Stock Market Today: All You Need To Know Going Into Trade On July 13

Stocks in the news, big brokerage calls of the day, complete trade setup and much more!

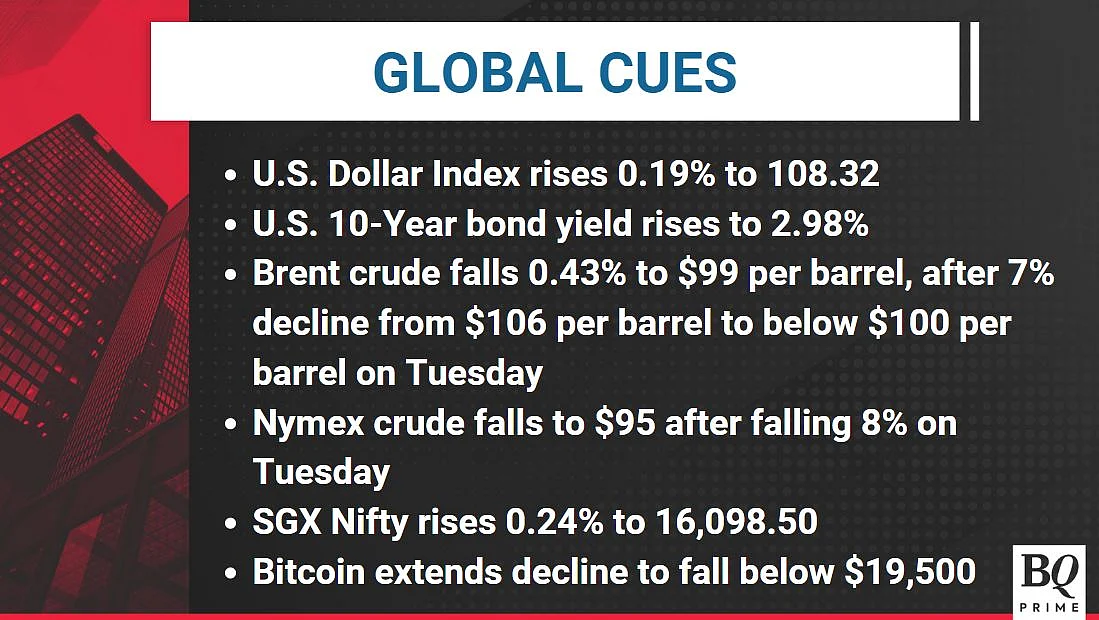

Asian stocks are volatile on Wednesday ahead of US inflation data for June.

MSCI Inc.’s regional share gauge made modest gains, helped by Japan. US futures were volatile after Wall Street incurred losses, dragged by tech and energy.

The 10-year US Treasury yield witnessed an inversion -- dropped as much as 12.4 basis points below the two-year rate, a magnitude last seen in 2007. Such inversions are one of the most widely watched signals of recession risk.

At 7:00 am, the Singapore-traded SGX Nifty -- an early barometer of India's benchmark Nifty 50 -- rose 0.28% at 16,104.50.

Oil fell below $100 a barrel while the dollar is at a 28-month high. The euro remains in sight of parity with the greenback for the first time in two decades. Elsewhere, bitcoin slipped further below $20,000.

Global Cues

Earnings Post Market Hours

HCL Technologies Q1 FY23 (Consolidated, QoQ)

Revenue up 3.84% at Rs 23,464 crore

EBIT down 1.89% at Rs 3,992 crore

EBIT margin at 17% vs 18%

Net profit down 8.63% at Rs 3,283 crore

Sterling & Wilson Renewable Energy Q1 FY23 (Consolidated, YoY)

Revenue up 1% at Rs 1,207 crore

EBITDA loss up 231% at Rs 343.87 crore

EBITDA margin at -28.5% vs 8.7%

Net loss at Rs 353.91 crore vs Rs 76.12 crore

Delta Corp Q1 FY23 (Consolidated, QoQ)

Revenue up 15% at Rs 250.27 crore

EBITDA up 27% at Rs 87.50 crore

EBITDA margin at 35% vs 32%

Net profit up 19% at Rs 57.13 crore

Anand Rathi Wealth Services Q1 FY23 (Consolidated, QoQ)

Revenue up 17% at Rs 131.6 crore

EBITDA up 20% at Rs 55.69 crore

EBITDA margin at 42.32% vs 41.13%

Net profit up 15% at Rs 39.7 crore

Stocks To Watch

Deepak Nitrite: The company's Nandesari plant, which had caught fire last month, has restarted operations--except the Nitrite section of the facility--following approvals from Gujarat authorities.

Mahanagar Gas: The company has raised CNG prices by Rs 4/kg to Rs 80/kg in Mumbai and of domestic PNG by Rs 3/SCM to Rs 48.50/SCM, Bloomberg reported citing an emailed statement.

City Union Health: The bank has signed a bancassurance agreement with Bajaj Allianz Life Insurance for distribution of its products through its branch network.

Care Ratings: The company will consider a proposal for buyback of shares on July 20.

Shilpa Medicare: The company’s newly commissioned facility for manufacture and testing of orodispersible films and transdermal systems situated at Dabaspet, Bengaluru has been issued GMP certificate by UK MHRA.

Max Ventures & Industries: The company has received no objection letter from BSE and National Stock Exchange of India for its merger with Max Estates.

Earnings Today

Mindtree

Tata Metaliks

Analyst Actions

Morgan Stanley on HCL Technologies

Maintains 'Equal Weight/In-Line' with the target price unchanged at Rs 1,300, an implied return of 40.12%.

Revenue beat in 1Q was more than offset by the margin miss and expectations of F23 margin toward the lower end of the band

Company requires sharp execution to manage margins; believe there could be downside risks

Sees consensus F23/F24 margins coming down, driving EPS estimate cuts

Lowers FY23-24F EPS by 7-9%, prefers Infosys

Nomura on HCL Technologies

Maintains 'Neutral' and cuts target price from Rs 1,100 to Rs 1000, still an implied return of 7.78%

Margin miss, deal wins hit in 1Q FY23.

Sees HCLT likely missing its margin guidance in FY23F.

Deal wins healthy; FY23F revenue guidance has lower risks.

Motilal Oswal on MF Positioning in July

On a MoM basis, the weights of Automobiles, Oil & Gas, Consumer, Healthcare, Telecom, and PSU Banks increased, while the weights of Private Banks, Metals, NBFCs, Cement, Retail, Utilities, Textiles, Insurance, and Chemicals moderated

Automobiles’ weight increased for the third consecutive month to a 42-month high of 7.6%. Ranks third in the allocation of mutual funds – it was in the fourth position a month back.

Oil & Gas’ weight stands at a 18-month high of 7.3% (+20bps MoM and +40bps YoY).

Metals’ weight moderated to a 26-month low of 1.9% (-30bps MoM).

Four of the top-10 stocks in terms of value increase were from Autos: Maruti Suzuki (Rs 3,210 crore), M&M (Rs 1,730 crore), TVS Motor (Rs 970 crore), and Motherson Sumi Wiring (Rs 630 crore).

Pledge Share Details

Swan Energy: Promoter Group Dave Impex created a pledge of 90,000 shares on July 11.

Insider Trades

Kotak Mahindra Bank: Promoter Group Janak Desai Sold 3,000 shares between May 31 and June 1.

Who’s Meeting Whom

Happiest Minds: To meet investors and analysts on July 22.

HDFC Life Insurance: To meet investors and analysts on July 19.

Delta Corp: To meet investors and analysts on July 13.

AGMs Today

Mindtree

Borosil

Trading Tweaks

Price Band Revised From 20% To 10%: Himadri Speciality Chemical

Ex-Date Dividend: Shree Cement, Aditya Birla Sun Life AMC, Shankara Building Products, Orient Bell, VST Industries

Ex-Date Annual General Meeting: Nureca, Shankara Building Products, Orient Bell

Record-Date Dividend: REC

Move Out Of Short-Term ASM Framework: Lloyds Steels Industries

Money Market Update

The rupee ended at Rs 79.60 against the U.S. Dollar on Tuesday as compared to Monday's closing of 79.43

F&O Cues

Nifty July futures ended at 16,030, a discount of 28.3 points.

Nifty July futures added 2.27% and 5,385 shares in Open Interest.

Nifty Bank July futures ended at 35,104, a discount of 28.25 points.

Nifty Bank July futures shed 9.55%, 9,523 shares in Open Interest.

Securities added to the ban list: Delta Corp