L&T Technology Services Ltd.'s share price declined on Thursday after analysts expressed scepticism about the company meeting its growth guidance for the financial year 2025 after its second-quarter EBIT margin declined, missing estimates.

Citi Research retained a 'sell' and Nomura kept a 'reduce' rating on L&T Technology Services, while both reduced the target price on the stock.

Citi Research reduced the target price to Rs 4,860 from Rs 4,895, implying a 10.20% downside from Wednesday's closing price. Nomura cut the target price to Rs 4,840 from Rs 4,960, suggesting a 10.68% downside from the previous close.

L&T Technology Services management reiterated their confidence of meeting growth guidance of 8–10% for the fiscal 2025. However, Citi Research believes that meeting this guidance will be challenging, even with improved seasonality in the sustainability segment in the second half, as well as anticipated deal wins due to stronger pipelines.

Higher investment in technology and sales weighed on the company's revenue and profit margin, according to Nomura. With investment on the priority list, the aim to achieve 16% EBIT margin in the current financial year looks challenging, the brokerage said.

L&T Technology Services said that the company needs to increase investment in key areas to capture high market share and improve its growth trajectory in the medium term through investing in people and technology building, Nomura noted.

L&T Tech Q2 FY25 (Consolidated, QoQ)

Revenue up 4.5% to Rs 2,573 crore. (Bloomberg estimate: Rs 2,570 crore).

EBIT up 1.04% to Rs 388 crore. (Bloomberg estimate: Rs 413 crore).

EBIT margin down 50 bps at 15.1% versus 15.6% (Bloomberg estimate: 16.1%).

Net profit up 1.91% to Rs 320 crore. (Bloomberg estimate: Rs 333 crore).

The company declared interim dividend of Rs 17 per share.

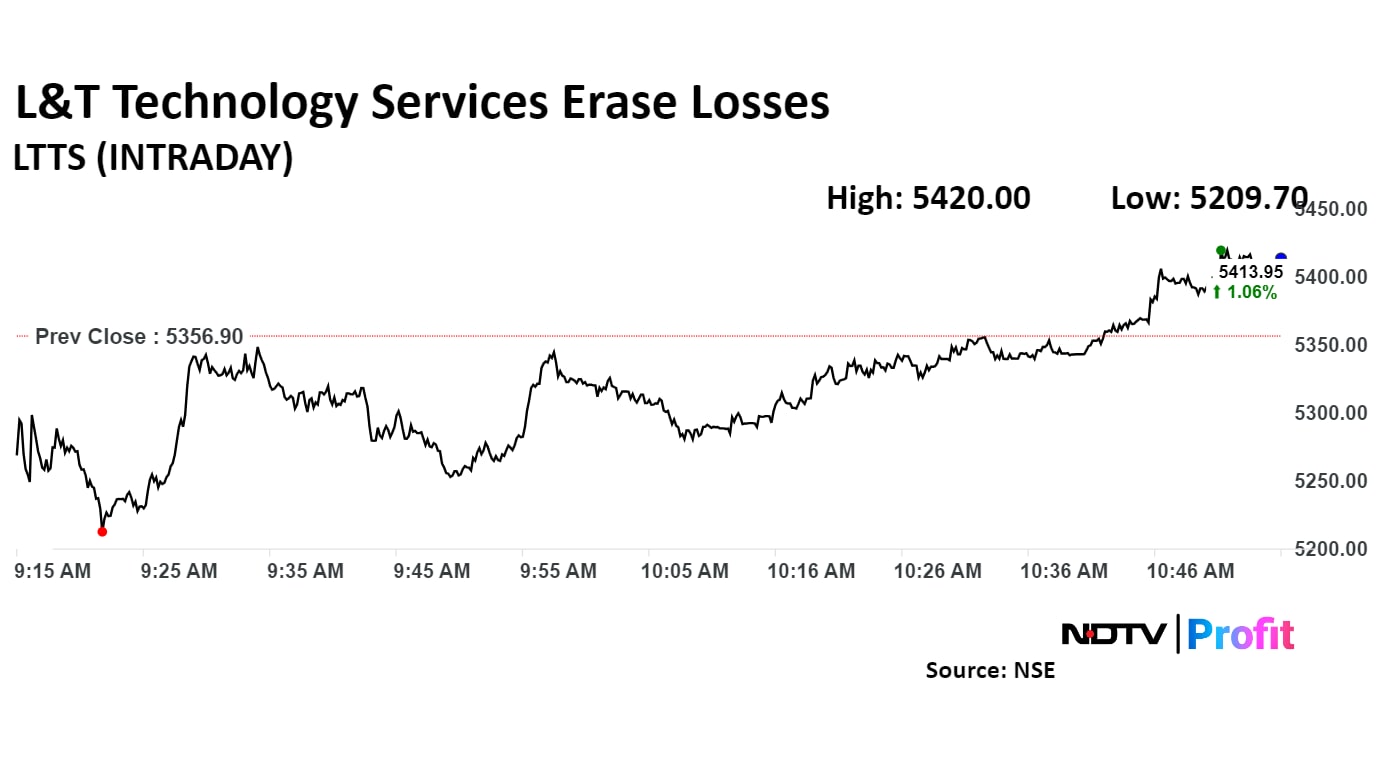

L&T Technology Services share price rose 1.06% to Rs 5,413.95.

L&T Technology Services share price declined 2.75% to Rs 5,209.70, the lowest level since Oct. 14. It erased losses to trade 1% higher at Rs 5,410.35 as of 10:53 a.m., compared to 0.50% decline in the NSE Nifty 50 index.

The stock gained 17.27% in 12 months and 3.08% on year-to-date basis. Total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 54.20.

Out of 30 analysts tracking the company, four maintain a 'buy' rating, seven recommend a 'hold,' and 19 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 5.4%

Watch LIVE TV, Get Stock Market Updates, Top Business, IPO and Latest News on NDTV Profit.