US junk debt investors are piling into the riskiest bonds even as Jamie Dimon and other prominent market watchers are cautioning that valuations on credit are stretched.

Bonds rated in the CCC range have gained 0.75% this month through Thursday, outpacing all other ratings tiers, including investment-grade debt. The highest-rated junk bonds, those in the BB tier, have turned in the worst performance among speculative-grade debt, implying that investors are trading out of the less risky junk bonds and into the securities paying the most yield.

It's a shift from March and April, when investors' fears about US President Donald Trump's trade policies spurred BB bonds to perform the best in the junk space. Now those worries are fading, the stock market is reaching fresh highs, and investors are eager to load up on risk.

“As investors have become more comfortable, they've begun to reach for risk,” said Robert Tipp, chief investment strategist at PGIM Fixed Income in an interview.

Not every market observer is convinced that the credit picture is getting better. Dimon, chief executive officer of JPMorgan Chase & Co., said this week that credit spreads are “a little unnaturally low,” a month after saying that if he were a fund manager, he wouldn't be buying credit. Jeff Gundlach, CEO of DoubleLine Capital, said last month that his firm has its lowest ever allocation to high-yield bonds because valuations don't reflect risk.

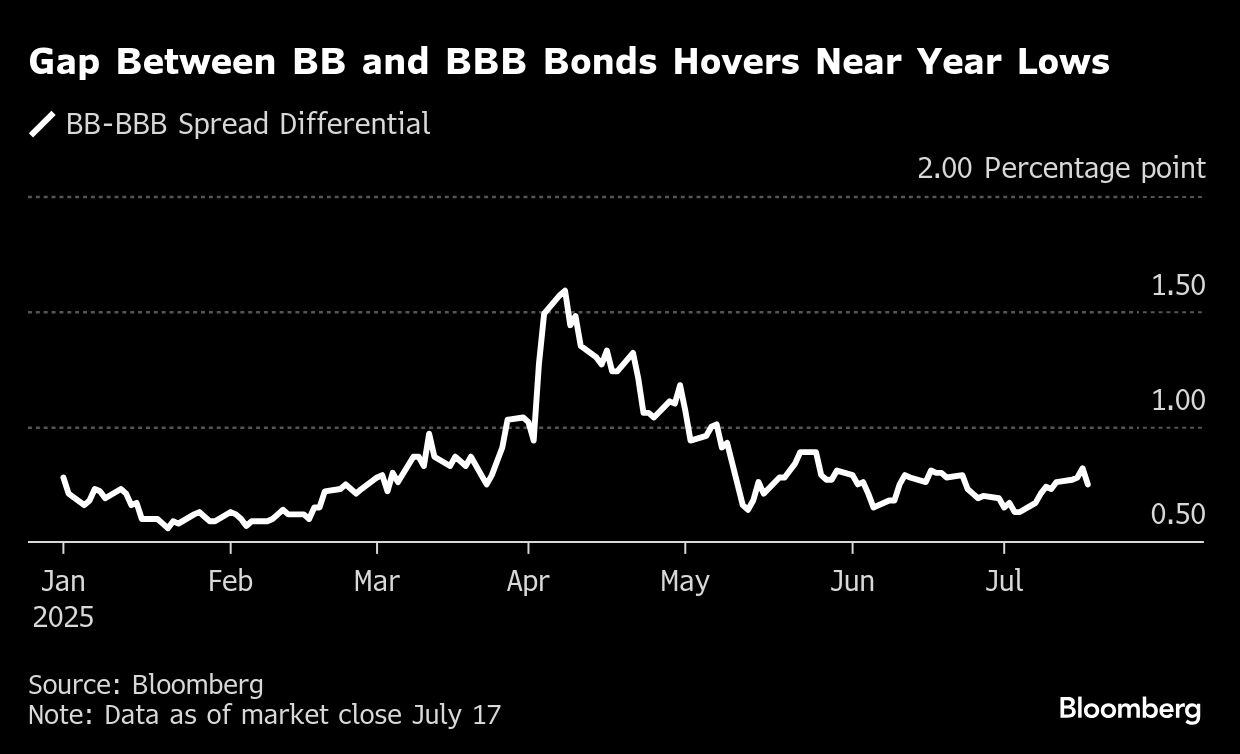

Some risk averse buyers are selling junk bonds and snatching up high-grade notes instead. The gap between BB high yield notes and BBB investment-grade bond spreads on Thursday was just 0.75 percentage point, or 75 basis points, well below the average for the last decade of about 1.2 percentage points, meaning investors can buy BBB bonds from larger companies and get a spread not terribly lower than BB debt.

Rajeev Sharma, a managing director in fixed income investments at KeyBank's Key Private Bank, said BB bonds are less attractive now to both buyers willing to assume risk and to those who prefer to go up in quality to mitigate any uncertainty.

“The BBs are getting stuck in the middle without the risk-reward benefits that you're getting in other rungs of rating categories,” Sharma said. “They don't have the outsized yields that CCCs offer, they don't have the safety of a BBB, and so they're kind of left behind a little bit.”

Global exchange-traded funds, too, are impacting the performance of BB debt, said Sharma. The trading vehicles have snagged as much higher-rated junk bonds as possible, creating a “crowded trade” for the group and a concern that if they have to sell securities for liquidations, BB-ranked bonds would be the first to suffer.

BBs can also be hit by fallen angels, or investment-grade companies that get cut to junk, which some strategists view as a rising risk now. Warner Bros. Discovery Inc.'s planned split into two companies, and subsequent ratings downgrade, brought billions of dollars of debt to the BB market this month.

“When big names come our way we need to determine how well these names can be digested and whether it will cause a technical dislocation,” said Kelly Burton, a managing director in Barings' US high-yield investments group.

Some developments have brought comfort to investors in the last week. On Wednesday, Trump said he has no plans to fire Jerome Powell, chair of the Federal Reserve, despite media reports to the contrary. Economic data has held up relatively well amid tariff negotiations. And again, the US stock market is hitting fresh highs, most recently on Thursday.

“The equities market is telling you that recession probability is not elevated right now,” said Bill Zox, a portfolio manager at Brandywine Global Investment Management. “So that all seems to be consistent with, the dedicated high-yield investor going from BBs to Bs or if an investor wants to move up in quality, why not go to BBBs rather than BBs.”

What to Watch

About $25 billion to $30 billion of US high-grade bond sales are expected in the coming week, with financial-based issuers expected to drive activity.

In Europe, 82% of professionals surveyed don't expect more than €20 billion ($23.3 billion) of sales next week.

In the US, Bloomberg Economics expects new home sales to post a modest gain in June after plummeting 13.7% in May. Report due July 24.

The European Central Bank is expected to hold rates, with the Governing Council's language after the July 24 meeting likely to be similar to the wording in June, leaving open the possibility of additional cuts without committing to them.

China's commercial banks are likely to keep their loan prime rates unchanged for a second month at the July 21 fixing. They will take their cue from the People's Bank of China, which has held its policy rate steady since making a 10-basis point cut in May.

For an in-depth look at the data and events around the world that could impact markets in the coming week, see the Global Economy Week Ahead from Bloomberg Economics.

The Trump administration is finalizing an executive order that would pave the way for 401(k) retirement savings plans to invest in private assets including credit, according to people familiar. President Donald Trump could sign the directive soon, but details are still being discussed and no date is set for an announcement, said the people. The move would be a major win for managers of private credit and equity, an industry that has been lobbying to secure a piece of the roughly $12.5 trillion held in 401(k)s.

Wall Street banks relaunched a sale of $1.5 billion worth of debt tied to Patient Square Capital's buyout of Patterson Cos., months after they got stuck financing an even bigger chunk of the deal because market volatility derailed the offering.

Banks sold a larger-than-planned $4.5 billion of debt backing Sycamore Partners' acquisition of the Boots pharmacy chain, selling $250 million more than intended to a market hungry for new deals.

Froneri International Ltd., the maker of Häagen-Dazs ice cream, wrapped up commitments for a debt deal to help fund one of the largest shareholder payouts on record, as its private equity co-owner looks to keep its stake in the company for longer.

JPMorgan Chase & Co. tapped the US investment-grade bond market while Wells Fargo & Co. and Citigroup Inc. opted to approach European investors before tapping their domestic market, in the first major funding moves from US banks after reporting earnings.

China Vanke Co. is seeking to extend some of its domestic bank loans by as much as 10 years, according to people familiar, in a move that could help the state-backed developer reduce liquidity risks.

Chuck E. Cheese owner CEC Entertainment is in talks with its equity investors for some $600 million to cover upcoming debt payments, after the company failed to raise cash in the junk-bond market.

Canada's Alimentation Couche-Tard Inc. abandoned its ¥6.77 trillion ($45.8 billion) bid to buy Seven & i Holdings Co., saying the Japanese operator of 7-Eleven convenience stores had refused meaningful engagement during the almost yearlong pursuit.

LifeScan Global Corp., the glucose-monitor maker backed by Platinum Equity, filed for bankruptcy protection in Texas after reaching a deal to hand over the business to creditors.

Zayo Group Holdings Inc. is nearing a tentative agreement with creditors that would extend maturities on some of the fiber-network operator's multibillion-dollar debt pile.

BNP Paribas SA promoted Giulio Baratta and Nicolas Rabier as co-heads of Global Investment Grade Finance. They replace Mark Lynagh who was appointed Head of Global Banking UK and Deputy Head of Global Capital Markets EMEA earlier this year.

California Public Employees' Retirement System named Mascha Canio as the new head of its private debt investment portfolio. Canio will join the largest US pension fund in October from Dutch pension fund manager PGGM, where she worked for the past nine years.

Craig Meisner, a managing director in distribution sales at ING and longtime leveraged-loan banker, has retired. Before joining ING four years ago, Meisner led loan syndications at Lloyds Banking Group and had spent most of his career at Commerzbank.

Antares Capital has appointed Jean Hsu to the trustee board of the firm's business development companies. Last year, Hsu retired from her role as the global head of private debt at California Public Employees' Retirement System, where she spent 25 years.

Forza Investment Group LP hired Arun Seshadri as managing director and portfolio manager of capital solutions and origination. He previously worked at BNP Paribas SA, where he was head of desk credit research for the US.

Macro View

Private Credit Loan Monitor

Investment-Grade Bonds

High-Yield Bonds

USD Loans

EUR Loans

Global Credit Index Returns

Week In Review

On the Move

Data Watch

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.