Shares of Kajaria Ceramic Ltd. were trading lower after paring gains on Thursday after the company received divided views from major brokerages UBS and Jefferies post first quarter of fiscal 2025-26.

UBS has upgraded its rating to 'buy' from 'neutral' and hiked the target price to Rs 1,600 from Rs 925. Meanwhile, Jefferies has downgraded Kajaria Ceramics' rating to 'hold' from 'buy' and hiked the target price to Rs 1,225 from Rs 1,120.

UBS believes that the market is not pricing in the sustainability of the improvement and may be positively surprised. Going forward, Jefferies estimates Kajaria Ceramics' volume growth to stay weak at 5.6% year-on-year in FY26, which led the brokerage to cut its FY27-28 EPS by 3.4%.

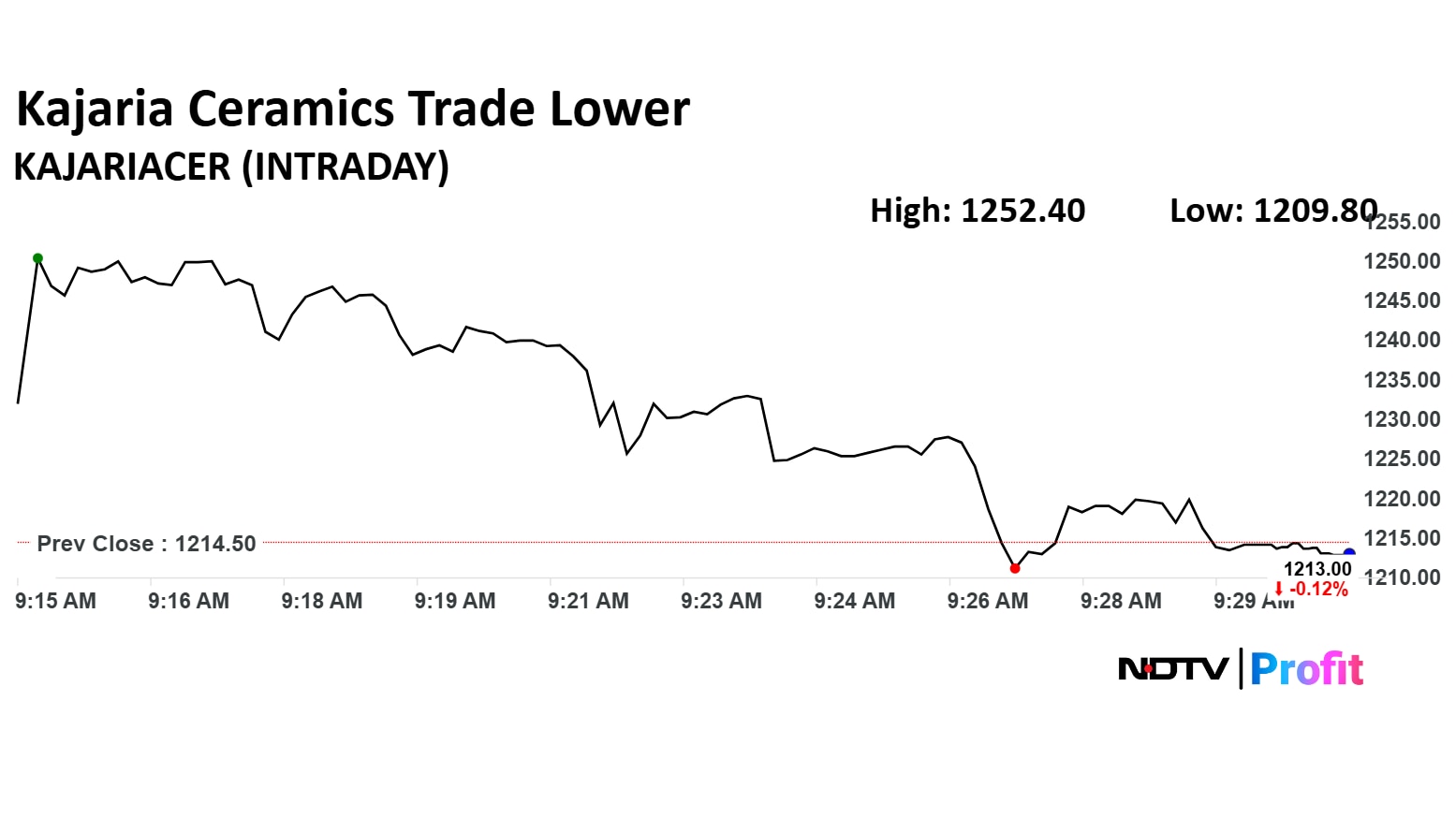

Kajaria Ceramics Price

Shares of Kajaria Ceramics rose as much as 3.12% to Rs 1,252.40 apiece. They pared gains to trade 0.12% lower at Rs 1,213 apiece, as of 9:32 a.m. This compares to a 0.01% decline in the NSE Nifty 50.

The stock has fallen 18.01% in the last 12 months and risen 4.03% year-to-date. Total traded volume so far in the day stood at 2.90 times its 30-day average. The relative strength index was at 55.56.

Out of 33 analysts tracking the company, 16 maintain a 'buy' rating, 15 recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 1.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.