- Aditya Halwasiya acquired 83 lakh shares, holding 2.19% stake in Karnataka Bank

- Karnataka Bank appointed Raghavendra Srinivas Bhat as MD and CEO for turnaround

- Net interest margin rose 10 basis points to 2.72% in July-September quarter

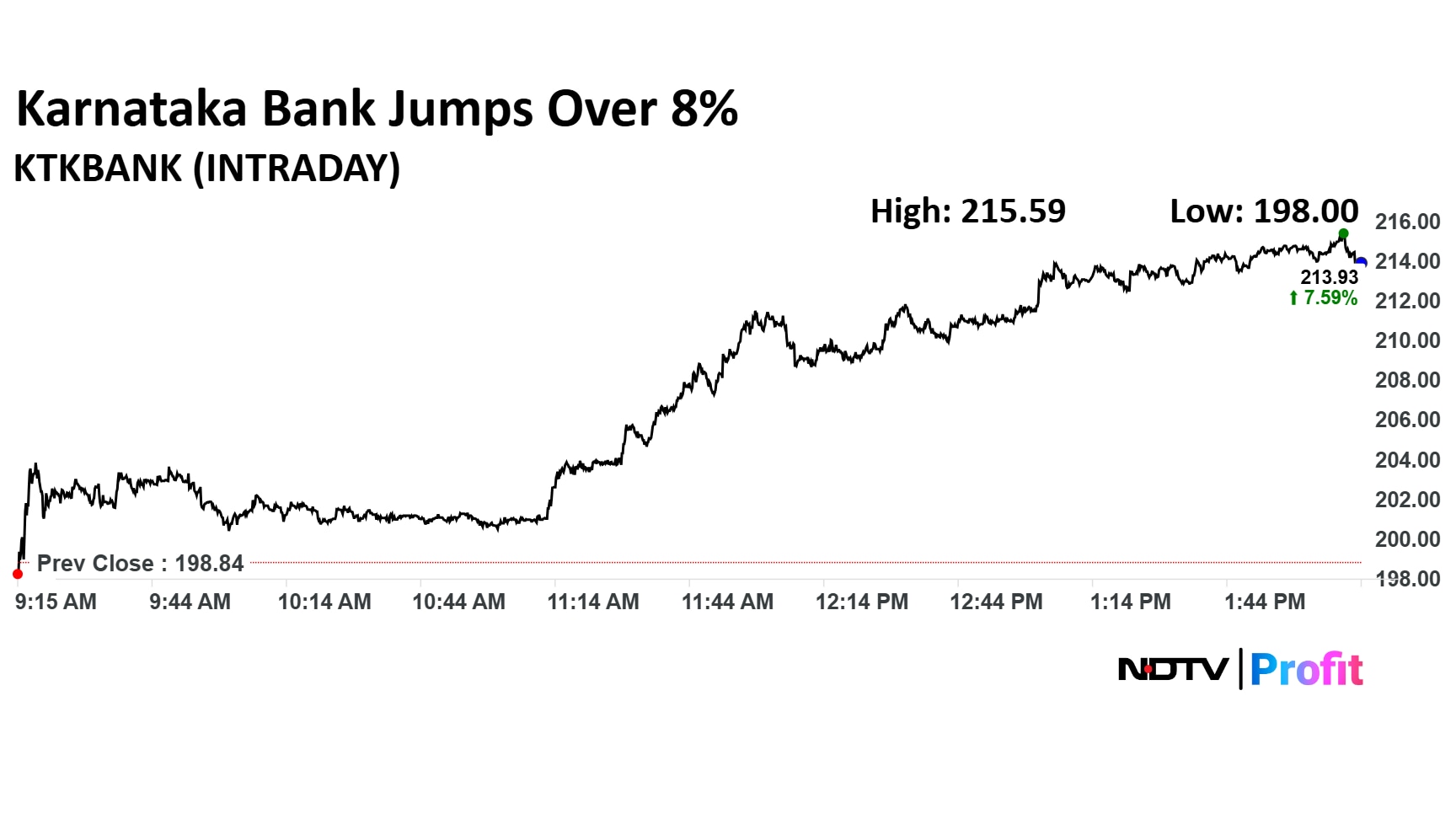

The Karnataka Bank Ltd. share price rallied to its yearly peak in Tuesday's trade after Aditya Halwasiya bought shares in the Quant Mutual Fund-backed private lender.

Halwasiya, chairman and managing director, Cupid Ltd. accumulated 83 lakh shares in last two sessions. His stakes in The Karnataka Bank stood at 2.19%.

Halwasiya is also a board member at the Tourism Finance Corporation of India, Apollo Micro Systems and Olka Technologies.

The Karnataka Bank is undergoing a turnaround under a new management. The board appointed veteran Raghavendra Srinivas Bhat as the managing director and chief executive officer.

Management of the private lender is expecting a higher growth in the second half. The bank will focus on the expense cut and recovery for non-performing assets.

Net interest margin rose 10 basis points to 2.72% on the quarter during July–September. The net non-performing asset was at 1.35% in the same period compared to 1.44%.The 12-month price-to-book ratio was at 0.62 times.

The Karnataka Bank share price jumped 8.42% to 215.59 apiece, the highest level since Jan 1. It has extended gains to the third session. The Karnataka Bank share price rose 7.67% to Rs 214.10 apiece as of 2:50 p.m. compared to 0.01% advance in the NSE Nifty 50 index.

The stock advanced 3.36% in 12 months, while it declined 0.15% on a year-to-date basis. Total traded volume so far in the day stood at 9.4 times its 30-day average. The relative strength index was at 80.44, which implied the stock was overbought.

Three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.