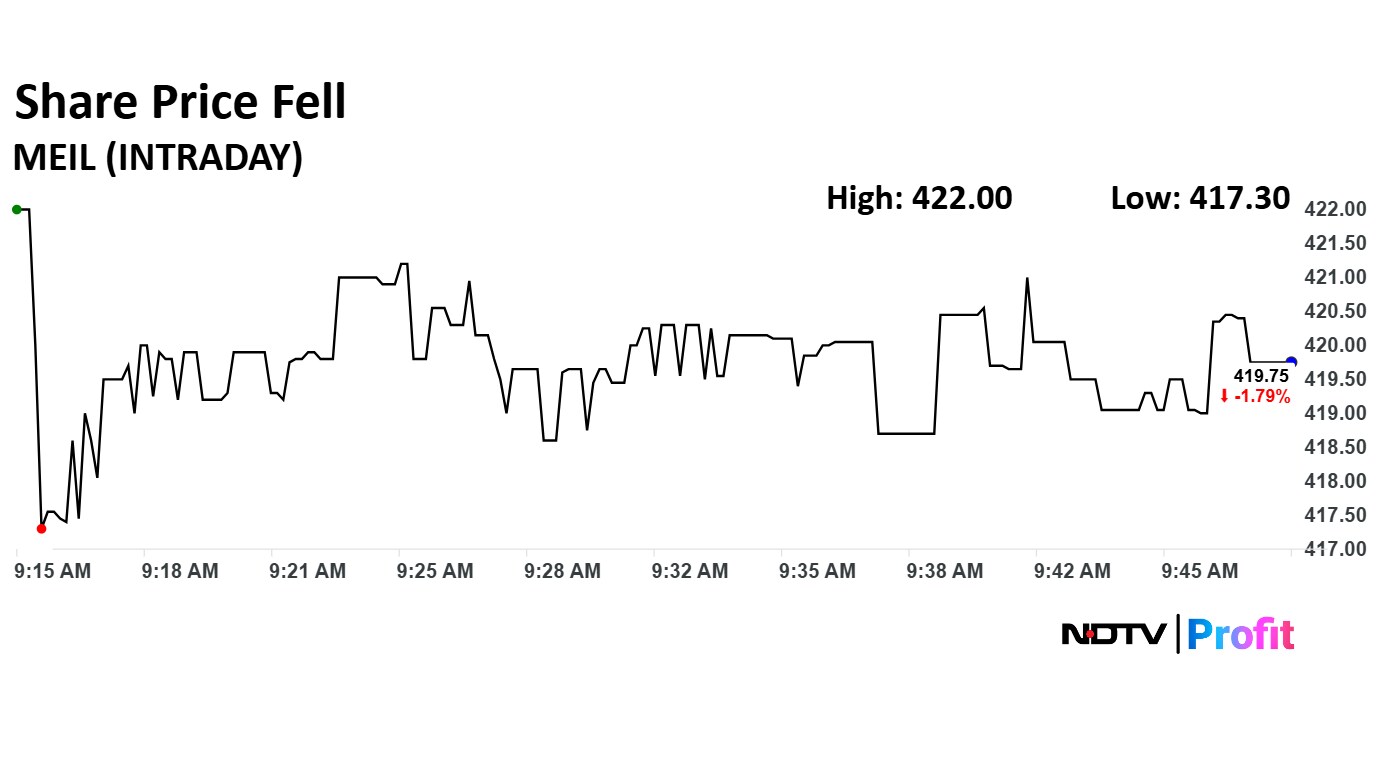

Mangal Electrical Industries Ltd.'s share price declined 2.36% on Monday after the company's three month lock-in period ended.

Mangal Electrical Industries' shares unlocked on November 24, as its three-month IPO lock-in period ends, releasing over 10 lakh shares, equivalent to 4% of its outstanding equity, valued at approximately Rs 46.75 crore. Listed on the BSE and NSE on August 28, 2025, the expiry of this lock-in is expected to inject fresh liquidity into the market, offering an entry point for new investors.

An IPO lock-in restricts promoters, early investors, and certain shareholders from selling their holdings for a defined period post-listing, ensuring price stability and preventing abrupt exits. Once this period lapses, these stakeholders can freely trade their shares in the open market. Analysts closely monitor such unlockings, as they often trigger heightened volatility in the initial days following the release.

The shares began trading at Rs 556 on the NSE and Rs 558 on the BSE. The issue price was Rs 561.

The IPO received a strong investor response, with the issue being oversubscribed by 9.46 times on the third and last day of bidding on Friday, Aug. 22. The mainboard IPO received bids for more than 4.96 crore shares against 52.53 lakh shares on offer.

Mangal Electrical Industries manufactures transformers used in the distribution and transmission of electricity. The company also processes transformer components and sells its products under the brand name ‘Mangal Electrical.' In addition, it provides EPC services for setting up electrical substations. Mangal Electrical Industries Ltd. has five production facilities in Rajasthan.

The scrip fell as much as 2.36% to 417.30 apiece. It pared losses to trade 1.64% lower at Rs 419 apiece, as of 09:48 a.m. This compares to a flat NSE Nifty 50 Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.