Shares of KFin Technologies Ltd. were up nearly 3% on Wednesday after Jefferies Equity Research shared a note highlighting the finserv company's strong domestic and international business performance.

The company is Jefferies' top pick in the mid-cap financial space, with a 'buy' rating from the brokerage. The stock also got a target price upgrade to Rs 1,530 from Rs 1,140 earlier, implying a potential upside of 25%.

Jefferies noted that robust capital market activity and market share gains in investor and issuer solutions were boosting KFin's domestic business. The mutual fund segment, which contributes 70% to revenues, has seen growth driven by strong inflows and data-driven services, while IPO-related issuer solutions have also gained traction.

Internationally, the company is progressing organically, expanding its client base in fund administration and software licensing from 20 to 66 clients over three years. With regulatory approvals to establish operations in Thailand, and ambitions to enter other markets like Singapore and the Middle East, KFin aims to increase the share of international revenues to 15% over the next 3-5 years.

The management is also evaluating inorganic opportunities to accelerate growth, focusing on acquiring licenses, key clients, and strong teams in target markets. Despite a high valuation of 44 times fiscal 2027 earnings, KFin is a top pick for Jefferies, which cites its strong long-term growth prospects.

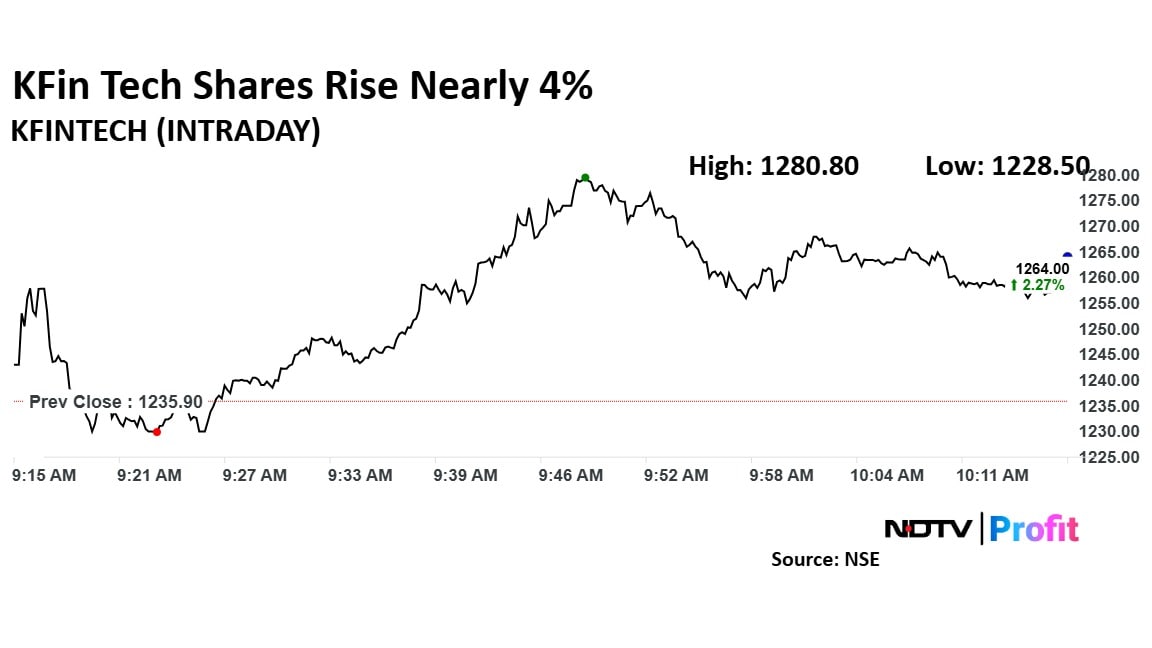

KFin Technologies Share Price Today

KFin Technologies stock rose as much as 3.63% during the day to Rs 1,280.80 apiece on the NSE. It was trading 1.68% higher at Rs 1,256.65 apiece, compared to a 0.39% decline in the benchmark Nifty 50 as of 10:15 a.m.

It has risen 145.35% in the last 12 months and 161.02% on a year-to-date basis. The total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 68.96.

Eight out of the 13 analysts tracking the finserv company have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,083.38, implying a downside of 14.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.