India currency, money, rupee.jpeg?downsize=773:435)

Shares of Mahindra & Mahindra Financial Services Ltd. gained on Monday after the company received a nod from its board to raise up to Rs 1,250 crore through the issuance of non-convertible debentures.

The non-banking financial company, in an exchange filing, said the board had authorised the issue of "secured, rated, listed and redeemable" NCDs on a "private placement basis."

The company would be issuing up to 1,25,000 debentures at a face value of Rs 1 lakh, the filing said.

The base size of the NCD issue is of Rs 750 crore, with a greenshoe option to raise an additional Rs 500 crore, it added.

The tenure of the instrument will be over three years, as the deemed date of allotment for the NCDs is Sept. 26, 2024 and the date of maturity is Dec. 24, 2027, the filing noted.

The NCDs will carry a fixed coupon or interest of 8.01% per annum. The redemption will be Rs 1 lakh per debenture, the company's statement further noted.

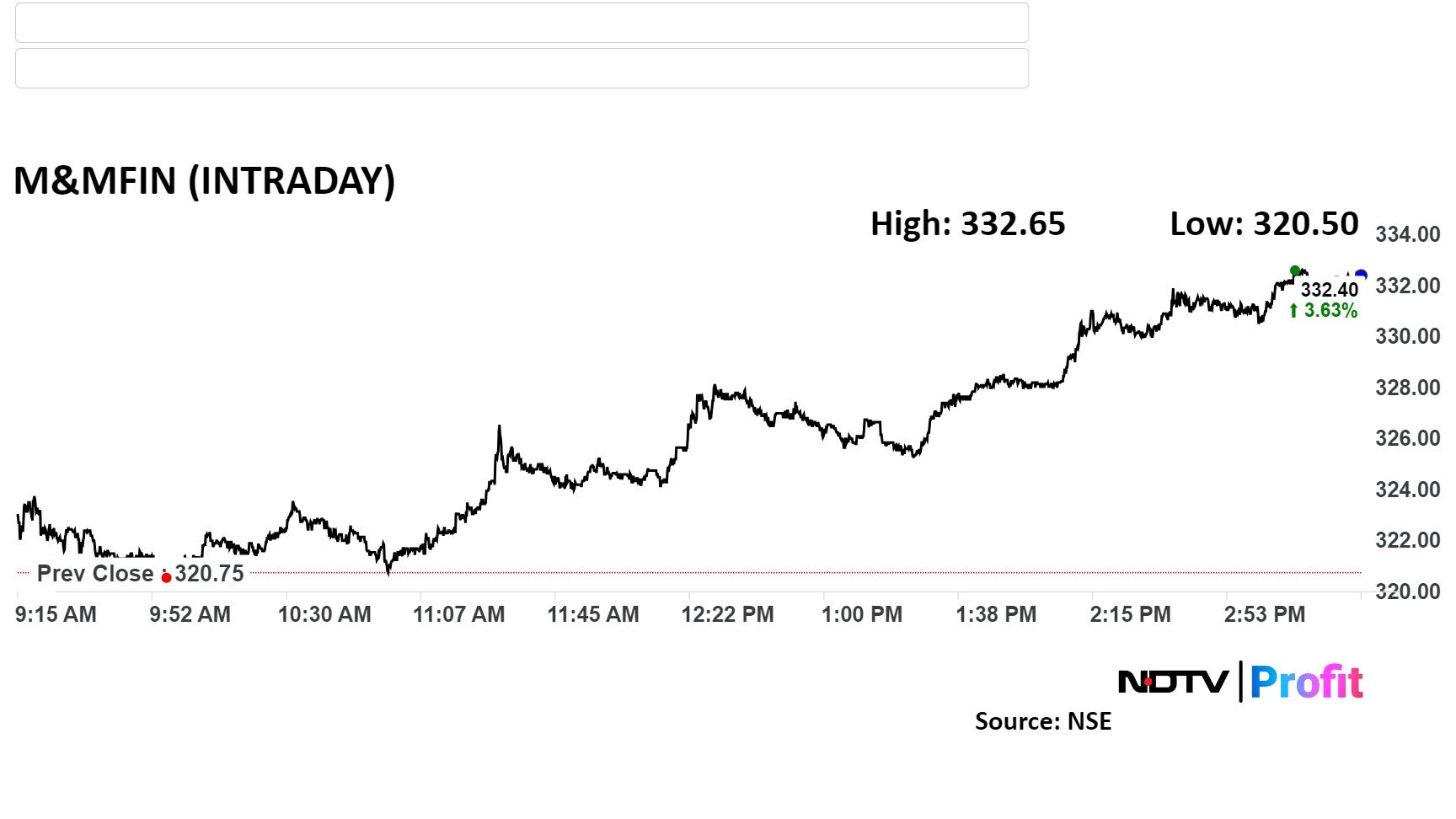

After the NCD issue was announced, shares of M&M Financial Services rose as much as 3.71% during the day to Rs 332.65 apiece on the NSE. At end of the market hours, the shares settled 3.51% higher, compared to a 0.57% climb in the benchmark Nifty 50.

M&M Financial's stock has risen 10.63% during the last 12 months and has advanced by 20% on a year-to-date basis. The total traded volume on Monday stood at 0.8 times its 30-day average. The relative strength index was at 61.

Seventeen out of the 38 analysts tracking the company have a "buy" rating on the stock, 12 suggest a "hold" and nine have a "sell", according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.