Lemon Tree Shares Rally On Sale Of Arm Fleur To Warburg Pincus

The plan focuses on unlocking value and raising funds through the formation of two distinct entities and bringing Warburg Pincus on board as a strategic investor.

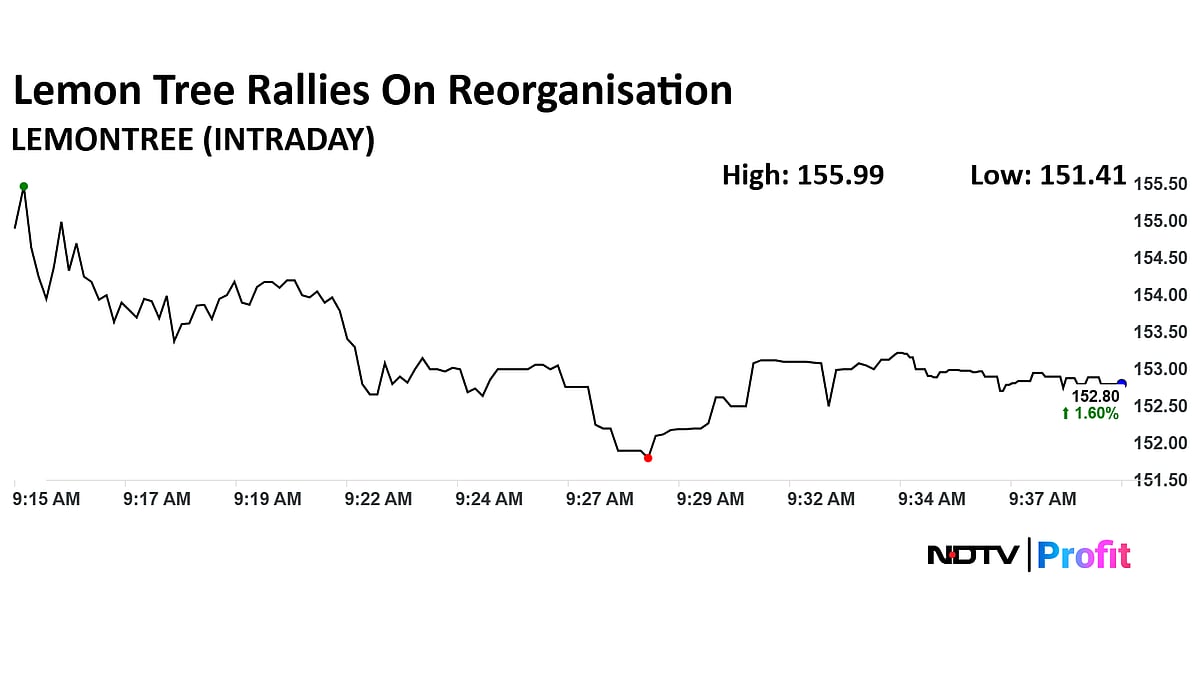

Shares of Lemon Tree saw a rise by up to 4% in early trade on Monday, following the announcement of a significant restructuring initiative. Global private equity major Warburg Pincus will acquire a significant stake in Lemon Tree's hotel ownership arm, Fleur Hotels.

Shares of Lemon Tree Limited are trading 1.60% higher at Rs 152.80 apiece. Of the 25 analysts, tracked by Bloomberg, who have coverage on this stock, 22 have a 'buy' rating, two have a 'hold' call, and one has a 'sell' view on the stock.

According to an exchange filing, Warburg Pincus will acquire APG Strategic Real Estate Pool’s entire 41.09% stake in Fleur Hotels and will also invest up to Rs 960 crore of primary capital in tranches to fund the platform’s future expansion.

The plan focuses on unlocking value and raising funds through the formation of two distinct entities and bringing Warburg Pincus on board as a strategic investor.

Fleur will be listed as a separate entity on the National Stock Exchange of India and the BSE within 12–15 months. This is Warburg's move aimed at unlocking long-term shareholder value amid a buoyant hospitality cycle.

The boards of Lemon Tree Hotels and Fleur Hotels have approved a composite scheme of arrangement that will split the group into two focused platforms.

Lemon Tree will operate as a pure-play, asset-light hotel management and franchising business, while Fleur will emerge as the asset-heavy hotel ownership and development arm, housing all owned hotel assets and leading acquisitions and greenfield developments.

Under the scheme, which is slated to become effective from April 1, 2026, Lemon Tree will transfer its owned hotel assets to Fleur but will continue to manage and franchise these properties.

Post-reorganisation, Lemon Tree shareholders will directly own 32.96% of Fleur, Lemon Tree will hold 41.03%, and Warburg Pincus will own 26.01%, excluding any dilution from the proposed primary capital infusion.

Founder Patanjali Govind Keswani will serve as executive chairman of Fleur Hotels and will eventually transition to a non-executive role at Lemon Tree Hotels.