- Larsen & Turbo Ltd's share price rose 1.79% after winning an ultra-mega order

- The order is for a Natural Gas Liquids plant and allied facilities in the Middle East

- L&T leads engineering and procurement while Consolidated Contractors Group handles construction

Larsen & Turbo Ltd.'s share price gained 1.79% after its Hydrocarbon Onshore business arm received an ultra-mega order for setting up a Natural Gas Liquids plant allied facilities in the Middle East.

“L&T has won the order in consortium with the Greece-headquartered Consolidated Contractors Group S.A.L”, the company said in an exchange filing submitted on Thursday.

The scope of work encompasses engineering, procurement, construction, installation and commissioning of a Natural Gas Liquids plant and allied facilities for processing Rich Associated Gas (RAG). This also involves all associated utilities and offsite and integration with existing facilities, the company said.

Under the arrangement, L&T, as the lead partner, will be responsible for engineering and procurement; CCC will handle the construction activities. The RAG sourced from offshore and onshore oil fields will be treated at the plant to remove impurities like H2S, CO2 and H2O, producing value-added products such as lean sales gas, ethane, propane, butane and hydrocarbon condensate.

Notably, L&T classifies an ultra-mega order as an order ranging over Rs 15,000 crore.

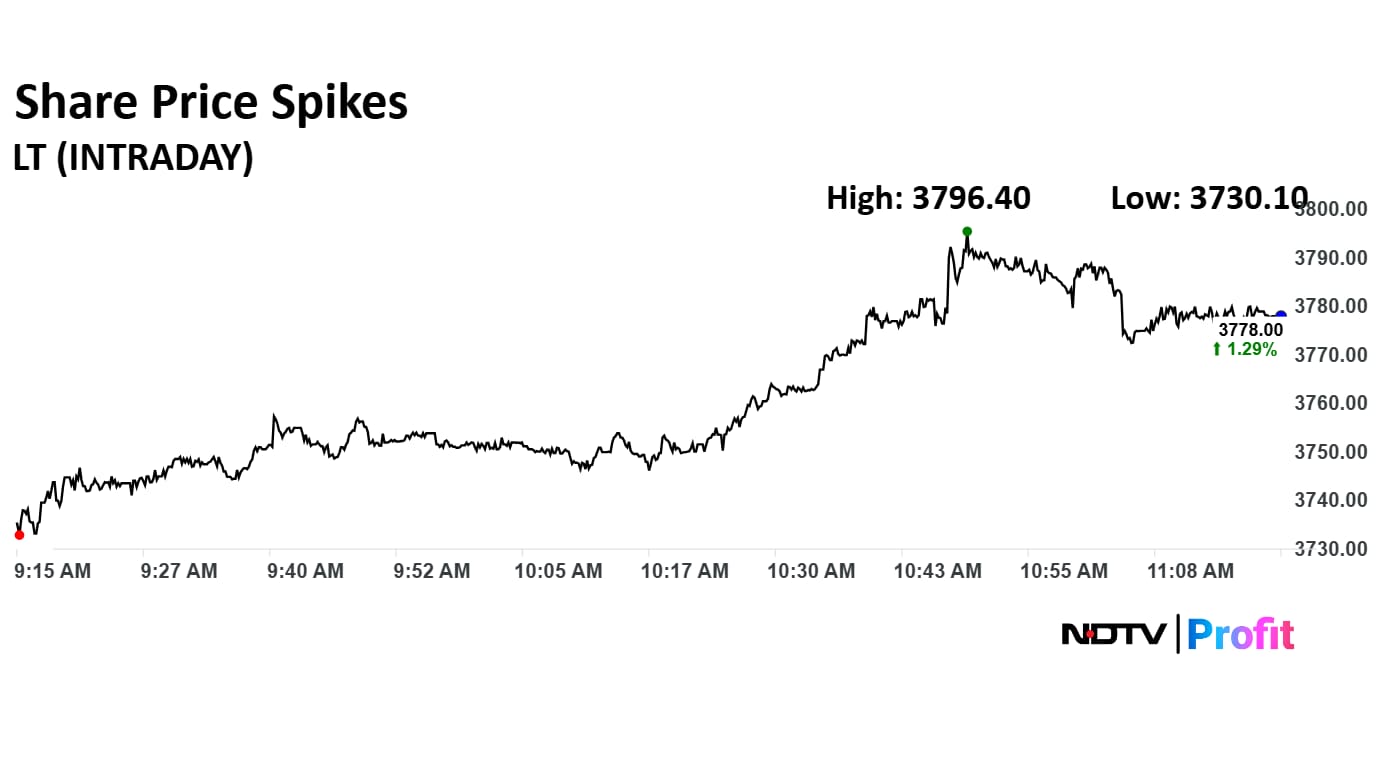

The scrip rose as much as 1.79% to Rs 3,796.40 apiece. It pared gains to trade 1.29% higher at Rs 3,778 apiece, as of 11:29 a.m. This compares to a 0.38% advance in the NSE Nifty 50 Index.

It has risen 8.34% in the last 12 months. Total traded volume so far in the day stood at 0.37 times its 30-day average. The relative strength index was at 65.

Out of 34 analysts tracking the company, 28 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.