Lloyds Metals and Energy Ltd. rose to its lifetime high after it received a 'buy' rating from DAM Capital as it initiated coverage on the stock with a target price of Rs 1,905, implying an upside of 32.7%. The brokerage sees multiple tailwinds for the stock including Ebitda outlook and capacity expansion.

"Lloyds Metals & Energy Ltd. operates Maharashtra's only iron ore mine at Surjagarh (Gadchiroli district) and has a diverse set of operations with an iron ore (high grade) mining capacity of 10 million tonnes, which is proposed to be extended to 25 million tonnes (finished ore) by 4QFY25," DAM Capital said. "It has a direct reduced iron capacity of 0.35 million tonnes and a captive power plant with a capacity of 34 MW."

"Further, the company will be moving up in the steel value chain by setting up integrated steel facilities of 1.2 million tonnes wire rod mill and 3 million tonnes hot rolled coils, along with a 12 million tonnes pellet plant," it added.

The brokerage expects Ebitda to rise at a compounded annual growth rate of 91% from FY25 to FY27, driven by higher ore volumes and improved value-added mix.

The company is poised for its next leg of growth with proposals to increase mining capacity to 55 MT (25MT will be for sales/internal consumption) in FY26, the brokerage said.

It expects revenue to grow at a CAGR of 62% from FY25-27. "We expect a strong growth ahead, projecting Ebitda to grow at a CAGR of 91% over FY25-27," it said.

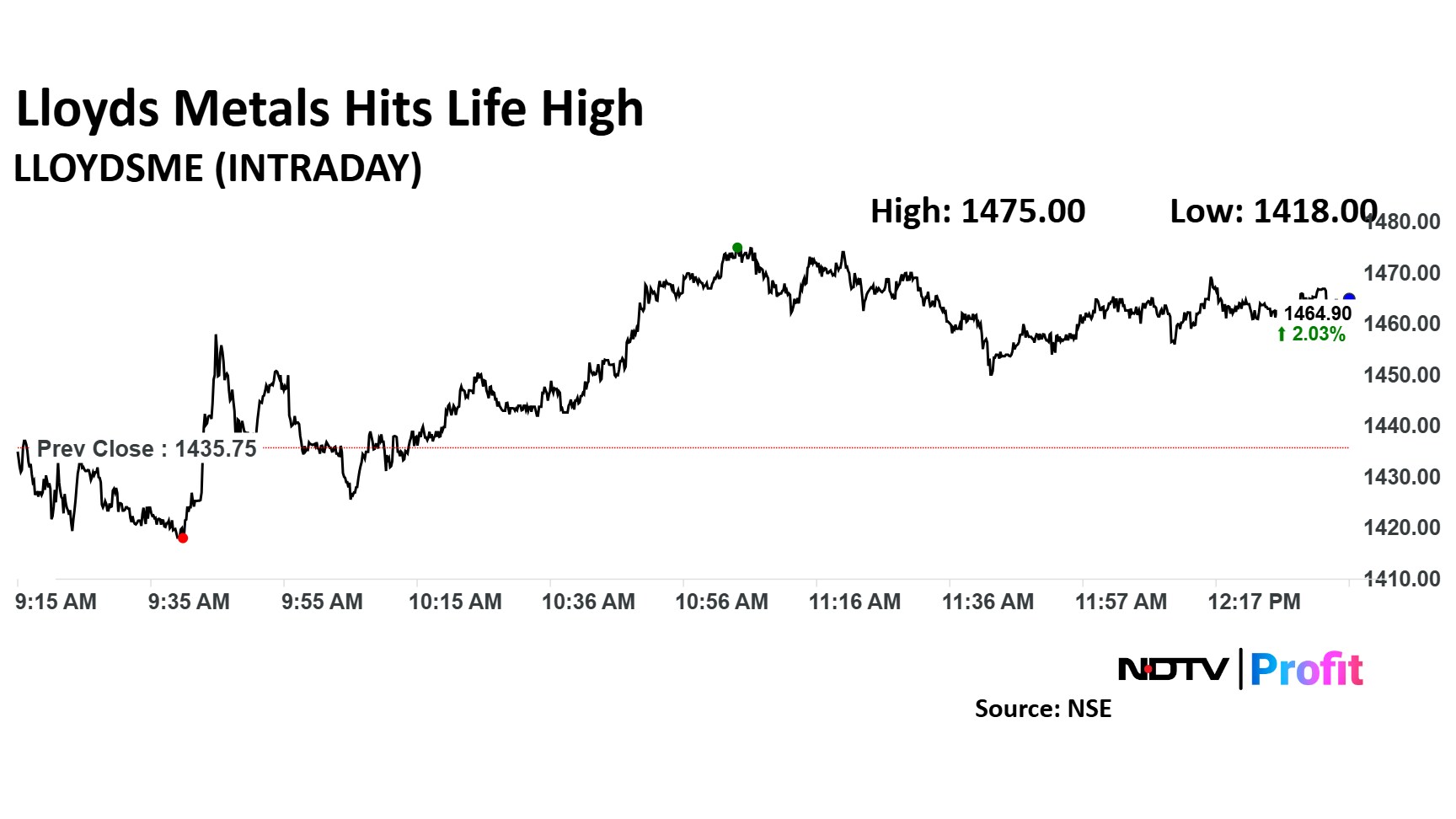

Lloyds Metals Share Price Today

The scrip rose as much as 2.7% to Rs 1,475 apiece, the highest level ever. It pared gains to trade 1.86% higher at Rs 1,468 apiece, as of 12:40 p.m. This compares to a 0.1% decline in the NSE Nifty 50.

It has risen 160% in the last 12 months. Total traded volume so far in the day stood at 0.86 times its 30-day average. The relative strength index was at 79, indicating that the stock may be overbought.

All five analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.