Over the past 13 years, the time gap between Sensex corrections of over 10% has gradually increased, a report by ICICI Prudential Alternate Investments has found. "Historically, markets have corrected by 10% on average three times a year," said Anand Shah, head of portfolio management, services and alternative investment fund investments at ICICI Prudential.

Shah added such fluctuations are a normal feature of equity markets, and that internal corrections have already moderated frothy valuations in recent months, providing a healthier foundation for the markets. "Corrections are a natural and healthy process for long-term investors. They offer a chance to realign portfolios and enter at fair valuations," he said.

While highlighting the broader trends, Shah observed that market volatility has also shown a decline recently, which he sees as a positive sign for valuations. "Reduced volatility is good for valuations and helps create a more stable environment for long-term growth," he said.

Anand Shah, head PMS and AIF Investments, ICICI Prudential AMC. (Image source: NDTV Profit)

Sensex Corrections Over The Years

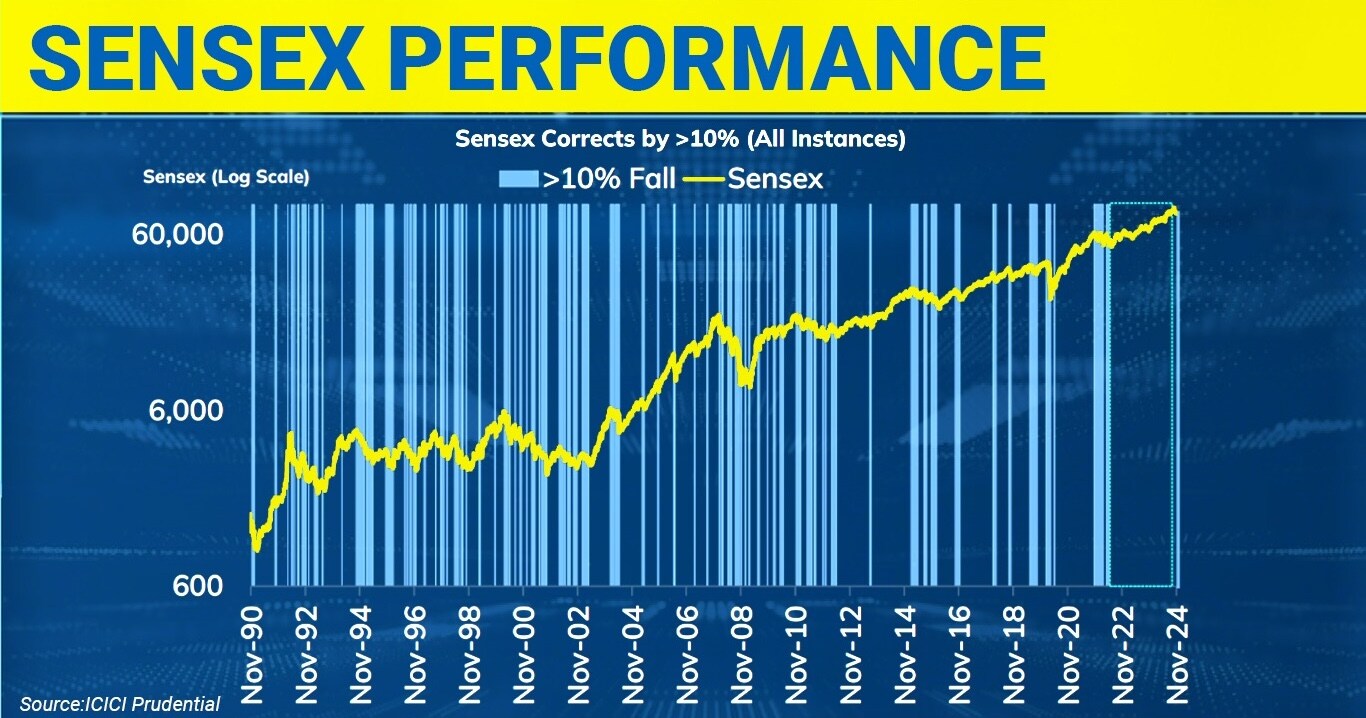

The chart above illustrates the historical patterns of Sensex corrections. "Since 2011, the time intervals between correction phases have been gradually increasing, indicating improved market resilience," Shah observed.

The research note said that over the past 34 years, the Sensex has corrected by over 10% on 107 occasions. Deeper corrections of over 20% occurred 12 times in two decades, and 30 times across 34 years.

Another notable aspect (see chart below) is that volatility which peaked in June, particularly around the election rally, has since shown a downward trend. "Volatility is here to stay, but the recent decline is a positive sign for investors," Shah said.

Anand Shah's Sectoral Views

Banking

"Banking remains a key sector, and we've now seen corrections in PSU banks as well. Both private and state-owned banks look comfortable to me," Shah noted. He noted strong credit quality, robust capital ratios, and low net non-performing assets as factors contributing to the sector's resilience.

"Obviously, there are early signs of some stress, but I think they are still manageable. Any revival in the economy, as consumption and capex pick up in the second half, will boost confidence in private sector capex," Shah added.

Retail And Quick Commerce

Shah flagged heightened competition in organised retail, especially between value retailers and quick commerce players. "There's a blurring of the lines. Value retailers are stepping up to match the convenience offered by quick commerce, and the latter is moving toward providing value," he said.

This trend benefits consumers, but poses challenges for investors. "We don't know where it will end, but until it does, it will be painful for investors," Shah cautioned. On quick commerce, he observed that companies like Zepto, Swiggy, and Zomato have capitalised well, but face competition from deep-pocketed players such as Reliance, DMart, and others. "It's a wait-and-watch to see who emerges with the better game," Shah said.

Power

Turning to the power sector, Shah noted its ongoing transition from coal-based generation to renewable energy. "We had a very soft demand growth rate for electricity over a decade when a lot of stuff was being manufactured in China and imported. That has changed, leading to the revival of power stocks over the last three to four years," he explained.

Shah noted the shift toward solar and wind energy, driven by lower prices for solar panels and batteries. "This transition has made solar more competitive vis-a-vis coal-based power. Through solar hours and peak hours with backup batteries, solar now offers a viable alternative," he said.

He also pointed out the changing landscape for capital goods companies. "We'll see a clear shift in beneficiaries from coal-based equipment providers, like turbine and boiler manufacturers, to those serving wind and solar energy projects," Shah said.

Watch The Conversation Here

Here Are The Excepts

Anand, what's your sense, I mean, we've done a bit of a recovery job from those 23,500 levels, and of late or in the last six-seven-eight days, the market is shrugging off bad news, building or latching on to good news. How are you seeing the texture currently?

Anand Shah: The way I see, the T20 phase of the market is over. I think as we go forward, we had a very exciting four years, we made a very swift return, because over and above alpha, you had a very strong beta, you had a 30-34% earnings growth rate. Markets have delivered that sort of return. I don't think that's sustainable and to that extent, from here on, it will be more of a test match. People will make money. It's not that the market will stop making money, but over long periods of time, with its own ups and downs.

Over a five year period, you will have down markets, you will have up markets, and then, similarly, within a month, you will have and there are factors, as you rightly said, GDP growth was one of the factors, but I think that got already factored in the earnings. If you see both the June quarter and the September quarter results were disappointing. People shrugged off the June quarter saying, look, it's one-off, but then it sustained in September.

Consumer companies had a really tough time because they were sort of doing well post-election, saying, look, the government will spend money, there will be revival in rural spending and rural consumption and that didn't come through in September, so that led to the market correction. But having said that, look, the market is down only 8-9% from its high. It's not like it's corrected so much that it has become a value.

You know, by the way, I don't know if you can just before, I don't know if you can pull up the chart, but there is this wonderful chart given in the presentation that ICICI Prudential has made, wherein they show when they talk about the periods of volatility, and I think maybe some what, 104 times, if I'm not wrong, in the last so many years, the Sensex has had a corrective move of over 10%... The interesting piece though, you were saying that we are still not at good valuations. Did I hear you right?

Anand Shah: So obviously markets have been expensive, but then you had a very solid earnings growth rate. Last four years, we had a 34%-odd earnings growth rate. So those rich valuations are fine. But if you see June quarter and September quarter, we had only 3% YoY growth rate just on that data... On an average, the market used to correct 10% on an average three times a year, and we haven't seen a 10% correction since Russia-Ukraine, which is June ‘22. This is the first 10% correction we saw since June ‘22.

So I think market have a very strong domestic flows, which is good counterbalance to the FII inflows or outflows, either ways, even when there will be strong FII inflow, I should expect that the domestic investors or the domestic institutions could be on the selling side, and to that extent, good news, rightly so, that the volatility of markets is reducing, which is a very good news for a richer valuations. But nevertheless, I think 10% correction is not a big deal when you look at the historic data.

So It's interesting you talk about the Nifty looking at the 10% correction right now. The last time we spoke, back in October, you had suggested, if you consider the Nifty 500, a majority of the stocks in there internally had corrected as much as 20% from their peaks. How does that picture look now and what are the areas that are now starting to emerge, in terms of gains?

Anand Shah: So when we looked at November end, where the Nifty is around 8.5% from its all-time high, we had 253 companies out of Nifty 500. So more than half of the market is actually down by more than 20% from their individual 52-week high and around 90-plus 93-odd companies down more than 30%. So the message is that while on the broader numbers, at the Nifty level, it doesn't look like it's corrected a lot.

I think internally, the markets have corrected a lot. We had frothy valuations in some segments of the market, or frothy expectations. To that extent, the market is much better than where it was in June or prior to that, when we had huge expectations of 400 paar and others. To that extent, I think coming back to your point, is it investable? I think for the long-term investors, these are very healthy corrections. I think this correction is what makes the market good for the long term investors, while obviously it's painful for the T 20 traders.

What areas are you starting to see emerge from there? Are there new leaders at this point in time?

Anand Shah: So I think banking remains, and within the banking there has been now, we have seen corrections in PSU banks also. So I think both private and state-owned banks look comfortable to me. I think the credit quality has been extremely good. To that extent, the capital ratios, the net NPA ratio, everything is very good. Obviously, there are early signs of some stress, but I think they are still manageable.

Any revival in the economy, and that is what will be the key thing over the next two quarters, in the second half, as consumption picks up, as Capex picks up, we will see some bit of confidence in the private sector to do some capex. I think banks, obviously we like them, they have been sort of an underperformer for a while. Valuations are reasonable, growth expectations are reasonable. They can surpass that, and the credit quality is still benign barring few segments of the market.

I think where we see risks emerging in the market, I think we are seeing extreme competition in organised retailing. There were the value retailers and then there were quick commerce retailers. What we are seeing more recently, I think there is a blurring of the lines, the value retailers have to match the game on the quick commerce and deliver a better convenience to the customers, and the quick commerce guys will have to offer value. So we are seeing good times for the consumers, but my take is, we don't know where it will end, but till it ends, it will be painful for the investors.

That's interesting. In fact, a lot of new companies are trying to enter into this Quick Commerce, the Blinkit and the Insta Mart space, and therefore, will that cap the relative valuations of some of these businesses because we are now seeing that getting formed as a sector, right?

There was Zomato, now there is Swiggy, Zepto at some point of time might list. So that internet space is alive and kicking, but is the retail or the delivery part of that business coming under a bit of threat, because other business houses also want to make an entry here, and these are deep-pocketed houses?

Anand Shah: Indeed. So I think the three quick commerce guys have got capital now. Zepto, Swiggy, Zomato all three have got capital. You're seeing even the other guys are deep pocketed, as rightly said, be it BV, be it Dmart, be it Reliance and others, and to that extent, you're right, it will be good times for customers. I'm again repeating because we'll get both convenience and value. But yes, we will have to see who has got the better game and to that extent, it will be a time before we know the winners. To that extent, that's a wait and watch area.

Okay, a question I'd have is on the Power sector, actually not quite Oil & Gas, but Power. Stupendous rally over the last couple of years, they've taken a bit of a pause. But the plans, I mean, we were speaking to Inox Wind today, the plans for FY 25-26-27 are very, very strong. Suzlon has spoken like that. Some of the other power companies are talking about Green Energy as it is. Would the stock price gain, if you believe they will gain, match earnings growth, or do you believe there will be a period of stagnation because the valuations are extreme and then the gains start?

Anand Shah: I think we had a very soft demand growth rate in electricity over a decade when a lot of stuff was getting manufactured in China and imported. I think that has changed, and that led to revival in the power stocks in the last three to four years. I think what's happening in power is transition. I think very clearly we have moved forward, transitioning from coal-based power generation to renewables and to that extent, if you see very clearly, there's a shift, both from the incumbents as well as new players who are investing more in solar.

I think lower solar prices, lower battery prices, they made it that much more easier to provide, if not round the clock, but at least through the solar hours and through the peak hours you can provide through a backup battery. So I think that makes Solar that much more attractive. It's becoming more competitive vis-a-vis coal based power also, and to that extent, the capital good companies, the providers of their equipment there also, we will clearly see the shift from the beneficiaries, moving from Coal based, the turbine, the boilers to the Wind and the Solar.

Anand, in terms of opportunities in the markets right now, and I'm talking from a portfolio construction point of view. You know, at this point in time, do you feel that a portfolio of around 35-40 stocks would now start looking at a portfolio just about 20-25 odd stocks or do you see that there are still plenty of opportunities, and that portfolio likely could stay at around 35 stocks?

Anand Shah: I think the opportunities, as I said, are now broader. Prior to 2020, we had a very narrow rally. We only had a set of companies which were doing well, the rest of the economy was, to large extent, struggling, and that's broadened over the last four years. Having said that, there was a value in manufacturing, there was a value in cap goods, there was a value in PSU banks and corporate banks in 2020 that also doesn't exist anymore. So now the market is more balanced.

We are going more bottom up. We are finding ideas in pharmaceuticals. We're finding ideas in IT, and Consumers also, which we had sort of not invested over the last two to three years. So now it's more bottom up than top down. Our economy is in good shape. We are all set to do well as the global economy also stabilises, especially China, and in that context, I think the number of stocks can be higher rather than lower, even if the opportunity is more broad based.

It's interesting that you spoke about Pharma specifically, and that you're saying that you're looking here in this area. Are there sub segments here in the Healthcare space? Is it just Pharma, is it Diagnostics? Are you looking at Hospitals? How are you placing your bets here?

Anand Shah: Indeed. So I think in India, Pharmaceuticals, each company is unique, and to that extent, you have to do a lot of bottom up. But yes, even retailing, Pharmaceutical retailing will become an interesting space. Diagnostics, as you rightly said, and Hospitals, they all again, as I said, they all discovered. It's not that things are undiscovered.

Whatever needed to be discovered broadly in the market, over the last four years, have been discovered and to that extent, it's much more hard work from here on, yeah, in each sector, forget Pharma, in each sector to find winners, and at the same time, they'll have losers in each of them. So I think it's much harder. Beta is obviously will be much lower than what we have seen in the last four years. Alpha is also going to become more difficult.

Everybody seems to be very constructive on the CDMO part of the pharmaceutical space. Are you as constructive or not?

Anand Shah: No. Again, as I said, in each individual name.

But as a theme, is it looking okay?

Anand Shah: Look, that's a big opportunity and even in terms of China plus one, also, that's an opportunity, because there is a very large market there, and we are very small in comparison to that and to that extent, some of that shift can also happen.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.