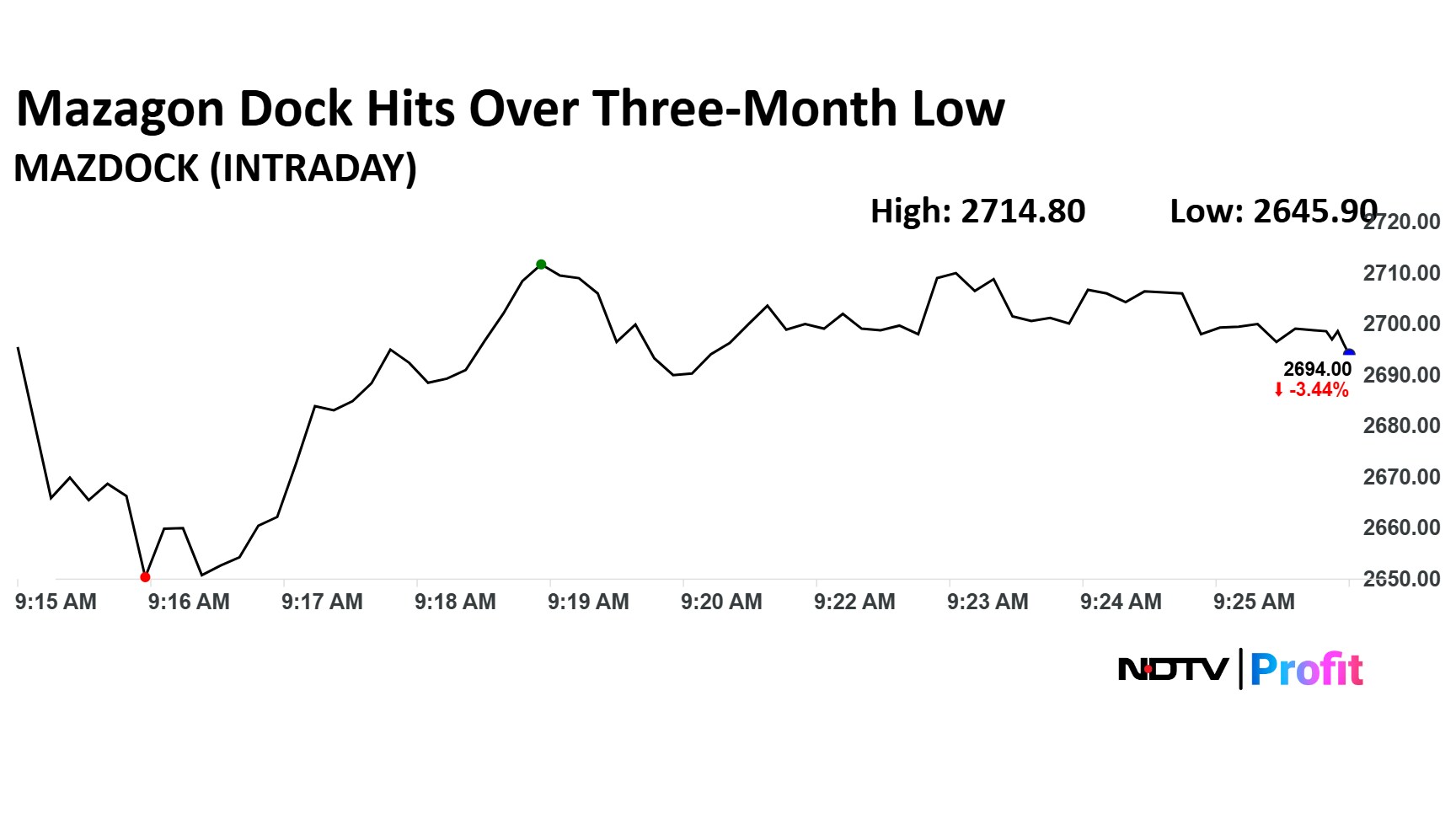

Mazagon Dock Shipbuilders Ltd.'s share price hit the lowest level in over three months as the company missed net profit estimates. Its consolidated net profit declined 35% to Rs 452 crore in April–June against expectations of Rs 695 crore.

Mazagon Dock Shipbuilders' Ebitda declined 53% year-on-year to Rs 302 crore versus Rs 642 crore due to high provisions. The company made provisions of Rs 510 crore to deal with anticipated losses. Provisions were also made for cost escalations in two fixed-price contracts—supply of a fast patrol vessel to the coast guard and six multi-purpose vessels for Navi Merchants, Denmark.

Mazagon Dock Shipbuilders share price declined 5.16% to Rs 2,645.90 apiece, the lowest level since April 25. It was trading 3.98% down at Rs 2,679.00 apiece as of 9:40 a.m., as compared to a 0.02% advance in the NSE Nifty 50 index.

The stock declined 0.14% in 12 months and 20.48% on a year-to-date basis. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 22.08, which implied the stock is oversold.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests to 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.