Shares of Honasa Consumer Ltd. surged in trade on Thursday, after the MamaEarth parent reported a consolidated bottom-line of Rs 39.2 crore compared to a loss of Rs 18.5 crore in the same quarter last year.

Revenue also saw an uptick, growing 16.5% to Rs 538 crore as against Rs 462 crore in the year-ago period.

Earnings before interest, taxes, depreciation and amortisation turned positive to Rs 47.6 crore, compared to a loss of Rs 30.8 crore in the year-ago period. The Ebitda margin stood at 8.8%.

Honasa Consumer Q2 Highlights (Consolidated, YoY)

Revenue rises 16.5% to Rs 538 crore versus Rs 462 crore.

EBITDA at Rs 47.6 crore versus a loss of Rs 30.8 crore.

Ebitda margin stood at 8.8%.

Net profit at Rs 39.2 crore versus loss of Rs 18.5 crore.

Jefferies hiked the target price for Honasa, indicating that the business consolidation phase is over. The new target price for the stock indicated 58% upside potential from Wednesday's close price.

Jefferies maintained a 'Buy' rating and hiked the target price to Rs 450 from Rs 400 apiece earlier.

The second-quarter results provide the glimpse of the turnaround for the Honasa Consumer, which had seen a difficult time since its listing on Nov 7, 2023. The business will likely deliver strong growth in the coming quarters, Jefferies said.

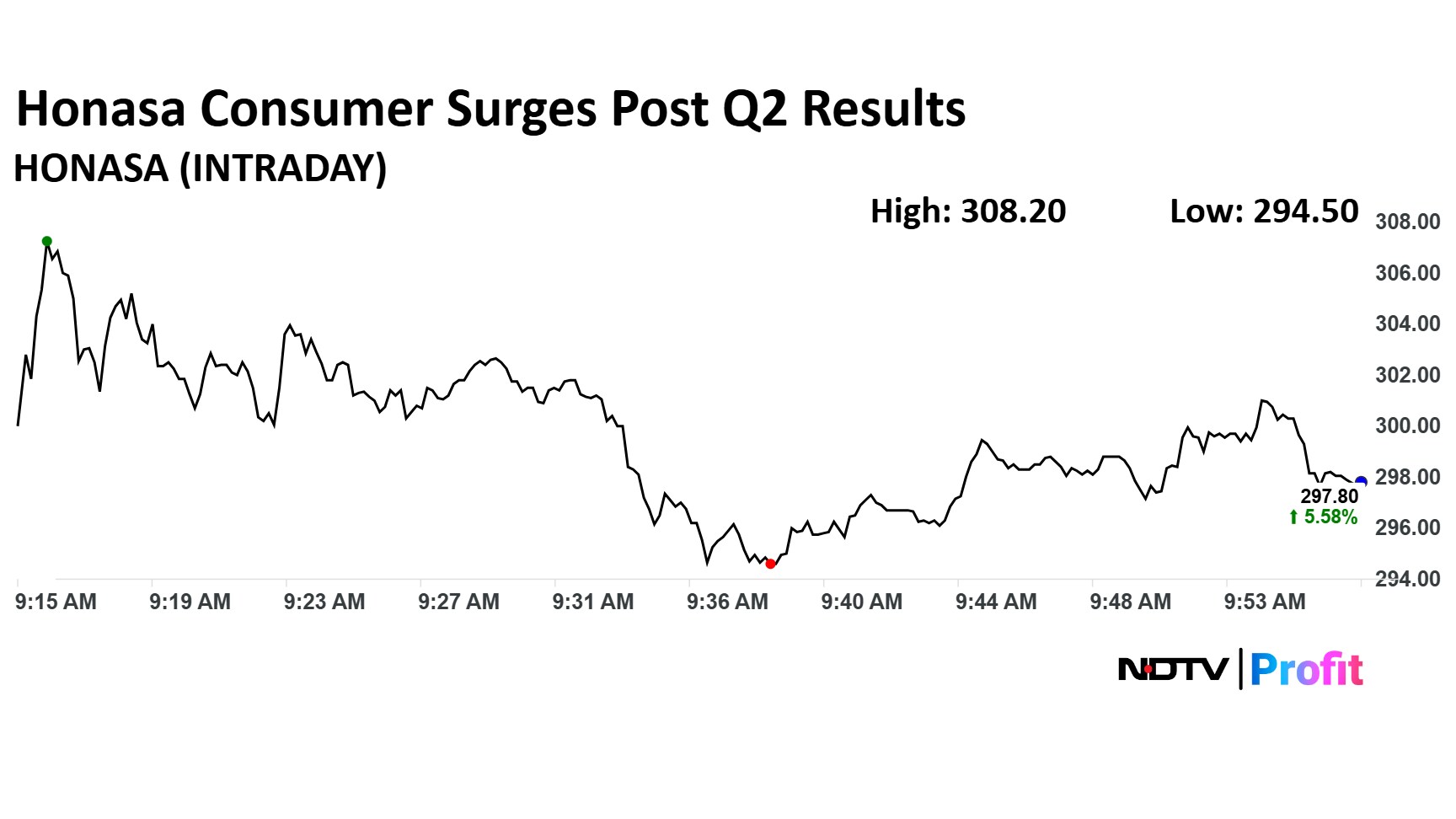

Honasa Consumer Share Price Today

The scrip rose as much as 9% to Rs 308.20 apiece. It pared gains to trade 5% higher at Rs 296.25 apiece, as of 09:53 a.m. This compares to a 0.01% decline in the NSE Nifty 50 Index.

It has risen 17.85% on a year-to-date basis, but has dipped 17.52% in the last 12 months. The relative strength index was at 45.40.

Out of 13 analysts tracking the company, seven maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.