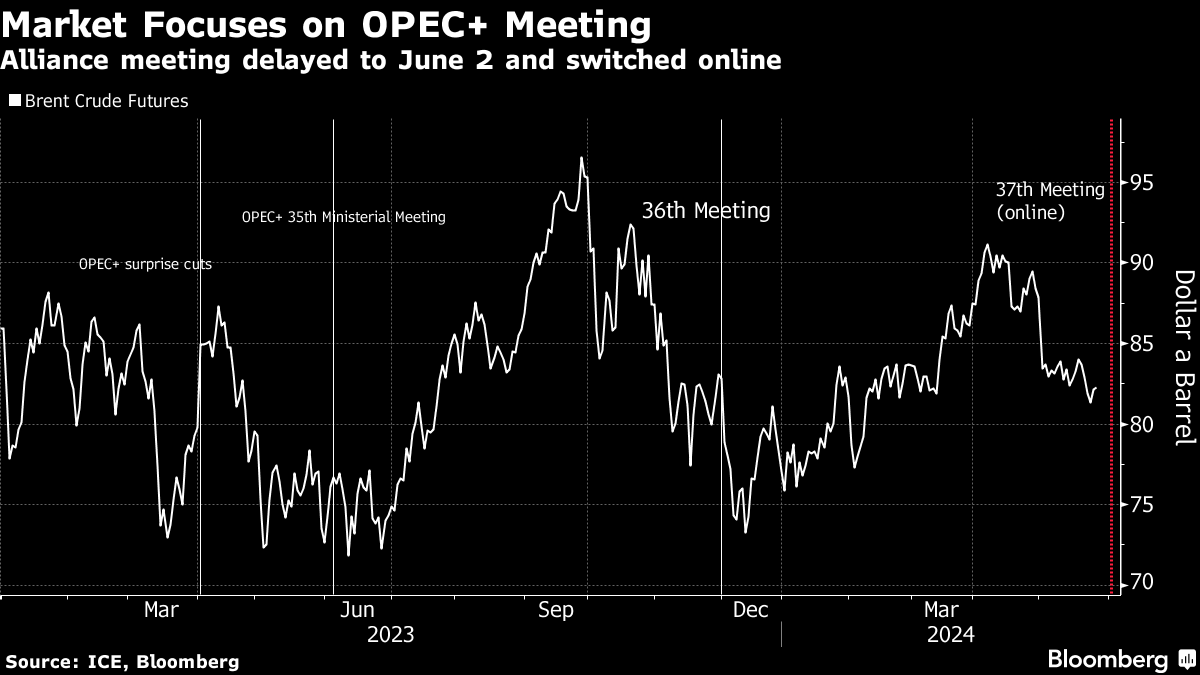

(Bloomberg) -- Oil edged higher after dropping last week, with the focus on an OPEC+ supply meeting on Sunday and US demand at the start of the summer driving season.

Brent futures held above $82 a barrel after dropping 2.2% last week and touching the lowest since early February. West Texas Intermediate was above $78. The Organization of the Petroleum Exporting Countries and its allies will hold a policy meeting online, and are widely expected to prolong production cuts into the second half of 2024.

Activity was muted with a holiday in the UK and the US, where the Memorial Day weekend kicks off the summer driving season, which will provide clues on demand trends. Early signs have pointed to a solid showing, with expectations that the number of people to fly over the weekend will be the highest in nearly 20 years, according to the American Automobile Association.

“We saw a very strong demand from the US last week ahead of the Memorial day long weekend,” said Giovanni Staunovo, a commodity strategist at UBS Group AG. “Record flight activity and strong gasoline demand should give some support to oil prices.”

Brent is up about 7% this year, supported by persistent geopolitical risks and OPEC+'s roughly 2 million barrels a day of output cuts. Still, futures have fallen since mid-April as concern have eased that the conflict in the Middle East would spread and disrupt oil flows.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.