.png?downsize=773:435)

Shares of Karur Vysya Bank Ltd. rose to touch an over one-month high on Tuesday, as Axis Capital initiated coverage with a 'buy' rating and a target price of Rs 295, offering a 41% upside from the current market price.

With a revamped management team, a more diversified loan book, and a focus on agriculture, retail, and commercial banking, Karur Vysya Bank is poised for strong performance, the brokerage said.

According to Axis Capital, the bank is well-positioned for continued growth, with loan, NII, PPOP, and PAT CAGRs of 16%, 15%, 16%, and 13%, respectively, over financial years 2025-2027.

Karur Vysya Bank's strong deposit franchise has allowed it to lower the cost of funds and price risks more effectively than its peers, the brokerage said in its note. Through digital underwriting and diversified loan origination channels, the bank has grown its loan book at a 14% CAGR over financial year 2025.

The note further said the bank has made significant strides in improving its asset quality. Its shift from corporate loans to a more granular and diversified loan book has improved asset quality and risk management.

Its GNPA and NNPA ratios have improved from 8.8% and 5.0% in financial year 2019 to 0.8% and 0.2% in the third quarter of fiscal 2025, respectively. The Provision Coverage Ratio has increased to 75.9% as of the third quarter of this fiscal from 45.6% in financial year 2019, reflecting stronger underwriting and loan monitoring practices.

According to the brokerage, with its well-diversified loan book and strong liability franchise, the bank is expected to maintain healthy margins. Elevated cost ratios may persist, but lower credit costs due to improved risk management will support profitability. Axis Capital expects the bank to achieve a RoA of 1.6% and RoE of 17% by financial year 2027.

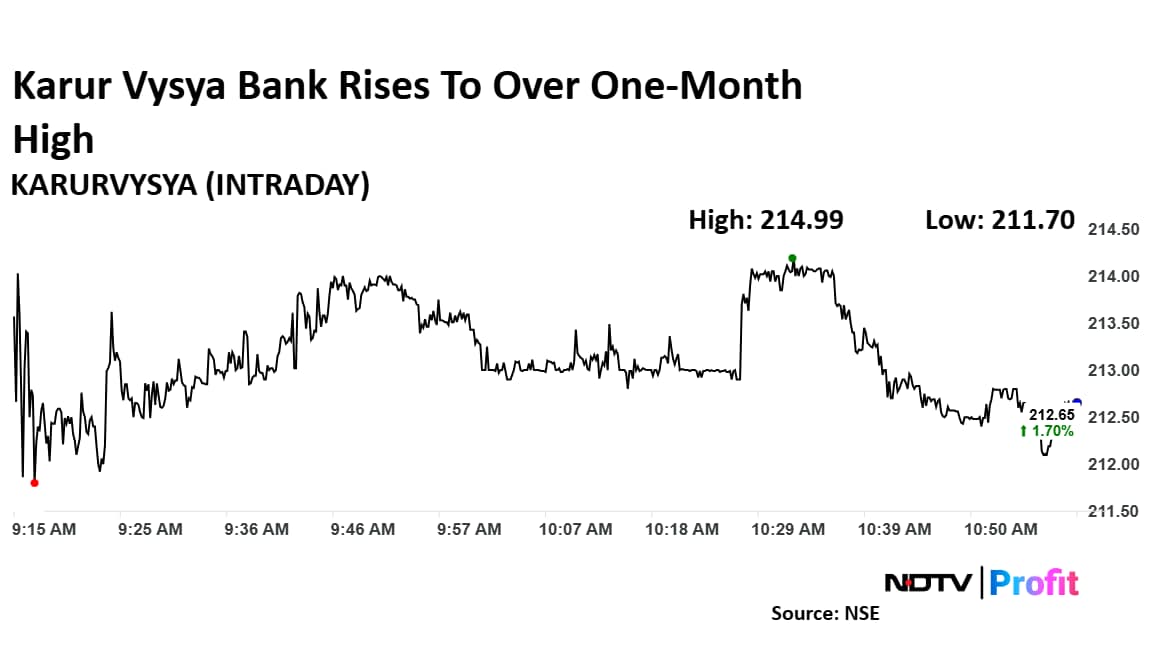

Karur Vyasa Bank Share Price Rise

Shares of Karur Vyasa Bank rose as much as 2.82% to Rs 214.99 apiece, the highest level since Feb. 21. It pared gains to trade 1.77% higher at Rs 212.80 apiece, as of 10:57 a.m. This compares to a 0.03% advance in the NSE Nifty 50.

The stock has risen 16.96% in the last 12 months and fallen 5.69% year-to-date. Total traded volume so far in the day stood at 9.3 times its 30-day average. Relative strength index was at 55.

Out of 16 analysts tracking the company, 15 maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 27.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.