The record surge in small and mid caps has triggered concerns about frothy valuations. At least two indicators suggest the risk-reward ratio may not be in favour of the broader market stocks.

Since small- and mid-cap stocks are riskier bets, they should offer a higher earnings yield to make them lucrative for investors. But the ongoing rally means that earnings yields of this category of stocks has fallen since April this year.

Similarly, while the market capitalisation of the small and mid caps has risen, their share in profits stays stagnant.

Smallcap 250 and Midcap 150 have surged 32.61% and 31.24%, respectively, so far this year, beating 10.43% rise in the benchmark Nifty 50. Both the broader indices hit lifetime highs of 12,573.3 and 15,599.05, on Tuesday.

"If you look at the mid- and small-cap space today, there are certain indicators that are emerging, which is making us a little cautious," Pankaj Tibrewal, senior executive vice president at Kotak Asset Management Co, told BQ Prime in an interview. "We believe that greed is on the street right now..."

Of the total 250 companies in the smallcap index, 189 are currently trading above their five-year average price-to-earnings multiple. And of 150 stocks in the midcap index, 113 are trading at a premium to historic valuations.

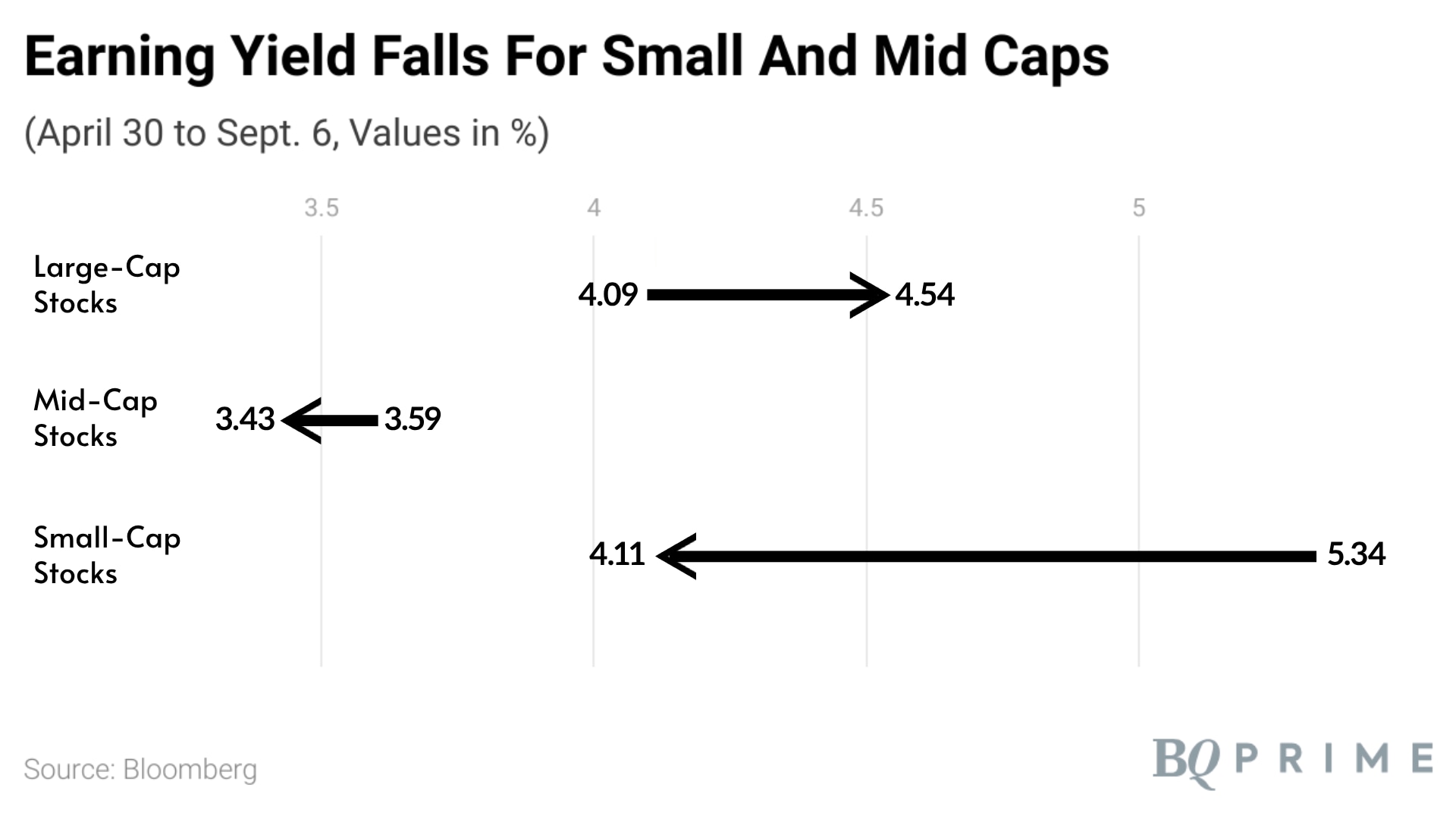

As valuations rise, the gap in earnings yield has narrowed. The average earnings yield for small-cap stocks among the Nifty 500, which was at 5.34% as of April 30, has now fallen to 4.11%, according to Bloomberg data.

Yields for mid-cap stocks also fell from an average of 3.59% to 3.43% during the same period, while those for large cap stocks observed a rise from 4.09% to 4.54%.

Large-cap stocks, which form 72% of the profit pool from stocks included in the Nifty 500 index, make up around 70% of the total market cap. Small-cap stocks contributed 8.7% of the profit pool, representing around 10% of the total market cap. But their share in profit pool is marginally below that level.

Not everyone is overly worried about small and mid cap multiples though.

While indicators may be presenting a picture of high valuations, Ravi Dharamshi, managing director at ValueQuest Investment Advisors, advised against generalising future projections based on market capitalisation.

One invests in a company, not in a market capitalisation, Dharamshi tweeted. "Such generalisation are distractions."

He suggests maintaining focus on identifying good companies that have large opportunities, along with those that possess a competitive advantage and are available at a discount to estimated future valuations.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.