Kalyan Jewellers India Ltd.'s share price surged nearly 5% after it released its third quarter update, which showed year-on-year consolidated revenue growth of approximately 39% in the December quarter. However, the stock slipped soon after that.

"Our India operations witnessed revenue growth of approximately 41% during Q3 FY2025, as compared to Q3 FY2024, led by very strong festive and wedding demand across both gold and studded categories," an exchange filing by the company said. It added that the company reported same-store-sales-growth of around 24%.

In the Middle East, it posted revenue growth of 22% over the same quarter last year. "Middle East contributed 11% to our consolidated revenue for the recently concluded quarter," the company said, adding it also launched its first showroom (Company Owned Company Operated) in the US.

"During the current quarter, we plan to launch 30 Kalyan showrooms and 15 Candere showrooms in India, keeping us ahead of our announced showroom roll-out plan of 80 Kalyan showrooms and 50 Candere showrooms in India for FY2025," it said.

Candere is the company's digital-first jewellery platform, which recorded a revenue growth of approximately 89% in the December quarter as the company launched 23 Candere showrooms.

For fiscal 2026, the company plans to launch 170 showrooms across Kalyan and Candere formats—75 Kalyan showrooms (all Franchisee Owned Company Operated) in non-south India, 15 Kalyan showrooms (all FOCO) across south India and international markets and 80 Candere showrooms in India.

"We have already started signing LOIs for the FOCO showrooms planned for the next financial year in India and international markets," it said.

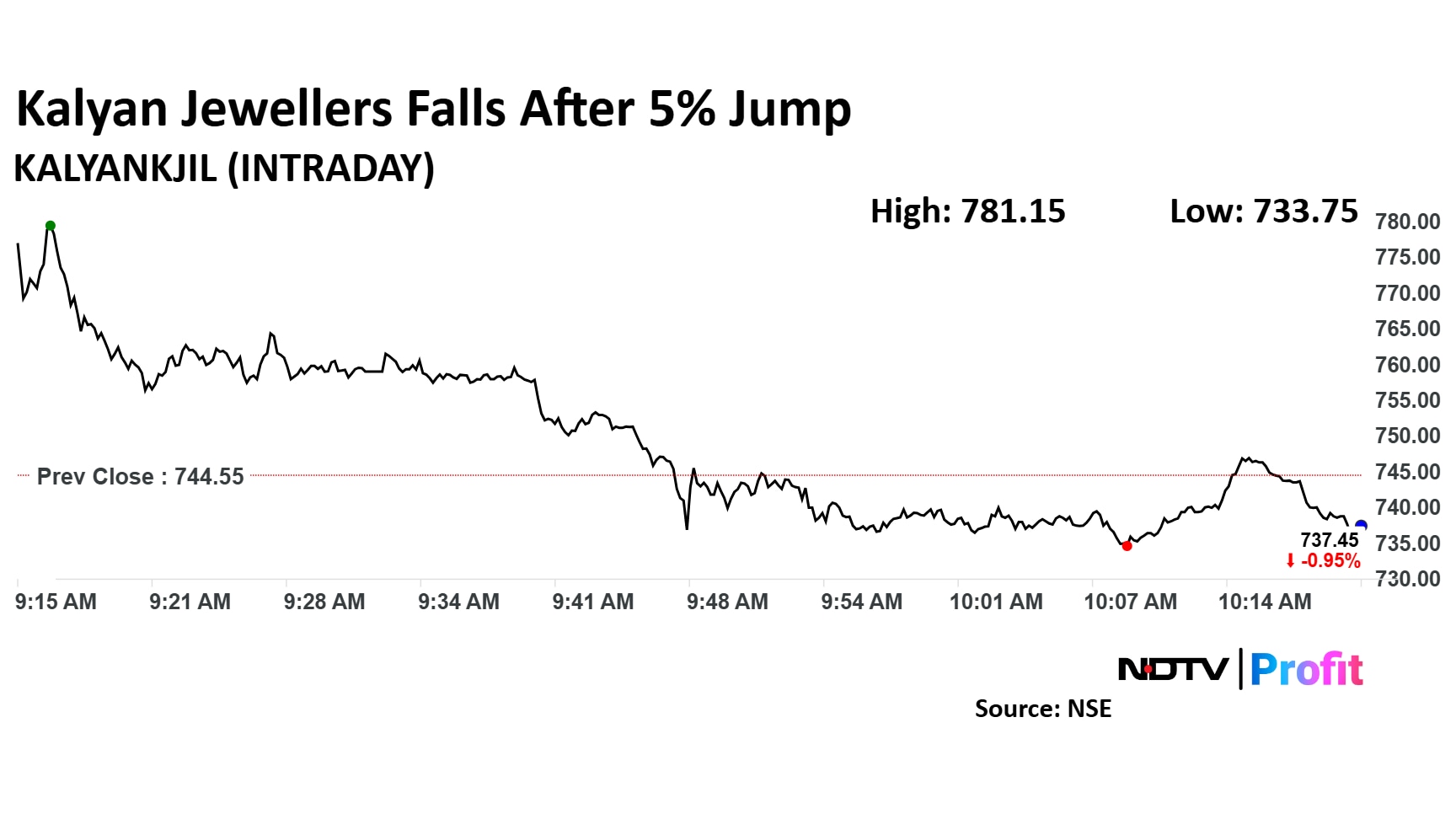

Kalyan Jewellers Share Price Today

The scrip rose as much as 4.92% to Rs 781.15 apiece. It erased gains to trade 0.7% lower at Rs 739.10 apiece, as of 10:25 a.m. This compares to a 0.48% advance in the NSE Nifty 50.

It has risen 111.55% in the last 12 months. Total traded volume so far in the day stood at 1.29 times its 30-day average. The relative strength index was at 50.51.

Out of nine analysts tracking the company, eight maintain a 'buy' rating and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.