Laurus Labs Ltd. share price rose on Tuesday as B&K Securities initiated coverage and projected an 18% upside potential for the stock price. The pharma company is set to begin a strong growth cycle as its main earning-driving segment margin expands.

Contract development and manufacturing organisation — the key growth driving segment of Laurus Labs — delivered a Rs 1,370 crore revenue in financial year 2025, which marks a 49% year-on-year increase. Over 110 active programs, increasing late-stage conversion, and strategic diversification into animal health and crop sciences have supported this growth, B&K Securities said in a report.

Laurus Labs will likely sustain 40% compound annual growth rate in revenue from small molecule CDMO over FY25-FY28, according to B&K.

The company has directed the majority of the Rs 4,000-crore or $450-million capital expenditure towards CDMO capabilities over the last five years. These capabilties include biocatalysis, fermentation, and high-potent chemistry with further Rs 2,000 crore or $232 million earmarked for the next two years.

As the sales mix shift toward the high-value segment, Ebitda margins are projected to expand from 19% in FY25 to 28% in FY28, driving a 51% CAGR in net profit over the same period.

Track live updates on Muhurat Trading here.

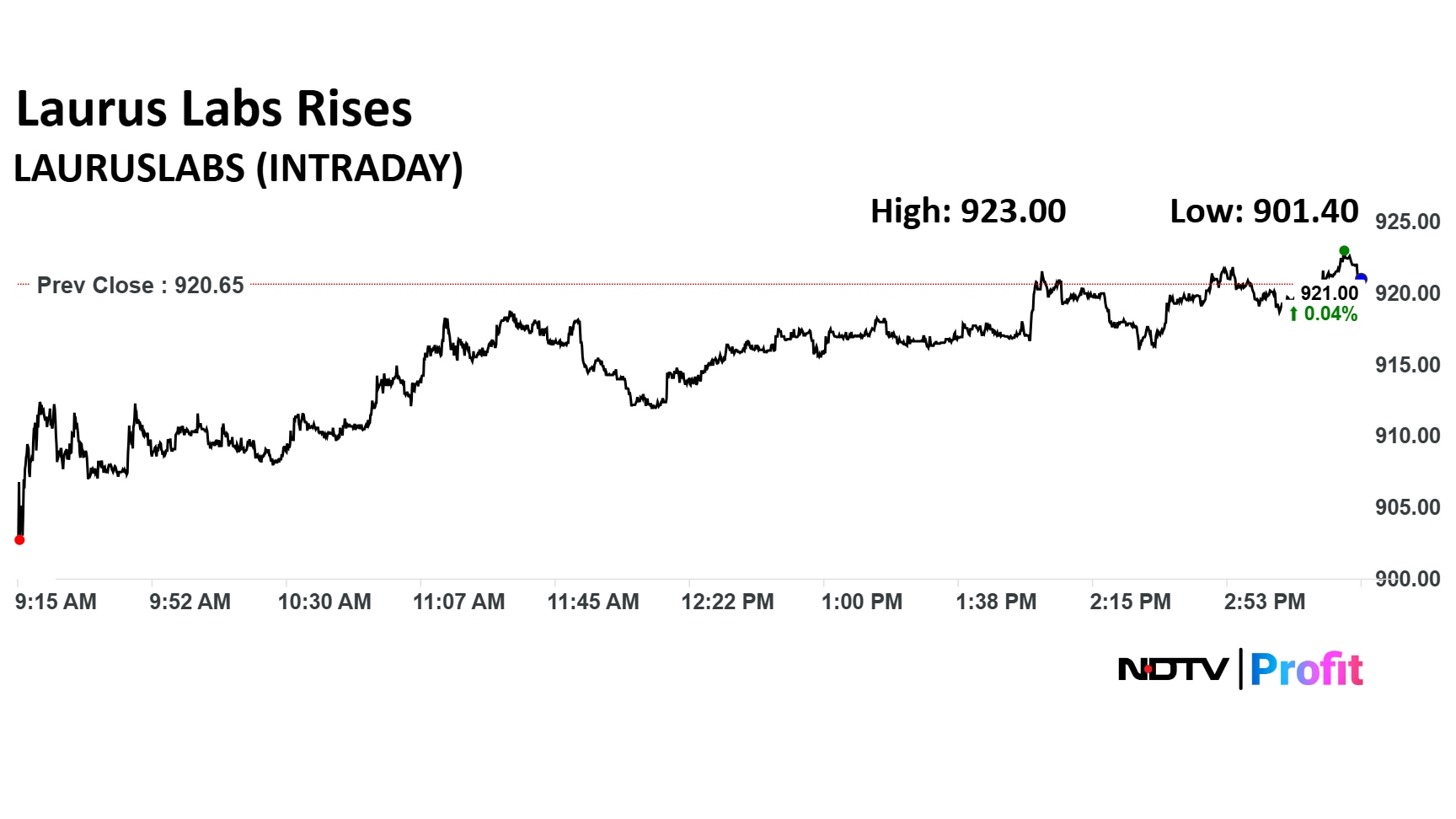

Laurus Labs shares were 0.48% higher at Rs 925 apiece as of 1:58 p.m., compared to 0.19% advance in the NSE Nifty 50 index.

The stock advanced 98.83% in 12 months, and 53.48% on year-to-date basis. The relative strength index was at 65.90.

Out of 17 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 11.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.