Shares of Jupiter Wagons Ltd., surged over 12% on Thursday after the company's subsidiary received wheelsets order for Vande Bharat Train worth Rs 215 crores.

The company announced that its material unlisted subsidiary Jupiter Tatravagonka Railwheel Factory Pvt. Ltd., has received a letter of intent dated Aug. 19, 2025, for supply of total 5,376 wheelsets for Vande Bharat Train for an order value of approximately Rs 215 crores, as per an exchange filing on Wednesday.

On Aug. 12, Jupiter Wagons reported a decline in earnings during the first quarter of financial year 2026. Consolidated net profit declined 64% to Rs 32.7 crore in the June quarter, compared to Rs 91.92 crore in the corresponding period last year.

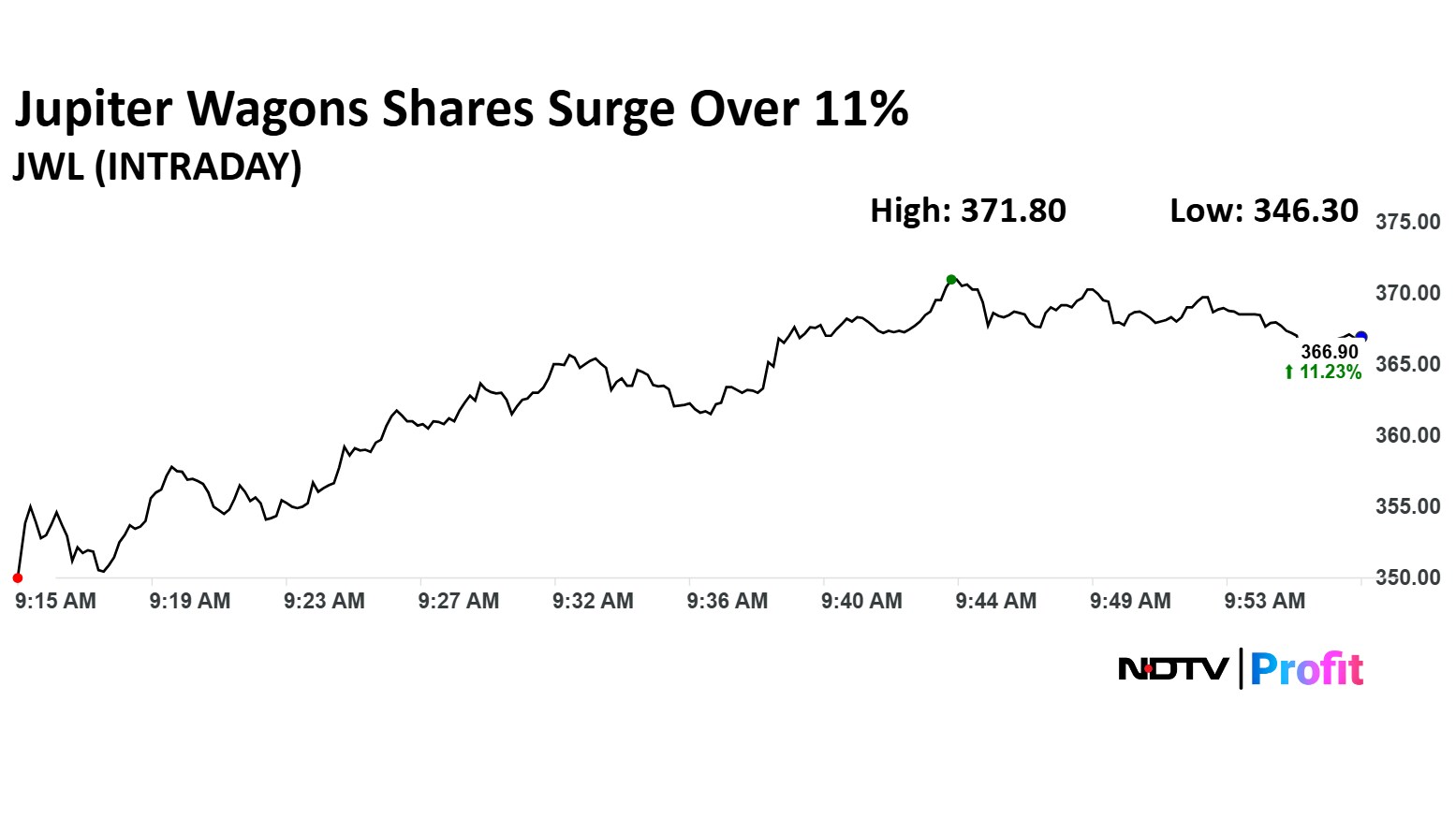

Jupiter Wagons Share Price

Shares of Jupiter Wagons rose as much as 12.72% to Rs 371.80 apiece. They pared gains to trade 11.23% higher at Rs 368.90 apiece, as of 9:55 a.m. This compares to a 0.17% advance in the NSE Nifty 50.

The stock has fallen 35.49% in the last 12 months and 26.82% year-to-date. Total traded volume so far in the day stood at 0.64 times its 30-day average. The relative strength index was at 50.85.

Out of five analysts tracking the company, three maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.