.jpg?downsize=773:435)

Shares of KEC International Ltd. rose more than 5% on Monday following the announcement that the company has secured new orders worth Rs. 1,073 crore across its diverse business segments.

The Mumbai-based infrastructure giant, part of the RPG Group, stated that these orders span several sectors, including transmission and distribution, civil, transportation, and cables.

In the T&D segment, KEC International has won projects in the Middle East and South Asia regions, further expanding its international footprint. The civil segment saw the company secure industrial orders within India, while its transportation division bagged a significant joint venture order for the design, supply, and construction of a passenger ropeway in the Northeast. Additionally, the cables business secured multiple orders for the supply of various cables both within India and internationally.

This influx of orders is expected to enhance KEC International's business prospects and strengthen its position in the global infrastructure market. The company's diverse portfolio and strong presence in multiple regions have contributed to its continued growth in the competitive infrastructure sector.

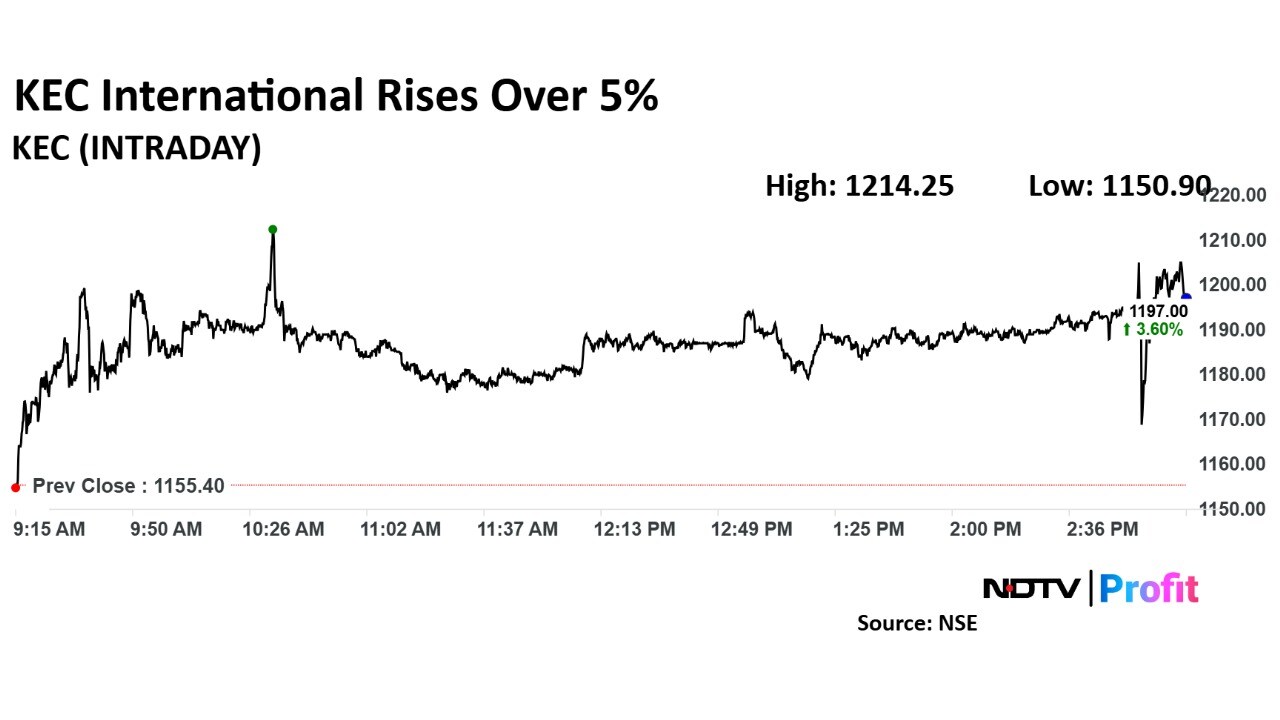

KEC International's scrip rose as much as 5.09% to Rs 1,214.25 apiece on the NSE, after the new order wins were announced. The stock pared some of the gains to trade 4.03% higher at Rs 1,201.95 apiece on the NSE, as of 03:08 p.m. This compared to a 0.68% decline in the Nifty 50 index.

The stock has risen 98.49% in the last 12 months. The total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 58.

Out of 24 analysts tracking the company, 13 maintain a 'buy' rating, seven recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 13.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.