Magnificent 7’s Stock Market Dominance Shows Signs Of Cracking

'This isn’t a one-size-fits-all market,' said Jack Janasiewicz, lead portfolio strategist at Natixis Investment Managers Solutions, which has $1.4 trillion in assets.

(Photographer: Cedric von Niederhausern/ Bloomberg)

To beat the market in recent years, many investors applied a simple strategy: Load up on the biggest US technology stocks.

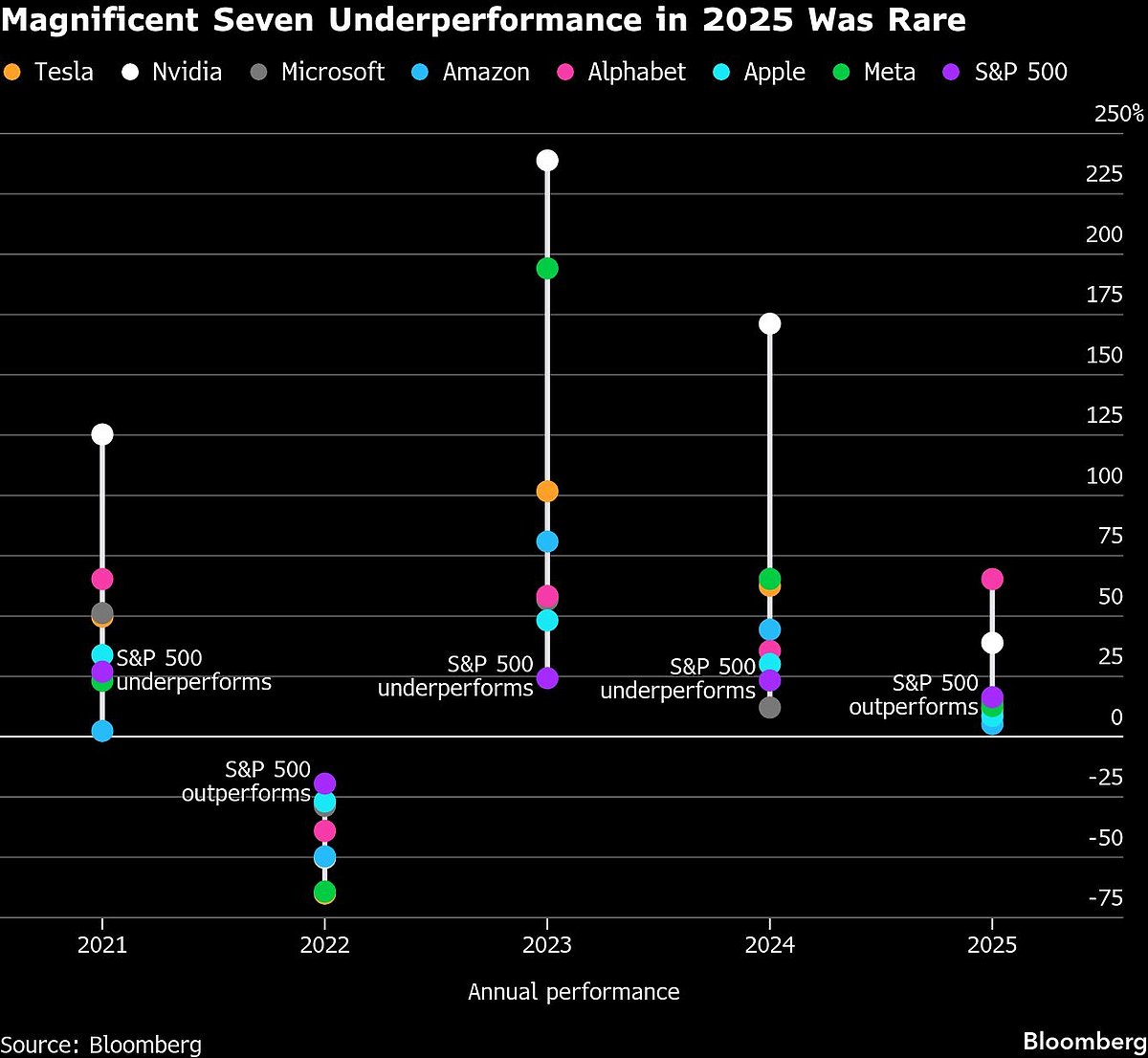

It paid handsomely for a long time. But last year, it didn’t. For the first time since 2022, when the Federal Reserve started raising interest rates, the majority of the Magnificent 7 tech giants performed worse than the S&P 500 Index. While the Bloomberg Magnificent 7 Index rose 25% in 2025, compared with 16% for the S&P 500, that was only because of the enormous gains by Alphabet Inc. and Nvidia Corp.

Many Wall Street pros see that dynamic continuing in 2026, as profit growth slows and questions about payoffs from heavy artificial intelligence spending rise. So far they’ve been right, with the Magnificent 7 index up just 0.5% and the S&P 500 climbing 1.8% to start the year. Suddenly stock picking within the group is crucial.

“This isn’t a one-size-fits-all market,” said Jack Janasiewicz, lead portfolio strategist at Natixis Investment Managers Solutions, which has $1.4 trillion in assets. “If you’re just buying the group, the losers could offset the winners.”

(Photo: Bloomberg)

The three-year bull market has been led by the tech giants, with Nvidia, Alphabet, Microsoft Corp. and Apple Inc. alone accounting for more than a third of the S&P 500’s gains since the run began in October 2022. But enthusiasm for them is cooling as interest in the rest of the S&P 500 rises.

With Big Tech’s earnings growth slowing, investors are no longer content with promises of AI riches — they want to start seeing a return. Profits for the Magnificent 7 are expected to climb about 18% in 2026, the slowest pace since 2022 and not much better than the 13% rise projected for the other 493 companies in the S&P 500, according to data compiled by Bloomberg Intelligence.

“We’re already seeing a broadening of earnings growth and we think that’s going to continue,” said David Lefkowitz, head of US equities at UBS Global Wealth Management. “Tech is not the only game in town.”

One source of optimism is the group’s relatively subdued valuations. The Magnificent 7 index is priced at 29 times profits projected over the next 12 months, well below the 40s multiples earlier in the decade. The S&P 500 is trading at 22 times expected earnings, and the Nasdaq 100 Index is at 25 times.

Here’s a look at expectations for the year ahead.

Nvidia

The dominant AI chipmaker is under pressure from rising competition and concerns about the sustainability of spending by its biggest customers. The stock is up 1,165% since the end of 2022, but it has lost 11% since its Oct. 29 record.

Rival Advanced Micro Devices Inc. has won data center orders from OpenAI and Oracle Corp., and Nvidia customers like Alphabet are increasingly deploying their own custom made processors. Still, its sales continue to race ahead as demand for chips outstrips supply.

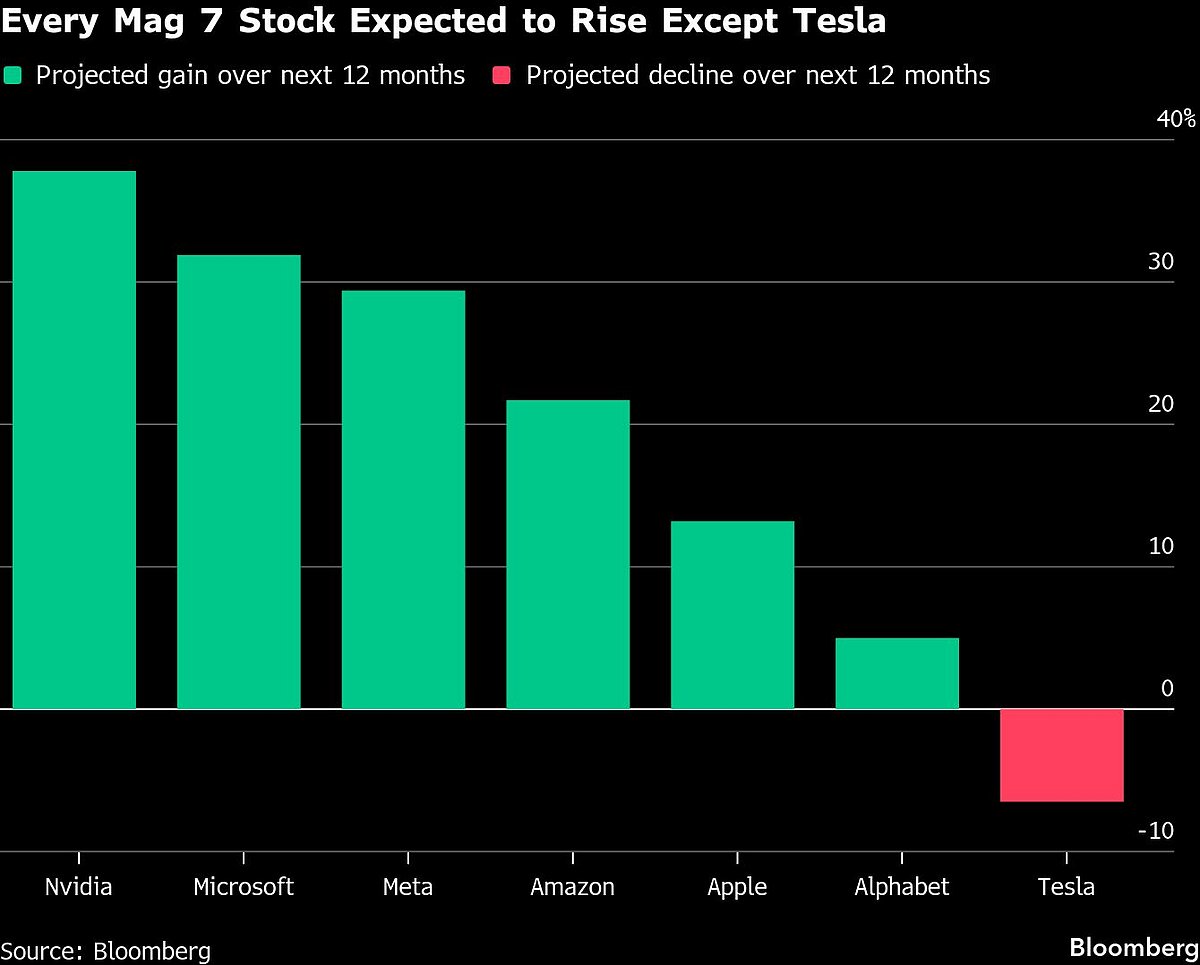

Wall Street is bullish, with 76 of the 82 analysts covering the chipmaker holding buy ratings. The average analyst price target implies a roughly 39% gain over the next 12 months, best among the group, according to data compiled by Bloomberg.

(Photo: Bloomberg)

Microsoft

For Microsoft, 2025 was the second consecutive year it underperformed the S&P 500. One of the biggest AI spenders, it’s expected to invest nearly $100 billion in capital expenditures during its current fiscal year, which ends in June. That figure is projected to rise to $116 billion the following year, according to the average of analyst estimates.

The data center buildout is fueling a resurgence in revenue growth in Microsoft’s cloud-computing business, but the company hasn’t had as much success in getting customers to pay for the AI services infused into its software products. Investors want to start seeing returns on those investments, according to Brian Mulberry, client portfolio manager at Zacks Investment Management.

“What you’re seeing is some people looking for a little bit more quality management in terms of that cash flow management and a better idea on what profitability really looks like when it comes to AI,” Mulberry said.

Apple

Apple has been far less aggressive with its AI ambitions than the rest of the Magnificent 7. The stock was punished for it last year, falling almost 20% through the start of August.

But then it caught on as an “anti-AI” play, soaring 34% through the end of the year as investors rewarded its lack of AI spending risk. At the same time, strong iPhone sales reassured investors that the company’s most important product remains in high demand.

Accelerating growth will be the key for Apple shares this year. Its momentum has slowed recently, the stock closed higher on Friday, narrowly avoiding matching its longest losing streak since 1991. However, revenue is expected to expand 9% in fiscal 2026, which ends in September, the fastest pace since 2021. With the stock valued at 31 times estimated earnings, the second highest in the Magnificent 7 after Tesla, it will need the push to keep the rally going.

Alphabet

A year ago, OpenAI was seen as leading the AI race and investors feared Alphabet would get left behind. Today, Google’s parent is a consensus favorite, with dominant positions across the AI landscape.

Alphabet’s latest Gemini AI model received rave reviews, easing concerns about OpenAI. And its tensor processing unit chips are considered a potential significant driver of future revenue growth, which could eat into Nvidia’s commanding share of the AI semiconductor market.

The stock rose more than 65% last year, the best performance in the Magnificent 7. But how much more can it run? The company is approaching $4 trillion in market value, and the shares trade at around 28 times estimated earnings, well above their five-year average of 20. The average analyst price target projects just a 3.9% gain this year.

Amazon.com

The e-commerce and cloud-computing giant was the weakest Magnificent 7 stock in 2025, its seventh straight year in that position. But Amazon has charged out of the gate in early 2026 and is leading the pack.

Much of the optimism surrounding the company is based on Amazon Web Services, which posted its fastest growth in years in the company’s most recent results. Concerns that AWS was falling behind its rivals has pressured the stock, as has the company’s aggressive AI spending, which includes efforts to improve efficiency at its warehouses, in part by using robotics. Investors expect the efficiency push to start paying off before long, which could make this the year the stock goes from laggard to leader.

“Automation in warehouses and more efficient shipping will be huge,” said Clayton Allison, portfolio manager at Prime Capital Financial, which owns Amazon shares. “It hasn’t gotten the love yet, but it reminds me of Alphabet last year, which was sort of left behind amid all the concerns about competition from OpenAI, then really took off.”

Meta Platforms

Perhaps no stock in the group shows how investors have turned skeptical about lavish AI spending more than Meta. Chief Executive Officer Mark Zuckerberg has pushed expensive acquisitions and talent hires in pursuit of his AI ambitions, including a $14 billion investment in Scale AI in which Meta also hired the startup’s CEO Alexandr Wang to be its chief AI officer.

That strategy was fine with shareholders — until it wasn’t. The stock tumbled in late October after Meta raised its 2025 capital expenditures forecast to $72 billion and projected “notably larger” spending in 2026. When the shares hit a record in August they were up 35% for the year, but they’ve since dropped 17%. Demonstrating how that spending is boosting profits will be critical for Meta in 2026.

Tesla

Tesla’s shares were the worst performers in the Magnificent 7 through the first half of 2025, but then soared more than 40% in the second half as Chief Executive Officer Elon Musk shifted focus from slumping electric vehicle sales to self-driving cars and robotics. The rally has Tesla’s valuation at almost 200 times estimated profits, making it the second most expensive stock in the S&P 500 behind takeover target Warner Bros. Discover Inc.

After two years of stagnant revenue, Tesla is expected to start growing again in 2026. Revenue is projected to rise 12% this year and 18% next year, following an estimated 3% contraction in 2025, according to data compiled by Bloomberg.

Still, Wall Street is pessimistic about Tesla shares this year. The average analyst price target projects a 9.1% decline over the next 12 months, data compiled by Bloomberg show.