Maverick Of Multibaggers: The Five Siddhartha Bhaiya Stock Picks That Propelled Aequitas' Growth

Siddhartha Bhaiya's investment philosophy was to generate outsized returns by investing in small-cap undiscovered companies.

The death of veteran investor Siddhartha Bhaiya has stirred curious minds to know more about his investment philosophy and record on delivering returns.

He was the managing director and chief investment officer at Mumbai-based Aequitas Investments, which ranks among the top asset management companies in India, offering specialised asset management services like Portfolio Management Services (PMS), Alternative Investment Funds (AIF), and Offshore Fund Management. It has assets under management of Rs 7,700 crore.

The firm's website showcases fives multibaggers, all in the small-cap space, that propelled its growth in the past contributing "to the standing among the best asset management company in India".

These are Apar Industries Ltd., Avanti Feeds Ltd., Gujarat Ambuja Exports Ltd., Power Mech Projects Ltd. and Jindal Stainless Ltd. They managed to beat the benchmark Nifty 50 by super large margins during the investment period.

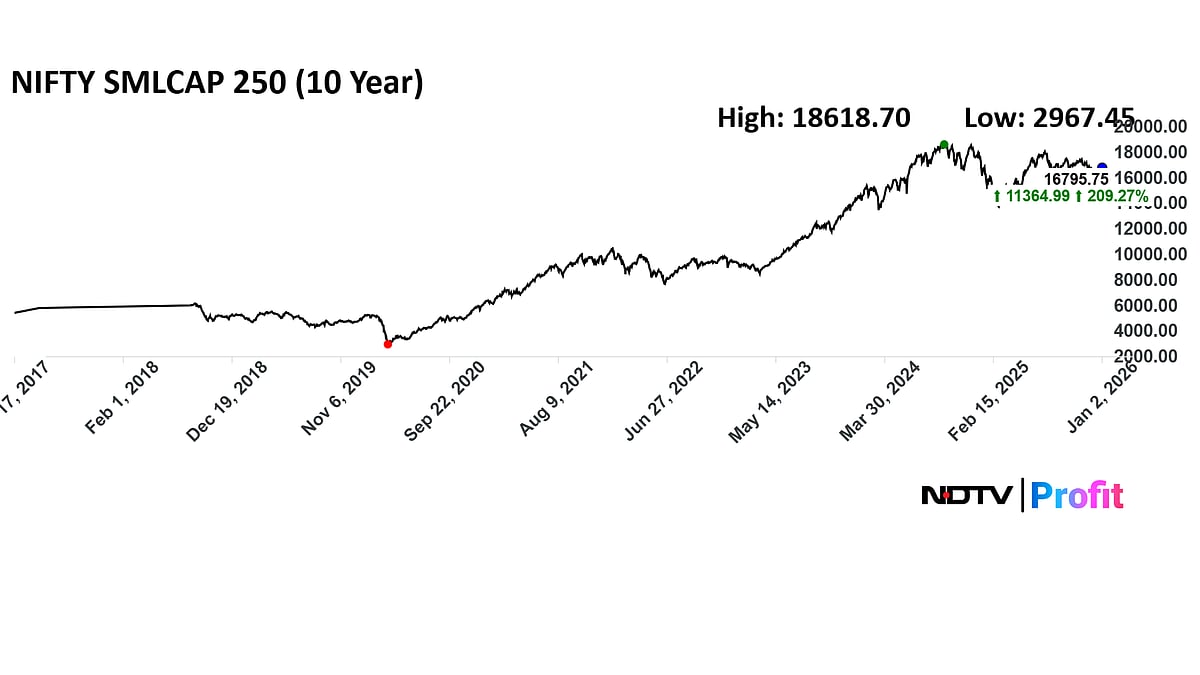

Aequitas' Multibagger Bets Of The Last 10 Years

ALSO READ

Siddhartha Bhaiya No More: India's Top Smallcap Multibagger Picker Passes Away After Cardiac Arrest

Avanti Feeds, a leading aquaculture company specialising in the shrimp feed manufacturing, generated an impressive 120x return from April 2012 to April 2018.

It was followed by Apar Industries, a major player in the electrical and energy space, delivering multibagger returns of 37x between April 2012 and April 2023.

Gujarat Ambuja Exports provided 27x returns during the period December 2012 to December 2022.

Siddhartha Bhaiya's investment philosophy was to generate outsized returns by investing in small-cap undiscovered companies. With exposure across all market capitalisation companies, he was a specialist in bottom-up stock selection – the "multibagger approach".

Bhaiya, regarded among India's top small-cap multibagger hunters, delivered as high as 2,800% absolute returns as Aequitas picked up promising stocks at early stages. This made Aequitas one of Dalal Street's top PMS funds. Bhaiya's vision was to scale it into a $1 billion net worth organisation.

Remembering Ace Investor Siddhartha Bhaiya

— NDTV Profit (@NDTVProfitIndia) January 2, 2026

Blood on the streets is where multi-baggers are made, the ace investor told Niraj Shah in November 2024. @_nirajshah

For the latest news and updates, visit: https://t.co/by4FF5oyu4 pic.twitter.com/8w2J8NfxAN