Max Financial Services Ltd. has emerged as Jefferies' top pick in the financial services sector after its insurance unit Max Life Insurance's rebranding to Axis Max Life Insurance, following a partnership with Axis Bank Ltd. The brokerage has maintained a 'buy' rating on the stock, with a target price of Rs 1,660 per share, implying a 47% upside.

The company's refreshed identity, driven by its partnership with Axis Bank, is expected to strengthen its brand recall, especially in tier-2 and 3 cities, where the bank operates over 5,500 branches. The move is also likely to expand Axis Max Life's footprint in bancassurance, agency, and online distribution channels, though it may incur upfront costs for brand campaigns and distribution expansion.

Key Catalysts Driving Growth

Axis Max Life could benefit from several regulatory changes being discussed, according to Jefferies. These include:

GST Exemption On Term Protection Plans: With term protection forming 9% of Axis Max Life's Annual Premium Equivalent, higher than listed peers, this exemption could enhance profitability.

Composite Licence Allowance: This would enable Axis Max Life to offer health insurance under one umbrella, leveraging its bancassurance channels.

Merger with Holding Company: A potential merger could collapse the listed entity into the life insurance business, reducing the holding company discount and simplifying the structure.

Bancassurance Norms Under Watch

Reports suggest the Insurance Regulatory and Development Authority of India may cap bancassurance premiums to encourage banks to diversify their life insurance partnerships. While Axis Max Life benefits significantly from Axis Bank's distribution strength, with the bank contributing 45% of its APE, potential regulatory changes on bancassurance norms could impact the company's reliance on this channel.

Jefferies projects an 18% compound annual growth rate in Axis Max Life's APE over FY24–27, driving a 15% CAGR in value of new business.

The partnership between Axis Bank and Max Life, which began in 2010, has deepened over the years. With Axis Bank holding a 20% stake in Max Life and appointing key executives, the collaboration has strengthened significantly.

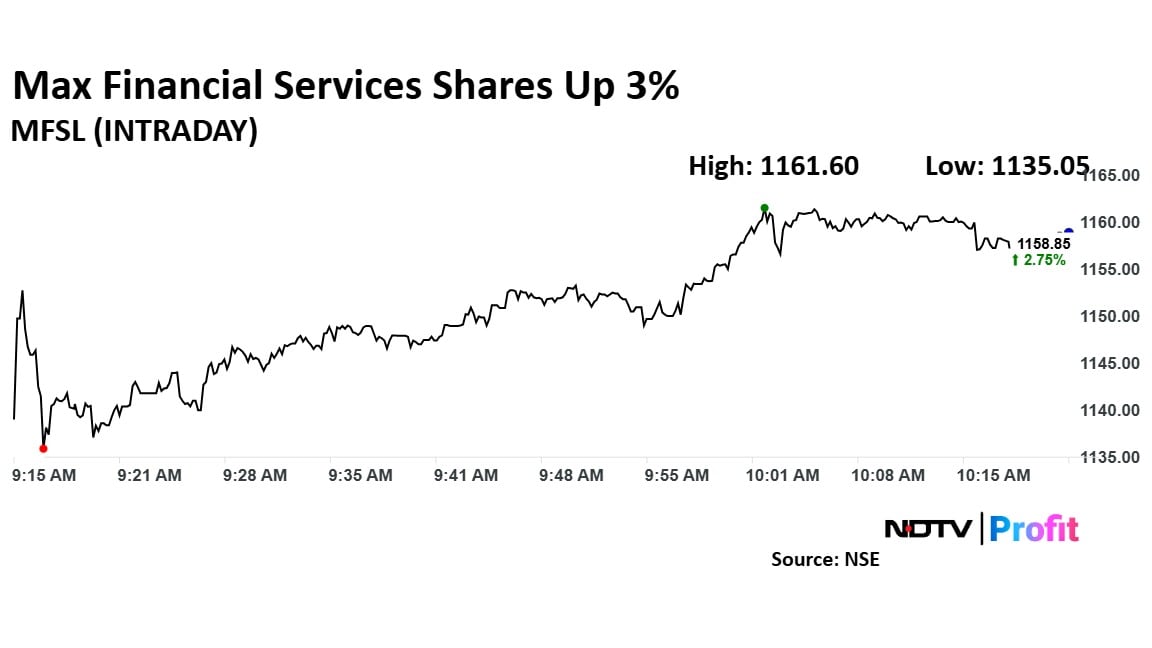

Max Financial Services Share Price Today

Max Financial Services stock rose as much as 2.99% during the day to Rs 1,161.60 apiece on the NSE. It was trading 2.77% higher at Rs 1,159.05 apiece, compared to a 0.19% decline in the benchmark Nifty 50 as of 10:07 a.m.

It has risen 19.30% in the last 12 months and 21.7% on a year-to-date basis. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 47.62.

Of the 20 analysts tracking the insurance company, 18 have a 'buy' rating on the stock and two recommend a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,435.56, implying an upside of 24.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.